Market Commentary: Former Buffett Stock Flashes Recession Warning

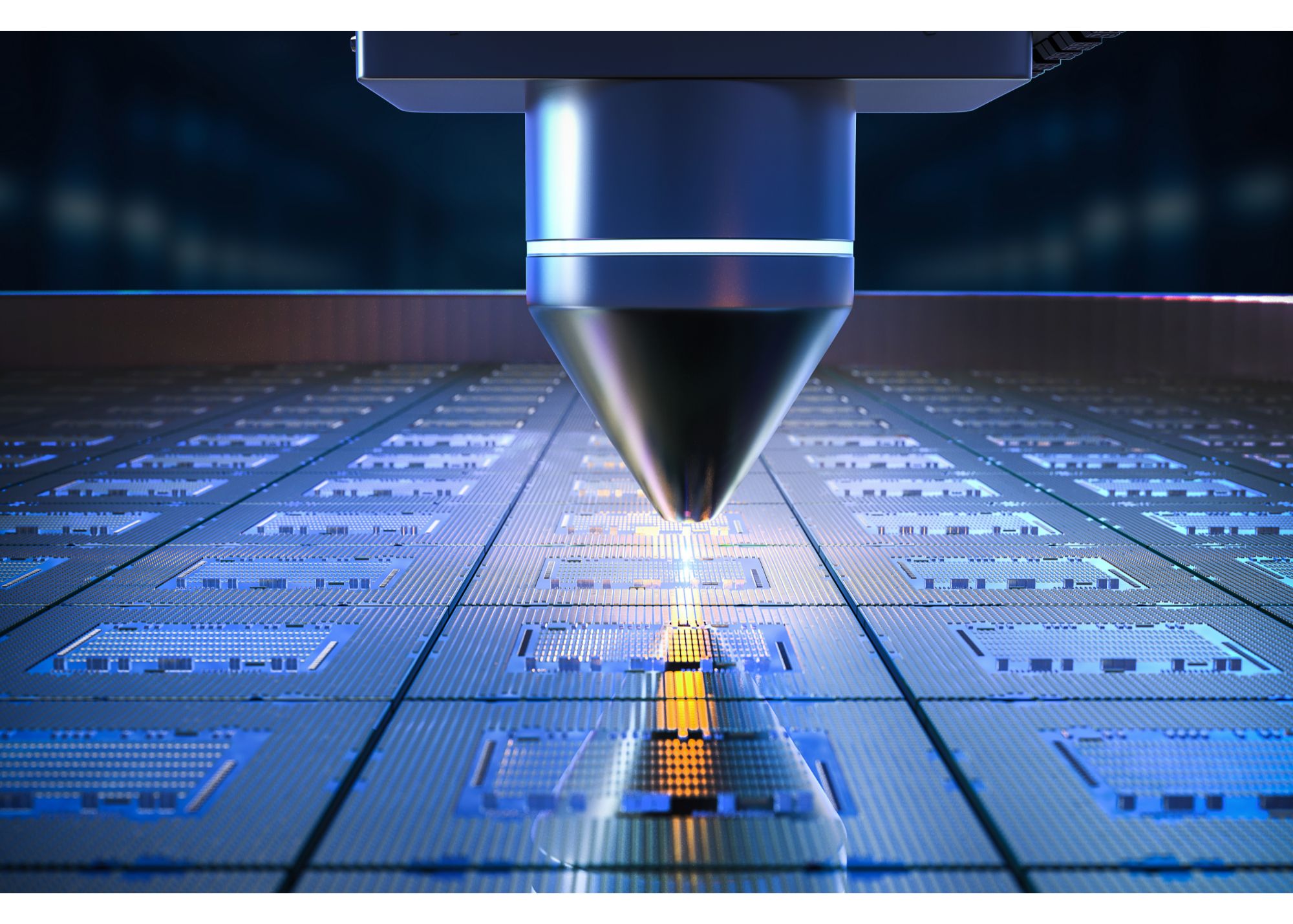

When Warren Buffett bought shares of Taiwan Semiconductor, some speculated it was a play on supply chain integration. TSM is the leading semiconductor manufacturer in the world, and famously supplies chips to Apple, his largest bet.

But then a funny thing happened: Buffett sold virtually his entire stake in TSMC a few months after establishing the position. Did he know what was on the horizon? The latest earnings report by Taiwan Semiconductor suggests Berkshire’s sale was prescient, and is likely an omen for what is to come.

Key Points

- Warren Buffett sold his stake in TSMC before sales fell 15% year over year.

- TSMC’s latest earnings report suggests that a global economic slowdown is on the horizon.

- The risks to equities are high right now, as the global economy is slowing down.

Why You Need To Pay Attention to Semis

As economies slow down, consumer demand declines. They push off the purchase of that iPhone another year until the next model comes out and hold off on buying the new TV. That translates to reduced demand for consumer electronics, such as smartphones, computers, and appliances. In turn, the demand for semiconductors is impacted, and the fallout is ultimately seen in chip manufacturers like Taiwan Semiconductor reporting lower numbers.

In 2008, when the Great Recession shattered the global economy, semiconductor sales fell by approximately one fifth. As sales of semis slow, a ripple effect permeates through the economy, hurting employment levels at semiconductor design houses as well as manufacturers.

It’s worth noting that a slowdown in semis is not always a function of a slowing economy. A trade war, for example, or changes in technology can be reasons why semi sales fall. But for investors, a good rule of thumb is to associate slowing semiconductor sales with a sluggish economy, which brings us to the warning sign that just flashed.

Warning Sign Flashed

In its monthly update, Taiwan Semiconductor reported that revenue had decline to $4.76 billion, representing a YoY fall of 15%. This in spite of modest quarterly growth versus 2022 suggested that demand fell off a cliff, and all of a sudden.

The fallout from TSMC’s results was shocking. The company has ties to businesses across all the major continents, Europe, USA, and Asia. The implication is clear, a global slowdown appears to have abruptly hit. The decline tallies with the reports from Apple that Mac shipments are down 40% in Q1 2023. Together, these reports flash a warning sign that an economic slowdown is about to be felt. If a recession is not already baked in, it’s coming is the message.

What does it mean for you? Risks to equities are high right now. This is not the time to be buying willy nilly hoping for the best. Throwing a dart at the market from 2010-2019 was virtually assured to produce a win over the subsequent twelve months. No longer is that the case. It’s now time to be more like Scrooge McDuck when it comes to committing capital, at least until the horizon looks a little rosier.