Oh, That Can’t Be Good

Usually, we talk about interesting stocks that may be on the cusp of growing revenues, profits or share price rapidly on a Tuesday but today we’re breaking from our regular programming to flag a major concern that could affect consumers. And because consumer spending is widely regarded to constitute about 70% of GDP, anything that affects it has a material impact on the broader stock market.

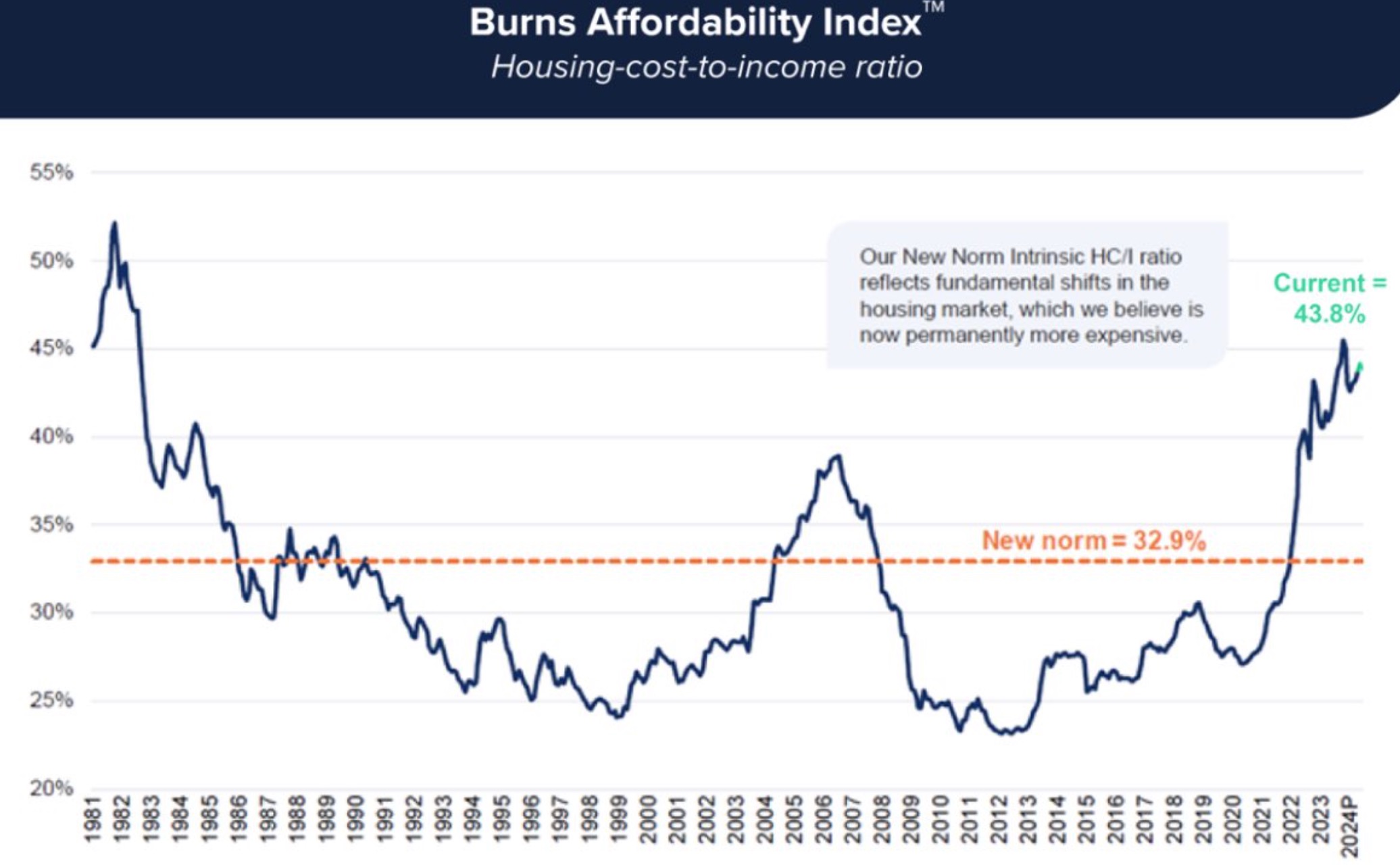

An interesting piece of research came across our desk from John Burns Research & Consulting, which tracks home prices and affordability over time. What the firm uncovered has the potential to seriously impact home price affordability and consumer spending more generally, and in turn where the stock market may go over the medium-term.

Key Points

- The Burns Affordability Index indicates that current housing costs, with a 7% mortgage rate, are as burdensome as 15% rates in 1982.

- Affordability issues are leading to a trend towards renting, with major private equity firms buying single-family homes, limiting homeownership and reducing discretionary spending.

- Government stimulus is currently supporting demand, but the market faces medium-term risks post-election due to ongoing home affordability challenges.

1982 Rates Revisited?

If the Burns Affordability Index is correct, what we’re seeing today in the housing market rivals what buyers experienced a full 40 years ago.

Today’s 7% mortgage interest rate seems cheap in comparison to the 15% level paid by buyers in 1982 but that analysis doesn’t factor in the full scope of home ownership costs.

What the Burns Affordability Index encompasses is not just the interest rate paid but also the cost of home prices, insurance, incomes, and property taxes among other variables. When you put all those ingredients into the pot you end up with a remarkable statistic: a 7% mortgage today is akin to a 15% mortgage back in 1982 when all other costs are factored in.

Credit: Burns Research

What Does It Mean For The Stock Market?

A famous line from the World Economic Forum’s 2030 Agenda stated that “you will own nothing and you will be happy” – that message has been interpreted many ways but one leading theory is that society will largely become one of renters, not homeowners.

In the chart from Burns Research, it’s clear why that prediction is very much on pace to become reality. With fewer consumers able to afford the total costs of home-buying, property ownership will stay in the hands of the few. We’re already seeing that with major private equity firms snapping up single-family homes en masse.

For those who are in the fortunate position to own a home, they will have less money in their pockets to splurge on impulse purchases let alone other discretionary items. With companies ranging from Etsy to Meta all dependent on consumer spending, that bodes ominously for the future. As spending falls, so too do revenues and earnings, and ultimately that translates to falling share prices.

Is It Time To Sell?

While home affordability continues to be ever more elusive, and pressure seems to be building on consumers wallets, a counterbalancing force is in full effect now: government stimulus.

Whether it’s loan forgiveness or new small business funding programs, the government is making an all-out effort to keep demand high, at least until the election takes place.

Those forces are likely to offset the weight of higher interest rates and limited home ownership affordability for the time being. In the medium-term, however, the market is likely to suffer from the ever-growing weight that’s dragging on it, and ultimately post-election, risks will grow.