Crazy Great Depression Stat Scares Investors

Some things only look crazy in hindsight. Did anyone in 1929 know they were on the cusp of The Great Depression? A tiny minority, at best. The rest, well, they all piled into stocks, and a just few of them too.

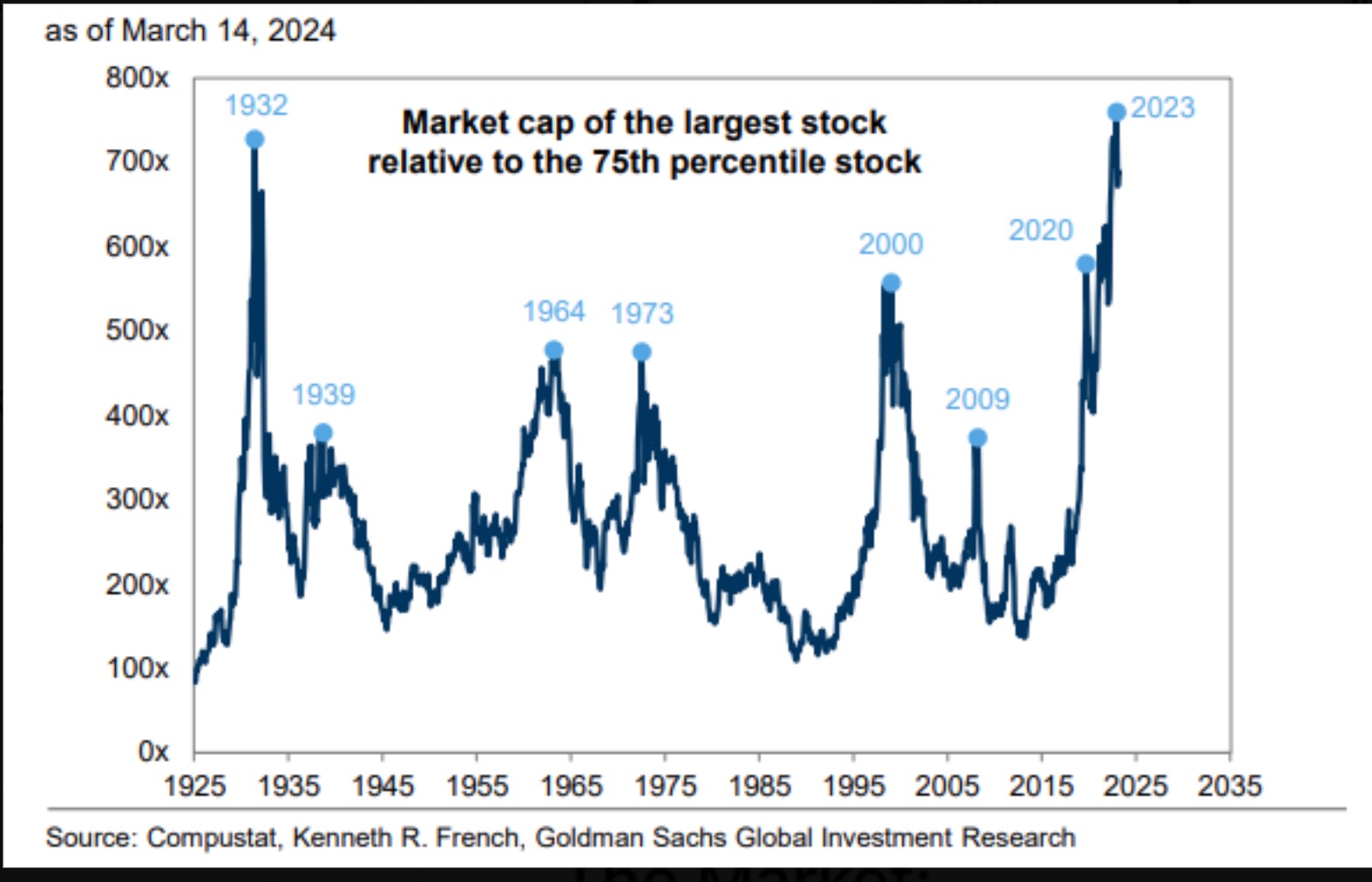

Fast forward almost a century and investors appear to be committing the same financial crime, betting it all on a small number of stocks. In fact, the last time stock concentration was as high as it is now was nearly 100 years ago.

The chart below highlights how stock concentration often correlates with market peaks. Of course, no indicator is perfect, but 2023’s statistic sure does look ominous when viewed in the context of a 100+ years of history.

Credit: ZeroHedge

Key Points

- Stock concentration is not a perfect indicator that a bubble is forming but history shows it correlates with many past stock market bubbles.

- Similarly when the top 10% of stocks by size versus the market power it higher, it tends to correlate with periods of irrational exuberance.

Top 10% of Stocks Power The Market

In a similar vein, looking at the top 10% of stocks by size versus the entire US stock market, a clear signal has appeared to warn investors that a few dominant stocks are powering the market higher.

Concentration risk is a factor that could lead to the downfall of many hedge funds and retail investors alike. After riding some monster rallies in Microsoft, Nvidia, Apple, Alphabet and Amazon, those select stocks represent a real threat to the broader market if they stumble.

And history shows all companies eventually, at some time, fumble the ball. The questions are only when and by how much?

Credit: SlenderSlim

What Should Traders Do Now?

Investing isn’t as binary as some financial news networks would like you to believe. It’s not about buy OR sell. It’s more about reward AND risk. You can ride a stock higher ad infinitum if it never closes below your key exit trigger, say a preferred exponential moving average.

But when an exit triggers, it’s time to move on. As more and more data points reveal that risk is growing, the key for investors is to be ruthless in adhering to stop losses, and rulesets.

Right now, the data points to reward diminishing and risk rising. The narratives of AI and bitcoin will drive a lot of speculation, so traders don’t have to sit on the sidelines and miss out. Rather, when the time comes to sell, they must be ruthless about exiting and not be deluded by narrative alone.