Billionaires Are All In, Are You?

It’s come as a bit of a surprise to many astute observers to see billionaires go all in on oil. For instance, in Warren Buffett’s top 6 holdings, 2 are oil stocks, Chevron and Occidental Petroleum.

Buffett has taken massive stakes in both companies. In Chevron, he holds an $18.8 billion stake while in Occidental the amount is $14.1 billion.

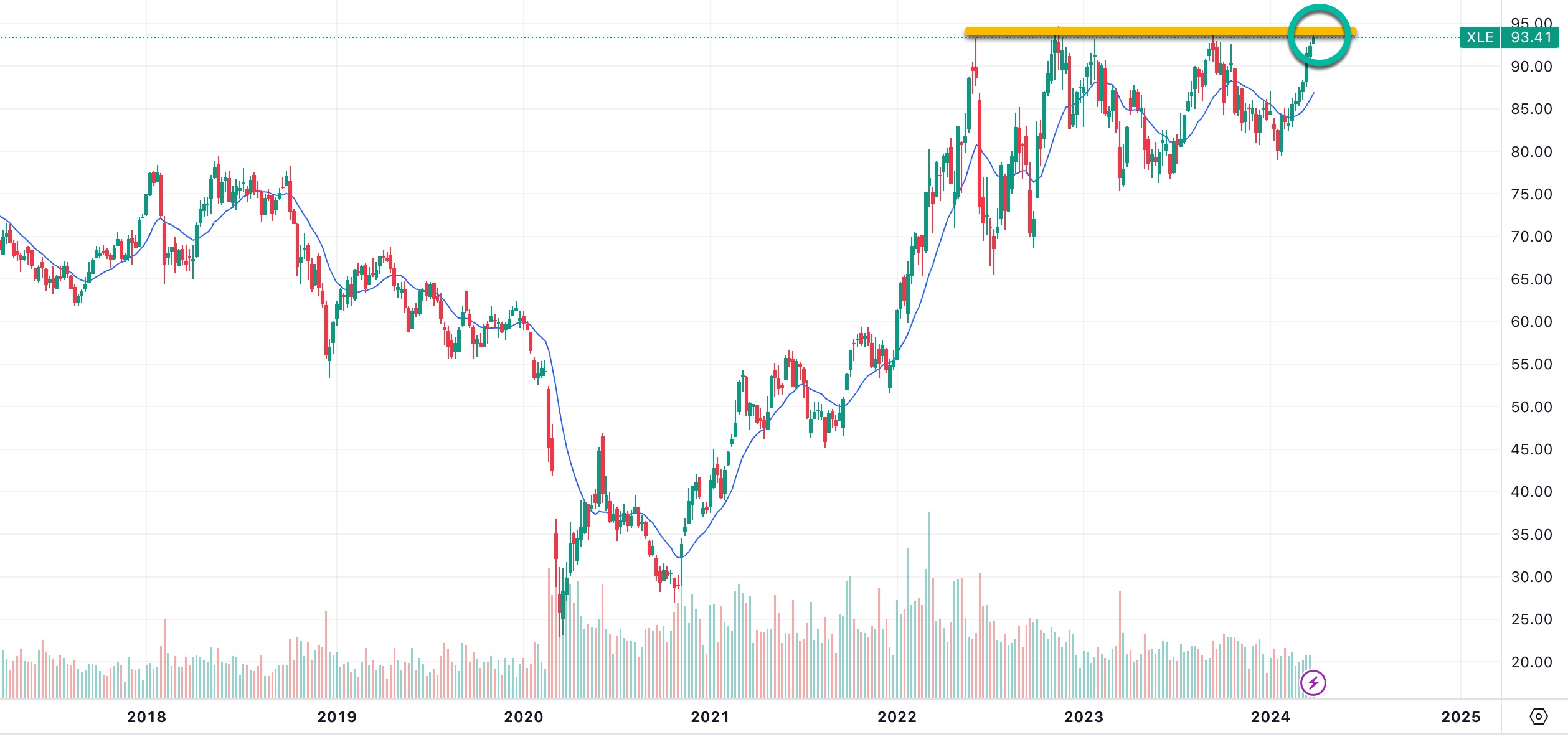

Looking to the technical chart, the Energy Select SPDR (XLE) is on the verge of a multi-year breakout. So is it time to follow in the footsteps of billionaires who are already bullish on oil’s prospects?

Key Points

- Billionaires have been accumulating large stakes in oil in recent years with Buffett’s Berkshire Hathaway alone holding over $32 billion worth of just two energy stocks.

- Technically, XLE appears to be on the verge of a multi-year and perhaps even decade-long breakout.

Why Buy Oil

While Buffett may well be eyeing the dividends and financial prospects of Occidental Petroleum and Chevron, he is more likely seeing both as strategic plays based on a deep understanding of the energy market’s dynamics and its long-term prospects.

In the case of Occidental Petroleum and Chevron, he likely envisions two firms that are not only well-positioned to weather the inherent volatility of the oil market but also to thrive as demand for energy remains strong around the world.

Several key factors contribute to a bullish outlook for oil. The recovery of global economies in the post-pandemic era has led to a resurgence in energy demand, especially from sectors like transportation and manufacturing. As economies continue to rebound, this upward trend in demand is expected to provide a strong tailwind for oil prices.

Oil supply has been under significant pressure due to geopolitical tensions in key oil-producing regions and decisions by OPEC+ to manage output levels strategically. So too has underinvestment in exploration and production in recent years led to tighter supply conditions. These factors combined contribute to a bullish scenario for oil as supply constraints push prices higher.

Why Chevron and OXY

Occidental Petroleum and Chevron both pay attractive dividend yields, a key attribute of both firms that that appeals to investors looking for steady income streams alongside potential capital appreciation.

In addition, both of these companies have demonstrated financial resilience, maintaining strong balance sheets and cash flows even in challenging market conditions. The financial stability of the two firms ensures the sustainability of dividend payments and allows management to invest in growth opportunities.

The upside still remains attractive today with Chevron trading at a 15.9% discount to fair value while Occidental Petroleum seems more fairly valued but pays a 1.3% dividend yield and continues to be very heavily accumulated by Buffett, whose Berkshire Hathaway has authorization to purchase up to 50% of the shares outstanding.

The bottom line is both companies have the potential to substantially reward shareholders over the long-term, and it’s that time horizon billionaires appear to be betting on.

Add any global shocks to the mix, from conflict to oil shortages, and these two titans of the energy sector may run much higher.