Did Jim Cramer Call The Top?

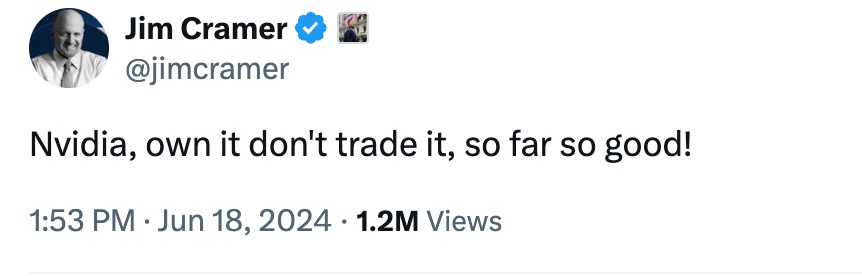

Nvidia has been famous for its astonishing rally over the past year but on June 18, Jim Cramer came out and declared, “Nvidia, own it, don’t trade it, so far so good”

Literally the very next day the stock started to fall. And it reported its first full week loss thereafter. Jim has made some famous calls right before trends change but this timing was impeccable.

So, did he call the top?

Key Points

- Jim Cramer posted about owning Nvidia not trading it right before the share price plunged.

- On a fundamental basis, Nvidia is set to deliver similar profitability to Apple five years from now.

- Even still, Nvidia’s market cap should reflect the much higher execution risk for Nvidia than for Apple.

Surprising Fact About Nvidia

There are all sorts of reasons to hate on Nvidia. It generates a fraction of the sales and profits that Apple or Microsoft does, yet eclipsed both to become the most valuable company in the world briefly, right before Cramer’s post.

Yet, there is one thing most casual observers will miss when citing the “crazy” 68.1x price-to-earnings ratio or the wild 36.1x price-to-sales ratio. And its forward earnings, or more specifically the rate at which they are set to grow.

When we look at the pace of growth forecasted it reveals a shocking figure. Net income is set to grow at an annual rate over the next 5 years of 34.4%. Put simply, if Nvidia can deliver on the bottom line as predicted, it will generate earnings that rival Apple’s in 5 years.

And so if you’re wondering why Nvidia ran up so sharply it’s on the back of expectations that profitability would match Apple’s, hence both have traded at a similar market capitalization of late.

Is Nvidia Overvalued?

Arguably, even if Nvidia does deliver the same level of profitability as Apple in 5 years, it shouldn’t trade at a similar market capitalization right now. The reason for that is Apple needs to only grow its net income at 8.5% annually to realize around $280 billion in annual profits whereas Nvidia needs its bottom line to grow about 4x faster.

A discount factor should be applied when such fast growth is applied because there is so much more execution risk for Nvidia than for Apple. When producing at such massive scales, there are inevitable bottlenecks with suppliers and production, as well as distribution globally. Apple has largely worked out all those kinks over the years whereas Nvidia still has to prove that it will.

So did Jim Cramer call the top? Certainly, in the short-term he did. Longer term, it’s still a question of whether Nvidia can deliver on the hype, but rational analysis would suggest that even if it is forecast to deliver almost identical profits to Apple in 5 years, it should trade at a discount to reflect the much higher execution risk.