Market Commentary: How To Pick Winners Every Day

It’s just so tempting to buy the dip or catch the falling knife. Maybe as consumers we are trained to buy the “flash sale” at the grocery store or retail outlet so when we see a stock price fall we think Buy, Buy, Buy. Whatever the reason, the reality is buying strength is a more time-tested strategy to build wealth. So, how do you do that?

Key Points

- Buying strength is a more time-tested strategy to build wealth than buying the dip or catching the falling knife.

- To find leaders, look for stocks that are outperforming the others in their sector.

- Once you find a leader, understand the thesis behind why the stock is doing well.

Start with the Leaders

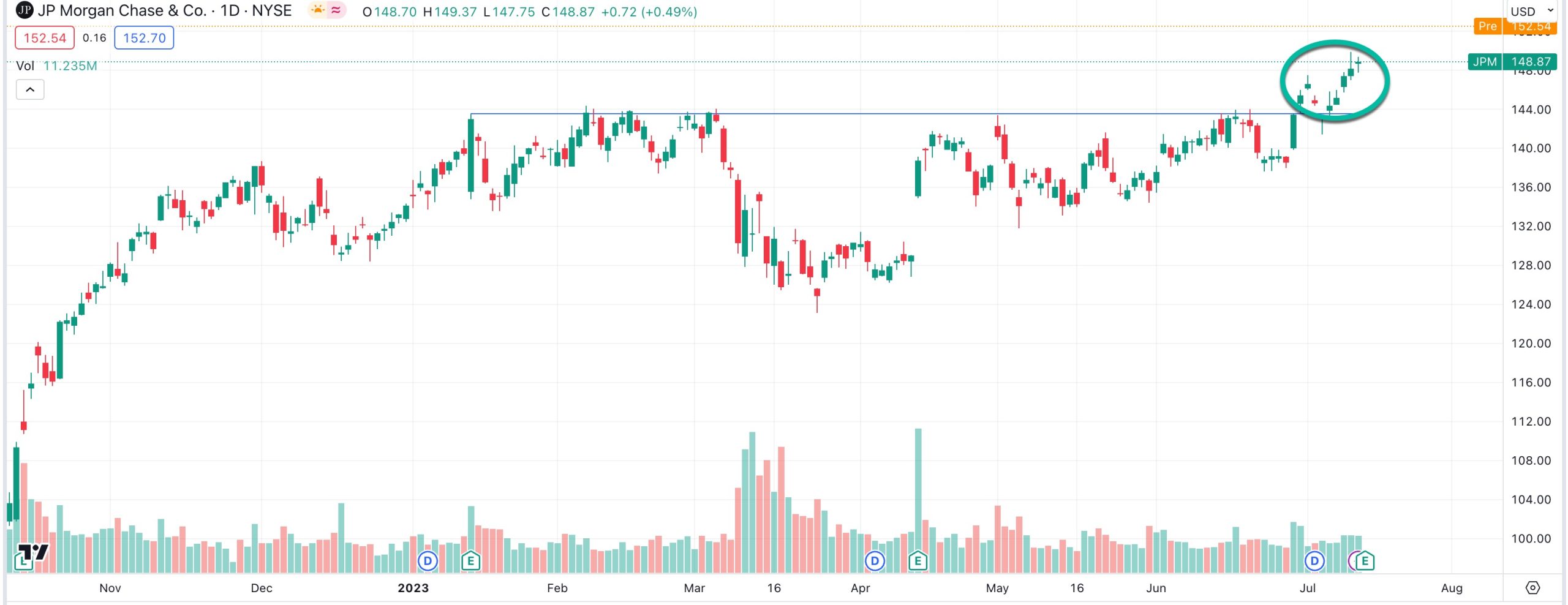

I was keeping an eye on JP Morgan in recent months. To paint a picture of the macro environment, we have just emerged from a period where the fears of owning bank stocks hit fever pitch levels following the failures of Silicon Valley Bank and Signature Bank.

Against this backdrop, JP Morgan not only demonstrated strength, but broke out as you can see below.

The thesis is that smaller regional banks are more susceptible to bank runs and so capital has flowed to the larger, more robust institutions. Indeed, JP Morgan reported in its prior quarter that deposits were up massively. And of course with interest rates so high and much of those deposits landing in checking accounts, JP Morgan could earn the spread, and goose earnings.

So what actually happened about a week or so ago in its most recent earnings report?

Jamie Dimon’s firm crushed earnings, which came in at $4.37 per share versus the $4 per share forecast and revenue was reported at $42.4 billion versus the $38.96 billion estimated by analysts.

How Do You Find Leaders?

The key thing to look for when trying to scout for opportunities like this is to look for relative strength. What stocks in a sector are outperforming the others? Once you can separate the wheat from the chaff it’s time to understand the thesis behind why these stocks are doing well.

In the case of JP Morgan the thesis is quite simple: massive capital flows away from regional banks to the big institution will lead to a higher than estimated deposit base on which Dimon & Co can earn the spread, or net interest margin.

By the way, this same approach works well for sectors as a whole. At different times in the economic cycle, sectors will outperform. Granted, in recent decades, technology has been the biggest winner. But within cycles you will find times when utilities outperform, consumer staples win the race, and energy firms rank best.

Once you see a sector perform well relative to others, the temptation is to pick the laggard in the hopes that it will catch up. But that’s usually a losing bet. It’s better to think of stocks like race horses. If you saw a horse leading a race you would put your money on it, not the one that’s at the back of the group.

The odds of it catching up are low, but the odds of the leader crossing the line first are a lot higher. Stick with the winners, and ignore the psychological temptation to catch the falling knife.