Sentiment Extreme Warns Traders To Watch Out

Largely, trading falls into one of 3 buckets. Fundamental, technical or sentiment analysis. For the most part, we focus on valuations as part of fundamental analysis and charts as part of technical analysis but sentiment analysis has a time and place, and they appear to be right here, right now.

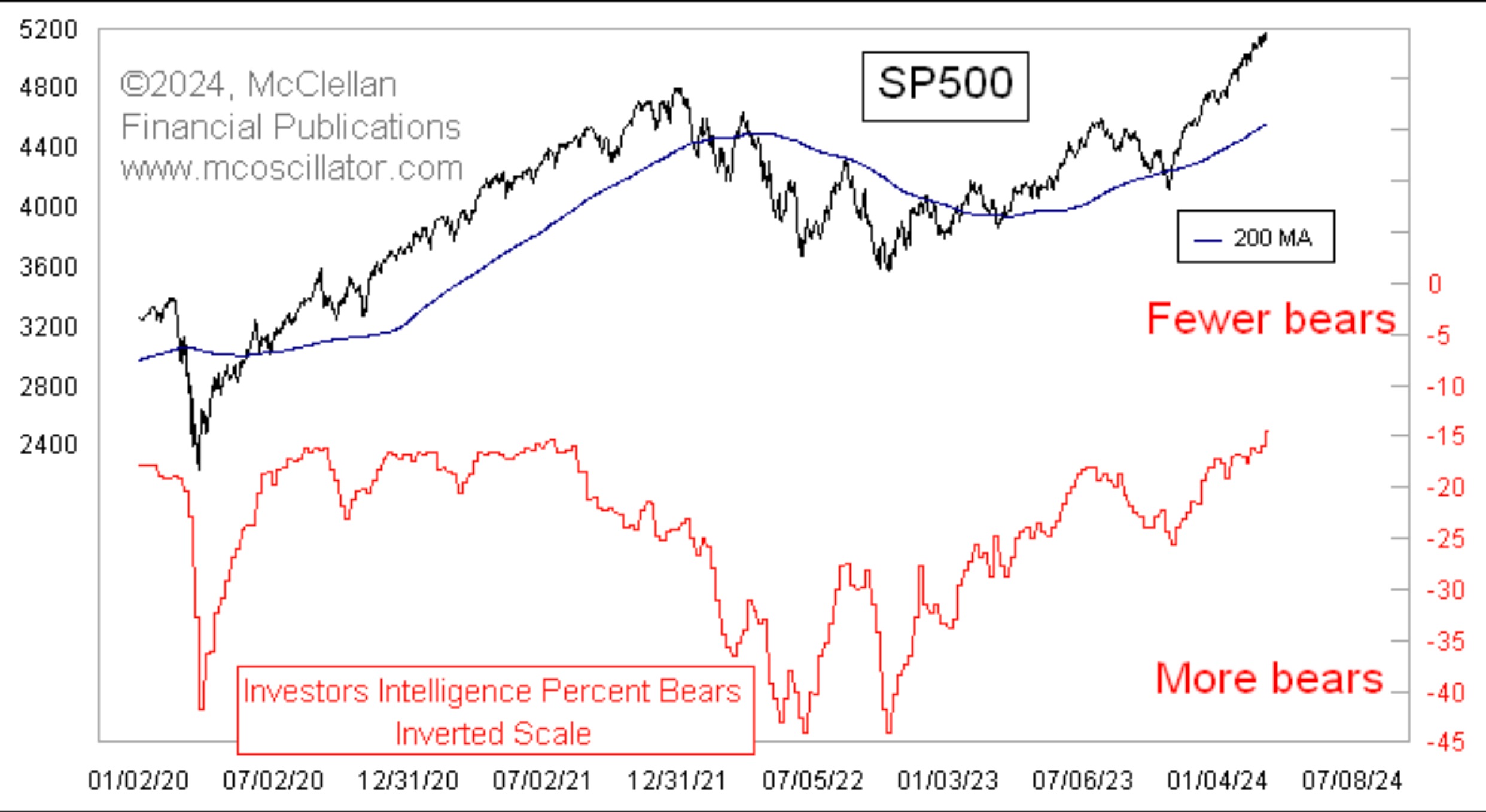

Tom McClellan, famous for creating the McClellan Oscillator pointed out a remarkable statistic that hasn’t surfaced in over 5 years. Not since February 2018 have so few bears been featured in the Investors Intelligence survey.

Below we highlight what the chart looks, what it means, and how to trade it.

Key Points

- Fundamental analysis and technical analysis help to spot daily opportunities in the market but sentiment is very helpful at market extremes.

- According to the Investors Intelligence survey, the number of bears in the market now rivals levels not seen since Q1 2018.

- Sentiment is as bullish as it has been in many years, and that suggests danger may be lurking right around the corner.

What Few Bears Mean

In the chart below, you can see just how extreme the sentiment is at this time with so few bears in the market.

Credit: Tom McClellan

The big takeaway from seeing few bears in the market is that pessimism is diminishing and so those on “the other side of the trade” are fewer and further between.

What the sentiment check reveals is a market reaching extreme levels. What it doesn’t necessarily imply or provide is a signal to short or sell. However, it certainly waves a red flag that warns be cautious out there. If there’s a time to bet the farm on a stock, this doesn’t seem to be it by a long stretch.

How To Trade Sentiment Extremes

Sentiment extremes are more easily traded at market bottoms than tops. For example, when the Volatility Index peaks above 50, it has historically coincided with market bottoms shortly thereafter – with a high level of accuracy.

When markets hit bullish extremes, though, the predictive quality of sentiment indicators is less accurate. That’s because a market can remain overbought for extended periods. Or as the old saying goes, the market can remain irrational longer than you can remain solvent.

So while no clear short signal has been issued by the Investors Intelligence survey figure highlighting fewer bears today than over the past 6+ years, a big warning sign has been raised declaring to watch out below. And at the very least, it screams don’t get too aggressive now.

Sure, over the long-term today’s prices may seem like a steal. But short-term, the risks appear to be rising that a pullback could lead to short-medium term losses.