Forget Nvidia, This Under-the-Radar Chip Stock Might Have More Upside

Chances are, you’ve never walked into a store and bought something with the ASML logo on it but almost every smartphone, tablet, or electric vehicle in your life probably wouldn’t exist without ASML’s technology humming away in the background.

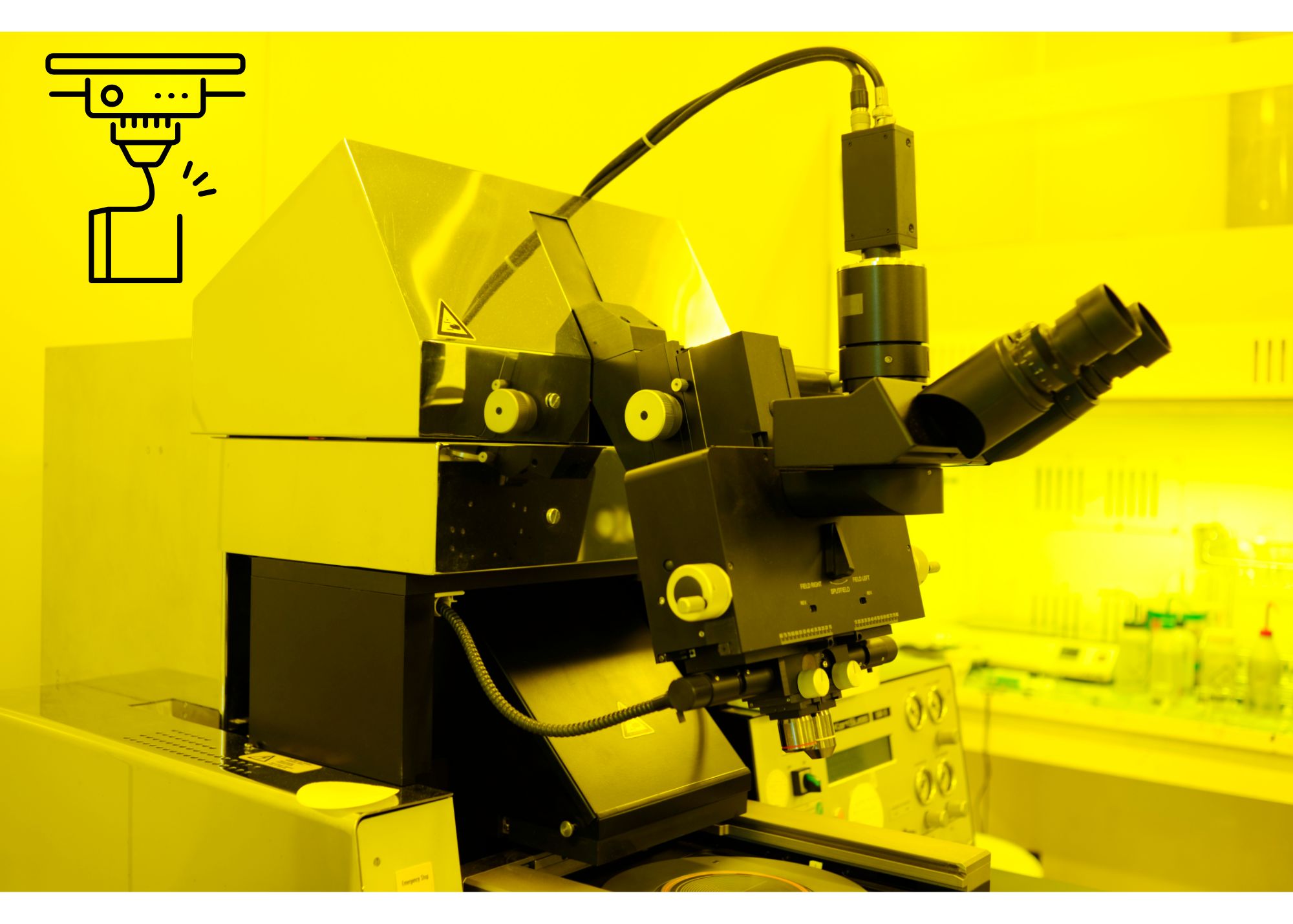

This Dutch powerhouse doesn’t make chips, it makes the machines that make the chips. And not just any machines.

ASML is the undisputed leader in photolithography, a process that essentially etches microscopic circuitry onto silicon wafers. Without that process, the entire semiconductor industry would stall. And ASML owns this niche so thoroughly that it might be one of the most important and least known companies in the world.

Over the past decade, ASML stock has surged more than 7x, trouncing the S&P 500’s 3x gain in the same period. But the stock took a sharp dive after the most recent results came out, so is it time to sell or buy the dip?

Key Points

-

ASML crushed expectations with €5.5 billion in new orders amid strong demand for EUV machines.

-

Its near-monopoly on cutting-edge lithography is protected by physics, not just patents.

-

While macro uncertainty may delay orders, long-term demand from AI, EVs, and advanced computing remains intact.

Why the Market Got Spooked

On the surface, ASML’s results were strong. Revenue came in at €7.7 billion, ahead of Wall Street estimates. Earnings per share were almost €6, also better than expected.

But when CEO Christophe Fouquet said the company couldn’t confirm growth for 2026 due to macro uncertainty, investors bolted.

That one cautious comment overshadowed an otherwise solid quarter. But here’s what most headlines missed, ASML booked over €5 billion in net new orders last quarter, almost a third more than analysts had modeled.

These Machines Cost More Than a Boeing Jet

When we say “bookings,” we’re talking about written purchase orders, not just interest, but cold, hard contracts.

And ASML’s most lucrative product line is its EUV, extreme ultraviolet, lithography systems, which accounted for nearly half of its net system sales last quarter.

Each EUV system goes for around $280 million. That’s more than the average price of a brand-new Boeing 737.

These machines aren’t optional, they’re mission-critical. Only ASML makes them, and its customers (think TSMC, Intel, and Samsung) need them to produce cutting-edge chips at 3 nanometers and below. Without EUV, today’s high-performance processors, AI chips, and future quantum architectures don’t happen.

The Real Story Is About Timing, Not Demand

The elephant in the room is macroeconomic uncertainty. From shifting U.S.-China trade rules to rising interest rates and global election cycles, chipmakers are hesitant to pull the trigger on large capital expenditures.

That’s why Fouquet didn’t want to commit to a 2026 growth forecast. But here’s the nuance, he didn’t say demand is going away. He’s saying it may just be delayed.

When demand does snap back, which it inevitably will, given the AI arms race and digital infrastructure buildout, ASML will be at the front of the line collecting checks.

Not Cheap, But Not Crazy Either

At the moment, ASML trades at a price-to-earnings ratio of around 31x, not a steal, but actually below its 10-year average. For a business with a near-monopoly, high margins, and rock-solid balance sheet, that’s not an unreasonable multiple.

And ASML expects to hit between €44 billion and €60 billion in annual revenue by the turn of the decade.

With net margins north of 25%, a growing dividend, and aggressive share buybacks, that growth has a high likelihood of turning into real shareholder returns.

Physics Is The Hidden Moat

ASML’s moat isn’t just about patents or market share. It’s about physics. The EUV machines use a light source powered by tiny explosions of molten tin droplets, 50,000 times per second, to create extreme ultraviolet light at a wavelength of 13.5 nanometers.

Reproducing that kind of engineering marvel isn’t something a competitor can do with more money or better marketing. The barriers to entry are literally rooted in atomic-level science.

That’s why many in the industry say ASML has a decade-long lead on any rival.

Volatility ≠ Risk

ASML’s stock can be volatile. That’s the price of admission when you’re investing in a company tied to global capex cycles. But volatility is not the same as risk.

Over the long haul, ASML’s dominance in a mission-critical industry, high switching costs, and deep customer relationships give it a wide margin of safety.

Short-term the picture is blurry but if you’re a long-term investor who believes semiconductors will power everything from AI to EVs to edge computing, dips like this might be the best shot you get to start or add to a position.