Alert: 41% Annualized from Safe Penny Stock

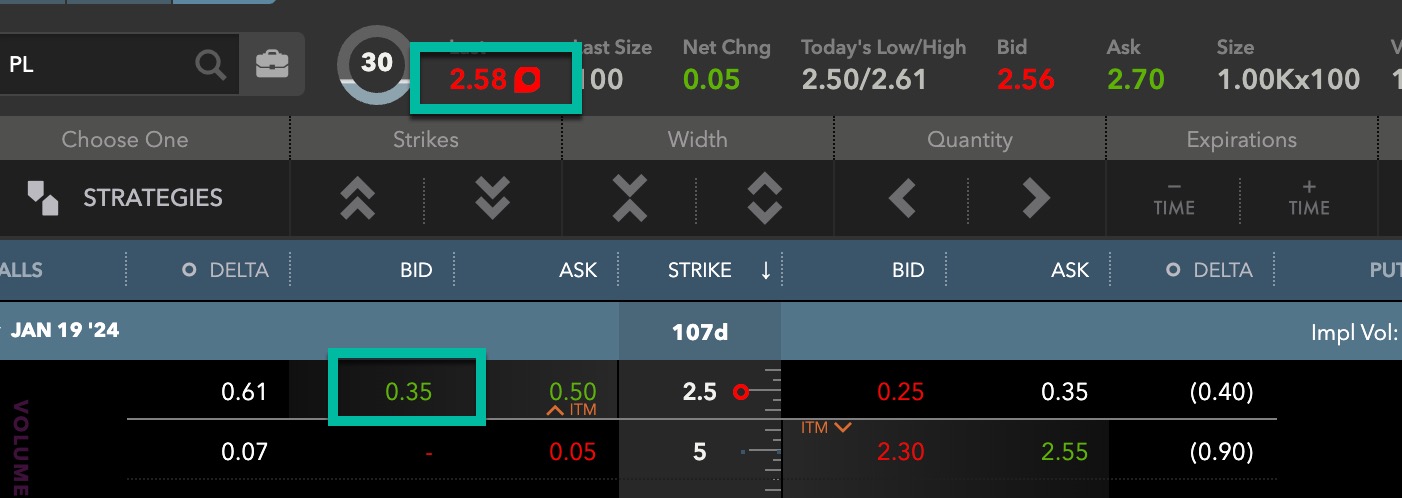

Investment Alert: Buy Covered Call (PL) at $2.50 Per share and Sell Strike 2.50 January 2024 Call for $0.35

Disclaimer: Investment Alerts have a medium to long-term time horizon. These do not constitute financial advice and you should contact a financial advisor before deciding whether it is appropriate for your individual circumstances.

In the old days a penny stock was, well, priced in the pennies per share. As inflation took its toll, penny stocks were officially categorized as stocks of companies whose share prices were trading under $5 per share.

And it turns out that there is one company generating hundreds of millions of dollars that is currently labeled as a penny stock while offering potentially very significant returns.

Simple Strategy with Massive Returns?

At a time when the bond market offers a 5% return, risk-free, equities need to be compelling to attract capital. And we found one that might just fit the bill.

Planet Labs (PL) was really hitting all-time lows of around $2.50 per share when we took a look at options contracts out about 3+ months in time.

Amazingly, the at-the-money strike 2.50 call contracts were offering $0.35 per share, meaning the out of pocket cost was just $2.15 per share.

A greedy investor might look at this and think, what’s $0.35, it’s not worth my time. But if your tempted to write off that $0.35 per share, go a little deeper and enquire whether your portfolio is up 41% over the past year?

That’s the benchmark to compare the trade against because a $0.35 return on $2.15 of risk is a 16% return in a little over 3 months or 41% annualized.

By the time we could snag a snapshot of the price action you can see the stock was up $0.08 per share while the option still offered $0.35, albeit with a wide bid-ask spread of $0.15 so it’s quite possible $0.40 could be received.

Now if we re-calculate the return on risk, it’s a cost of $2.58 for the stock minus $0.35 per share for the option or $2.23 total out of pocket while the return is $0.27.

At this point the naysayers may really be willing to move past the opportunity but again if you’ve done your calculations properly you’ll see where the return on risk is quite compelling.

A $0.27 return on $2.23 of risk is a 12.1% return in 107 days or a 41% annualized return. For comparison’s sake that’s 8x the return offered by risk-free bonds at the moment. Of course, the trade off is the equity position is not risk-free.

What Could Go Wrong?

A potential 41% annualized return is highly enticing so what could go wrong? For one, it’s possible that this stock, already down over 40% for the year could fall even further.

Don’t forget if you buy a stock that falls from $10 to $5 and another person buys it at $5 and it falls to $2.50, both of you lose 50% of your capital. So, Planet Labs needs to prove it can turn those growing revenues into profits before its share price is likely to turn around in earnest.

Another possibility is that the market has moved by the time you read this, and that’s okay. If the opportunity is missed, don’t fret because there are literally thousands of similar opportunities available each day.

All you need to do is look at the share price of a company that you believe has a higher reward to risk ratio based on its financials, find one ideally in a technical uptrend, and look at selling at-the-money call options.

The key thing to note is if the stock goes higher the maximum return when selling an at-the-money call option is the premium of the call. So if Planet Labs soared to $5 per share, the return would still be capped at the figures listed above. That’s the tradeoff of locking in a gain. Still, if the upside is 41% annualized without the stock having to rise, that’s not too bad.