Time to Buy or Short This Meme Stock?

History may not repeat but it sure does rhyme and right now there are echoes of pandemic era euphoria. Roaring Kitty’s first tweet in 3 years led to Gamestop share price soaring. And now the public is giddy to know where the trader who turned tens of thousands into tens of millions is turning his attention next.

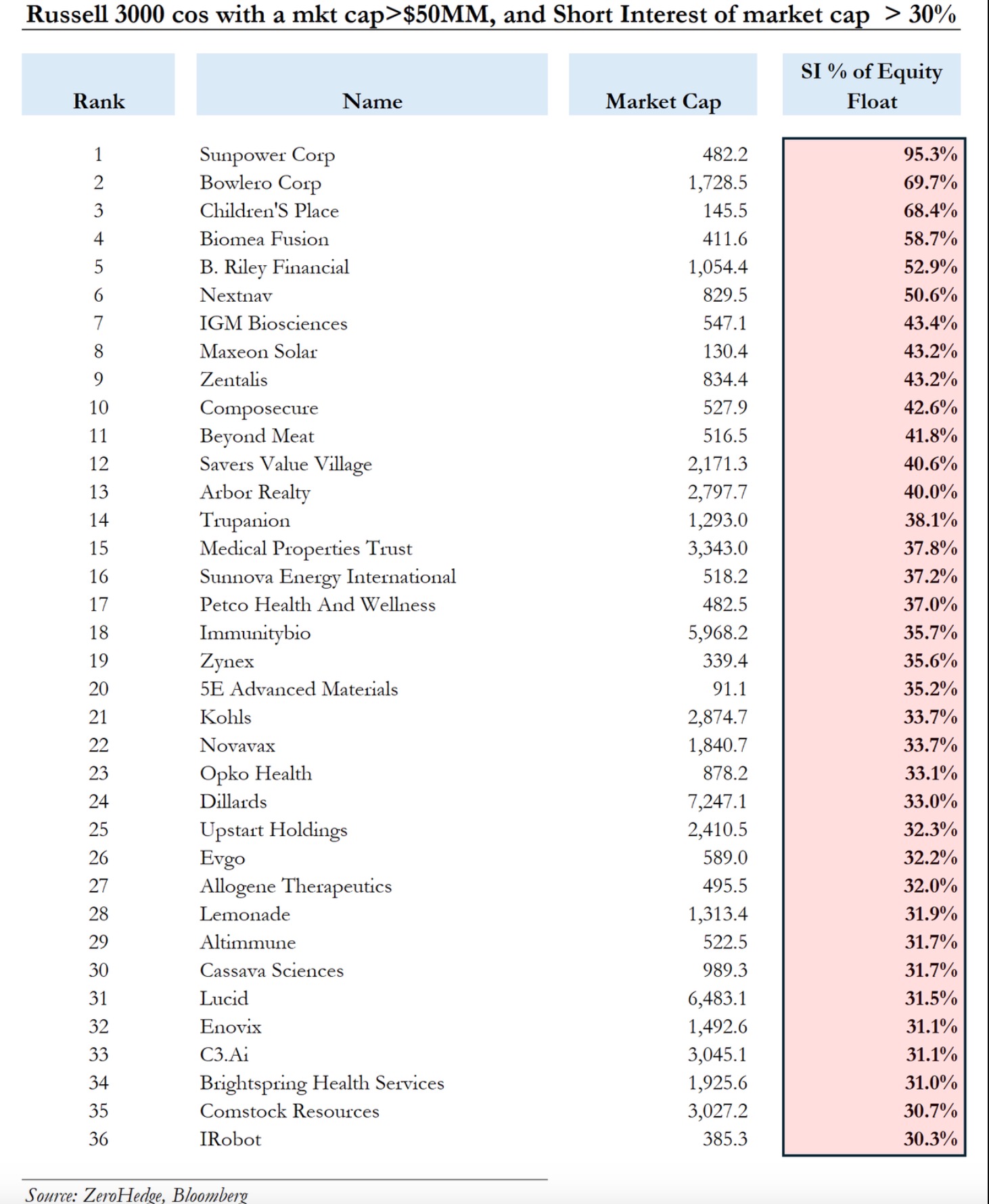

The list of potential candidates is numerous. Take a look at this laundry list of most shorted stocks that could trigger fast short covering rallies with a single tweet from Roaring Kitty.

One stock that doesn’t make the list but has attracted meme stock enthusiasm and also been a purchase of Berkshire Hathaway, a rare combination is Sirius XM, so is it time to buy or short it?

Key Points

- Roaring Kitty’s recent activity rekindled interest in meme stocks, causing a surge in GameStop’s stock and highlighting the market’s responsiveness to influencer-driven movements.

- Sirius XM has transitioned from a penny stock to a profitable company with strong cash flows and a substantial subscriber base.

- The satellite radio leader’s growth has slowed, transitioning it from a growth to a value stock.

The Bull Case for Sirius XM

While Sirius XM may have been a penny stock at one time, it has grown into a cash flow monster that produces an enormous $1.2 billion in FCF. It’s no wonder that it attracted Buffett’s attention because it’s also not trading at a particularly elevated price-to-earnings ratio of just 9.1x.

Speaking of earnings, the EBITDA of $2.7 billion is monstrous and signals just how high the margins are at Sirius. The strong financials are a function of the 30 million plus subscribers that tune in, largely when driving their cars. Sirius XM did a phenomenal job making itself the go-to provider for satellite ratio on-the-go, and has made great strides embedding its service in cars of all brands sector-wide.

Add Pandora to the mix and Sirius XM has the makings of predictable revenue generator with tremendous earnings and cash flow for the foreseeable future. All of the positives can be distilled in a 3.3% dividend too attracting investors like Buffett who see passive income and upside opportunity.

The Bear Case for Sirius XM

It’s not all sunshine and rainbows, though. The reason Wall Street has a low multiple on the stock is that growth has largely dissipated. The spike in numbers that did come a few years ago originated from the inorganic acquisition of Pandora.

Without an obvious growth trajectory, analysts have been muted on the prospects of the firm and so it appears to have metamorphosized from a growth stock to a value stock.

The bull case that caused the share price to pop a few years ago has also diminished now that people are back at work and retention figures have diminished.

Given the stable financials, bears haven’t jumped on board with abandon to short the firm and so arguably the best path forward for shareholders is actually to simply hold the stock like Buffett, enjoy the economics that beat those of the average company in the market on a multiples basis.

If anything Sirius is a stock that has the hallmarks of being a call option because a long-term investor can hold tight and benefit from any upside that may come one day without worrying about an expiration period. In the meantime, they can capture the regular dividend income too.