Is This The Perfect Bitcoin Strategy?

A decade or so ago, betting on bitcoin really was risky. The cryptocurrency was entirely unproven, unregulated, little-known and fraught with risk. Fast forward 10+ years and the times have changed substantially in favor of Satoshi’s creation.

Now exchange-traded funds exist that facilitate regular flows into the cryptocurrency and some companies, like Microstrategy, have all but bet their futures on its success.

Yet bitcoin is famous for its monumental drawdowns, so what’s the best way to trade it?

Key Points

- One top analyst recommends timing Bitcoin trades around halving events to maximize returns, predicting potential prices reaching over $100,000 by late 2024 and $300,000 by 2025.

- Michael Saylor emphasizes the upcoming Bitcoin halving’s impact on miners’ strategies, who are reducing reserves for long-term sustainability.

- New spot-based Bitcoin ETFs in Hong Kong may attract significant Chinese investment, potentially transforming Bitcoin’s global appeal and market dynamics.

Perfect Bitcoin Strategy

According to one analyst, the ideal approach to trading bitcoin is not, as some advocate to buy and hold. Doing so has admittedly led to enormous gains over the past decade but nowhere near the returns that can be achieved by following an entirely different approach that is dependent on the famous bitcoin halving events that occur every few years. Plus, buy and hold is subject to massive, intermittent drawdowns.

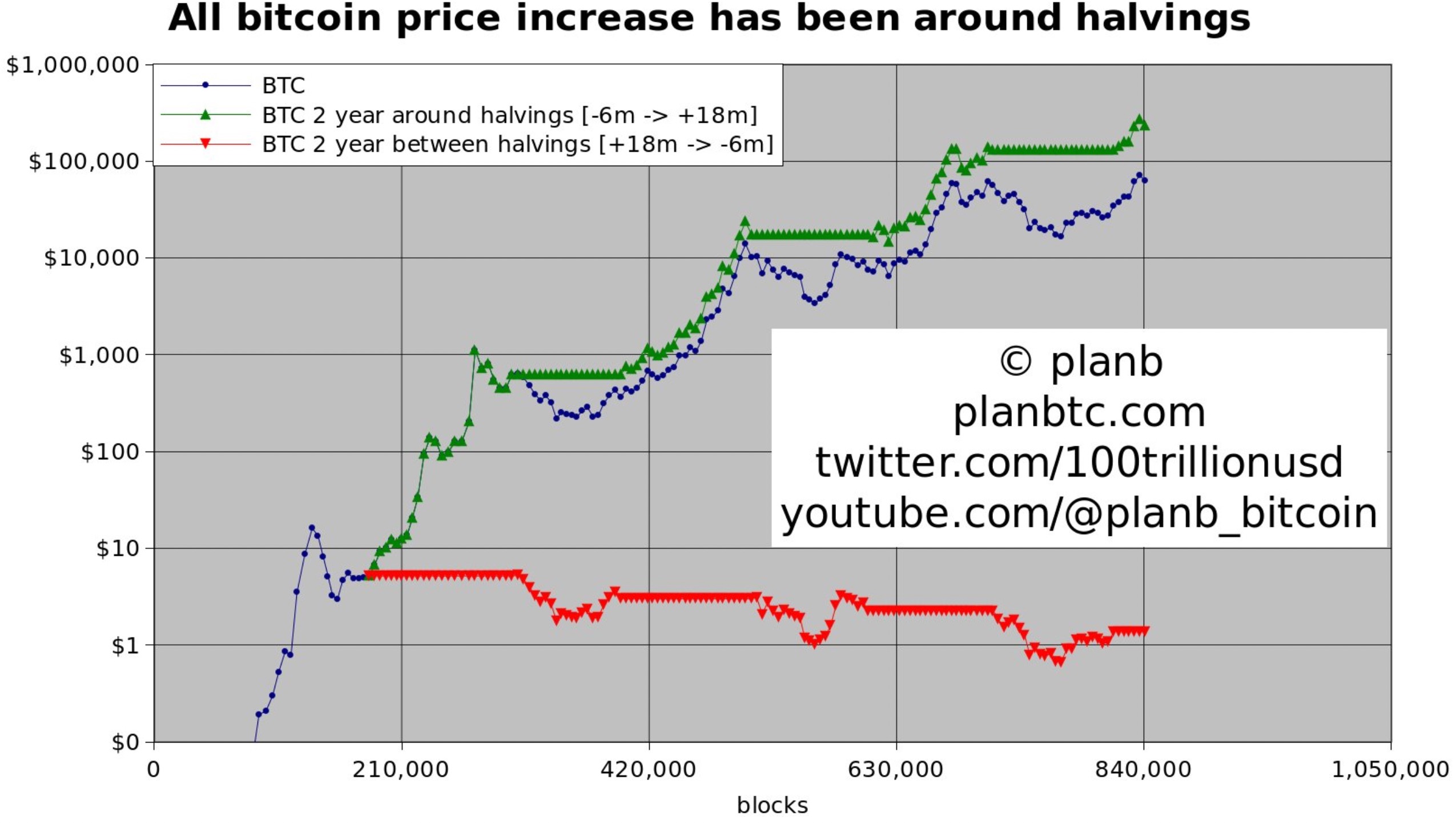

In the analyst’s view, bitcoin prices tend to increase around the halving. More specifically, the ideal time to buy, based on history, is six months before the halving and the ideal time to sell is 18 months after the halving (see the green line in the chart below).

Credit: PlanB

If the analyst is correct, bitcoin stands to rise to over $100,000 per coin by the end of 2024 and to over $300,000 per coin at some stage in 2025.

Michael Saylor’s Warning

Microstrategy’s Michael Saylor has weighed in on the upcoming halving event. He emphasizes the impact it will have on mining mechanics. Bitcoin miners are adjusting their strategies by reducing their coin reserves in anticipation of decreased block rewards, reflecting a deep understanding of market dynamics and a focus on long-term viability.

Plus, spot-based Bitcoin ETFs in Hong Kong are likely to catalyze investment from Chinese investors and enhance Bitcoin’s global appeal. The Asian market has not adopted bitcoin to the same extent as the US and potentially large capital flows are coming.

The bottom line is miners’ strategic preparations for the halving, and the prospective introduction of new investment vehicles resulting in profound transformation of the Bitcoin ecosystem promises substantial impact on BTC’s valuation and broader adoption.