1 Monster Stock In Global Chip Shortage

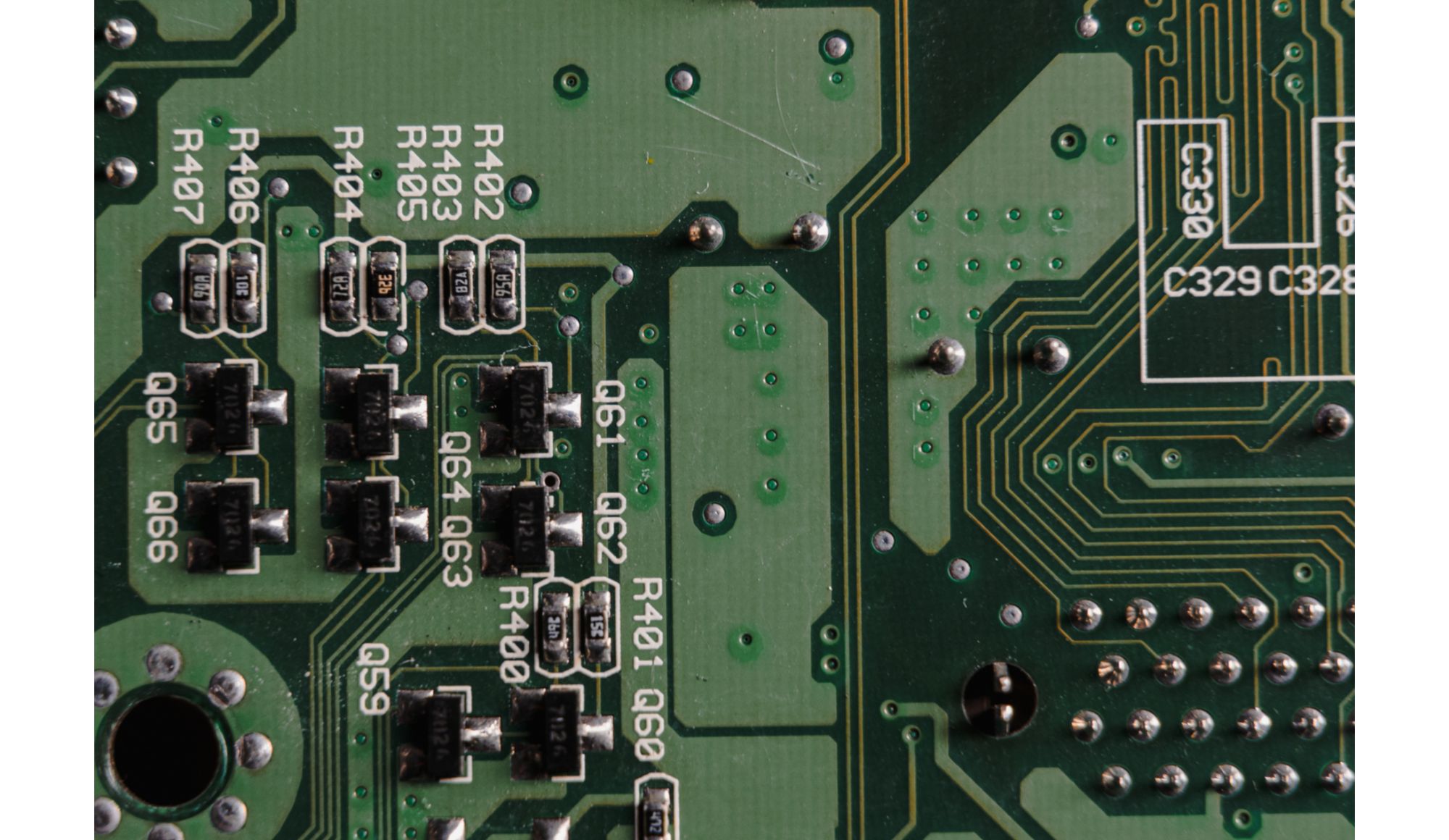

A global semiconductor shortage has made it difficult for several companies, including those in vehicle and smartphone manufacturing, to keep up with demand. Practically any industry that relies on microchips has faced disruptions over the last few years.

While the global chip shortage hurts many companies, it creates enormous opportunity for chip manufacturers. As demand grows, they can charge higher prices for products and generate more revenues.

How can investors take advantage of this situation? One attractive option is Taiwan Semiconductor Manufacturing (NYSE:TSM).

TSM Positioned for Success

Taiwan Semiconductor Manufacturing has become the world’s largest, most reliable semiconductor manufacturer. It managed to pull ahead of competitors by focusing its business model completely on manufacturing.

Most semiconductor manufacturers also design their products. TSM, on the other hand, lets its clients develop chips and then manufacturers them.

This approach has made TSM very successful. Many chip design houses outsource manufacturing to TSM because they can hire U.S.-based talent to design chips that are then manufactured at a world class facility offshore. They don’t have to spend money building a factory because they can rely on TSM to manufacture chips that match the specs of new designs and, most importantly, TSM offers the latest generation chip manufacturing capabilities.

TSM works closely with its clients to develop prototypes and test them for success. The company estimates that it helps build 85% of start-up prototypes.

This is a win not only for the startup design houses but also TSM, which invests its money into the equipment needed to manufacture a broad range of semiconductor products.

Taiwan Semiconductor Manufacturing’s Financial Performance

TSM has an impressive financial history:

- Delivering 17.5% revenue CAGR

- $57 billion in revenue for 2021

- Gross profit margin of 51.6%

- Operating margin of 42%

Why Is Taiwan Semiconductor Manufacturing’s Stock Struggling?

With growing revenues and increasing demand, you might expect to see TSM’s stock price surging. Certainly, share prices became more valuable during the global shortage, but they still aren’t as high as they have been historically.

During 2019, shares hovered between $35 and $60. After March 20, 2020, the stock began a steady climb to reach $138 on February 12, 2021. It plateaued at around $115 for the rest of the year. Since late February 2022, the stock has been falling.

Why would Taiwan Semiconductor Manufacturing’s stock struggle when it has so many opportunities to thrive?

In a nutshell, macroeconomic risk. Officially, Taiwan is a part of China. Taiwan. China remains committed to its authority over Taiwan, creating a difficult situation that could lead to a military occupation of the island. Some worry that the conflict could lead to a situation similar to Russia’s occupation of Ukraine. If that happened, TSM’s operations would likely be disrupted.

Additionally, governments could decide to restrict imports from China as a way to hurt the country’s economy. Such economic sanctions could hurt Taiwan as well as mainland China.

Should You Buy, Sell, or Hold TSM?

Whether you should buy TSM is less a function of TSM’s fundamentals, which are stellar and more a function of macroeconomic risk.

China represents a very serious threat that could prevent Taiwan Semiconductor Manufacturing from serving its clients. An invasion would likely further disrupt the semiconductor and chip industry.

It’s a risk, but it’s also what’s pushing the stock’s price below its fair value. If you’re willing to gamble on China not invading, then TSM offers around 33.9% upside to $114.75 based on our calculations, running a discounted cash flow forecast analysis.