Market Commentary: 1 Stock Has Popped 80% Of The Time

Dick’s Sporting Goods has lots going for it. It’s a well-known brand with a trusted customer base, and its sales have been on the rise the past few years, up 28.3% in 2022 alone before slowing down in 2023.

It’s also got a pretty attractive dividend, paying out 2.7% to loyal shareholders. And at an 11.7x P/E ratio the company is not trading at a particularly lofty multiple.

But one metric stands out more than others for this national sporting goods retailer, its seasonal trend.

Key Points

- Dick’s Sporting Goods has demonstrated attractive sales growth and trades at a reasonable valuation.

- It also offers a generous dividend to shareholders who are interested in passive income.

- The company’s seasonal trend now suggests the next few weeks could be positive.

Seasonal Trend Incoming?

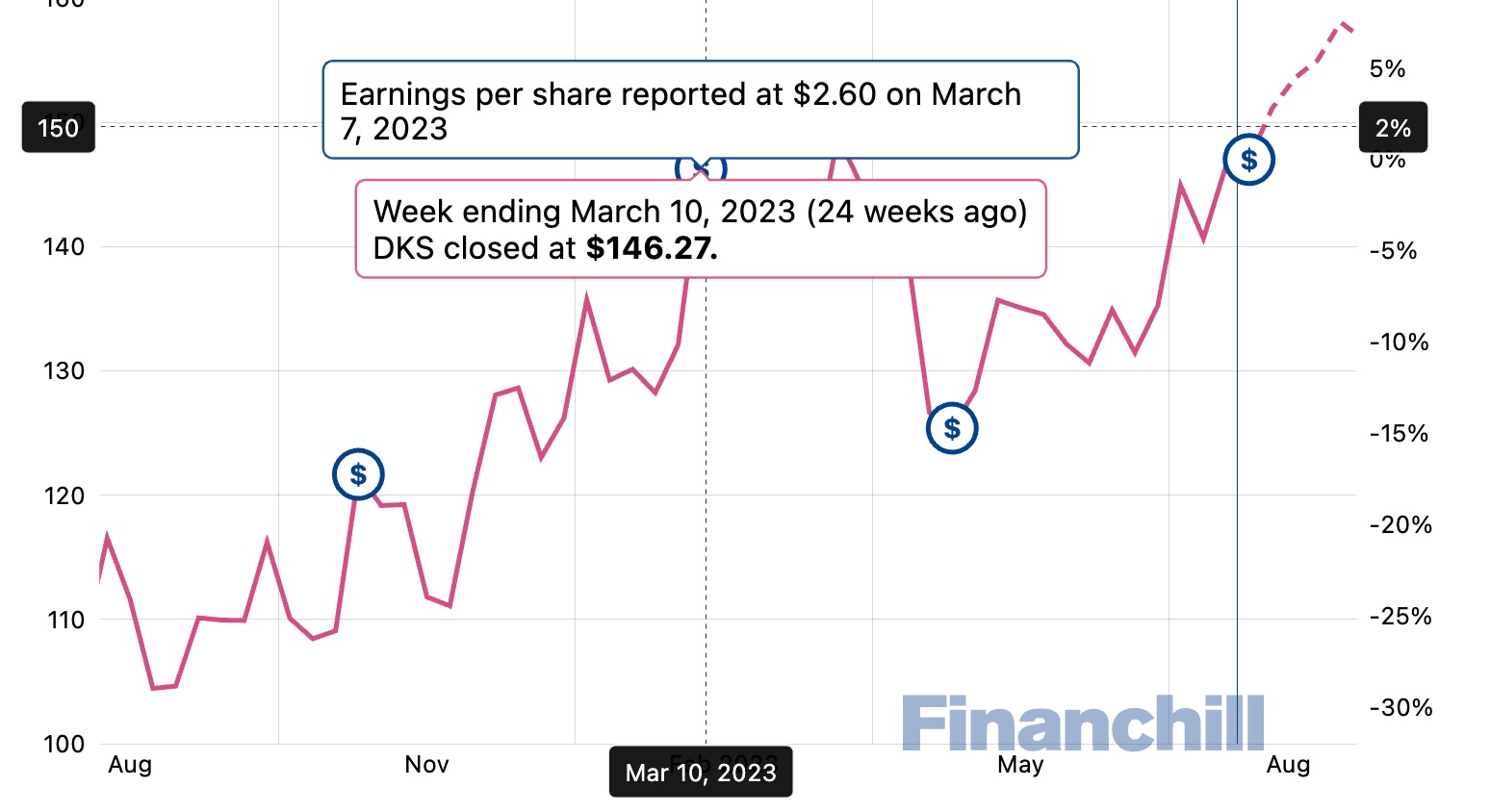

In the period from Aug 23 – Sep 22, Dick’s Sporting Goods has historically been a top performing stock, beating the market averages by a considerable margin. Indeed in 16 of the past 20 years, DKS has popped on average by 7.5%.

Compare that to the market which typically has a poor September, and Dick’s Sporting Goods appears to be a solid bet for investors to park their capital during a period of tumult.

Whether Dick’s Sporting Goods unusual seasonal trend will make an appearance again over the coming few weeks is the looming question. After all, the stock market has shown some considerable weakness in the recent few weeks.

Most recently, the bullish support line that held since Q1 was broken convincingly to the downside.

But that’s precisely what makes the Dick’s seasonal trend so unusual and intriguing. With September historically being a very poor month for the stock market, Dick’s has continually and non-randomly held its own. Not only has it not fallen when the market has been choppy, it’s bucked the trend entirely and found a way to rise.

One theory is that the market is discounting upcoming holiday sales that would provide a healthy tailwind for DKS profit and loss statement. In short, investors buy in anticipation of good future sales.

Regardless of the reason, it’s impossible to ignore a trend that has occurred on average 4 years in every 5 for the past two decades.

How To Play The Trend

If you have a lot of high beta stocks that are susceptible to a rationalization, meaning a big haircut, should the market fall, Dick’s Sporting Goods offers a potential port in a storm, where not only could capital be preserved but history would say the odds of it growing are high too.