Market Commentary: Champion Traders Key Rule To Win

When you win the US trading championships numerous times, you deserve closer scrutiny than the ordinary trader. And that’s why in today’s post we examine an absolutely crucial component of successful trading that just about every ordinary trader ignores, dismisses, or simply fails to adhere to in spite of knowing better.

To exemplify the rule, we’re going to share some stock charts from one champion trader and reveal when he bought and when he sold, precisely. The point is to highlight the mindset of a great trader, and more importantly, his actions and the reasoning behind them.

Key Points

- A key to successful trading long-term is to know precisely when to sell, and then to actually sell when the exit criterion is met.

- Rather than trading on expectations for what you think will happen or thought would happen at the start of the trade, it’s better to take actions based on the chart in front of you, regardless of whether it contradicts your original thesis.

When To Buy & Sell

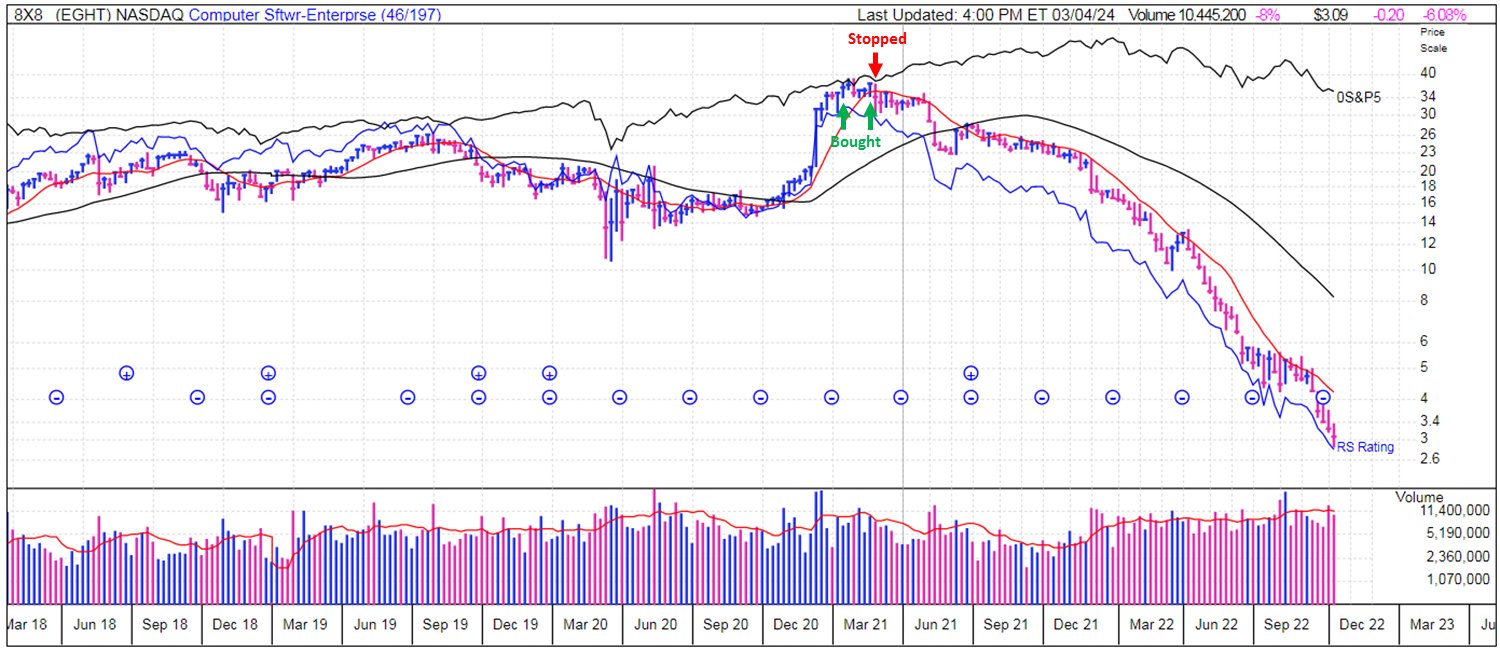

The credit for the chart below goes to Mark Minervini, the champion trader to which we referred above. As you can see from the first chart below, Minervini, bought 8×8 stock on a breakout above a former resistance level.

Critically, within a few days, he sold when the share price plunged below his key moving average line.

Mark has mentioned in the past that, as a champion trader, he’s not actually going to buy winning stocks all the time. Far from it, he’s going to buy a bunch of losers, even ones that go to zero.

In the example below, EGHT share price plunged from the $30+ region by about 90% but he wasn’t part of the journey down, why?

Mark comments that if you’re not willing to take small losses, you can be assured that you will take larger ones. That’s a big insight into a champion’s mindset.

You might think that being so successful he would have the view that his picks are “right” but he has a completely different perspective. If the chart says “go” he buys. If the chart says “sell” he exits. What he thinks is irrelevant. He trades what’s in front of him, not what he thinks should happen or what he originally thought would happen.

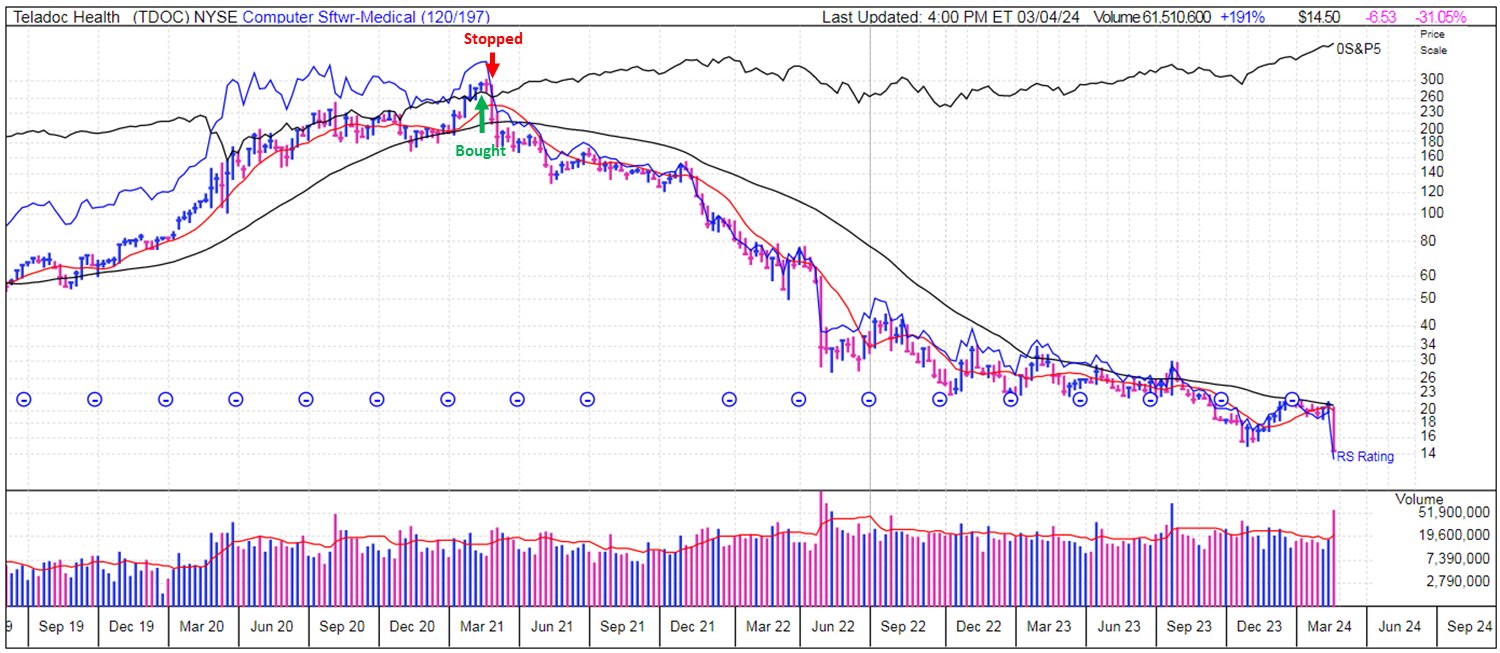

Another example he cites is Teladoc. Again you will see the breakout was bought but the reversal shortly thereafter was sold.

Mark has taken aim at Cathie Wood for implementing poor risk management rules by buying stocks like Teladoc all the way down and then ultimately selling after a large downturn.

How Champions Trade

His approach would never experience such losses because once the line in the sand, the moving average, was violated, he exited.

Now it is fair to say that big money investors, like Wood, don’t have the luxury of flipping on a dime because they are deploying huge amounts of capital. The liquidity simply doesn’t exist in the market to be able to buy and sell on any given day. Instead, they need to exit over many days or even weeks in some cases.

Still, it’s important to create a line in the sand and even more important to stick to it. If that’s the 20-day EMA, when crossed, stick with it. If that’s the 50-day EMA, like institutions typically use, don’t be left holding the bag when the share price closes below it.

As other champions will testify, sometimes the market simply shakes you out by closing below your key level. There’s simply nothing that can be done but accept that’s part of the game. As Minervini says, the only way his portfolio can be destroyed is through death by a thousand cuts, or a thousand losses all piling up one after the other.

That’s highly unlikely, though, because he has implements an asymmetric trading system that puts the odds in his favor. He rides the winners and cuts the losers quickly. That should be the mantra of every trader too: buy the breakouts, and ride the trend higher until the moving average is violated. If that happens in 3 months or 3 days, stick with the rule. That way you can stick with the winners and exit the losers quickly, just as he did in the example charts above.