1 FinTech Firm with 30.6% Upside

When you study business for a while, certain metrics just turn out to be much more important than others. The cost to acquire customers is a key focus for many new business owners but their retention is what those who have been around the block focus on.

If you can acquire customers at the same price as the competition but sell them into many other products and services, you end up with higher margins, more profitability and overall a much better business.

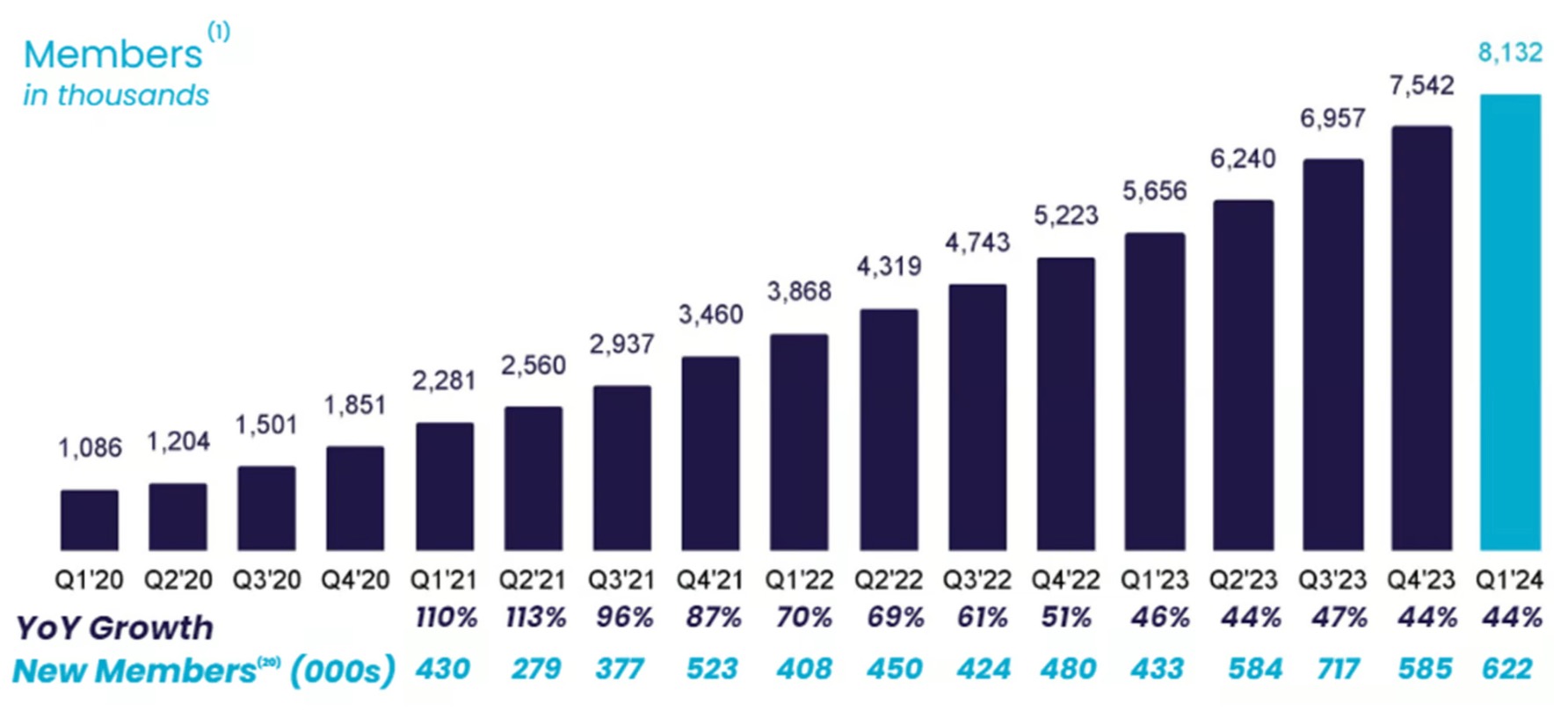

It’s this key focus on retention that has made SoFi such a standout performer in the world of lending, wealth management and banking. What started as a simple pitch, pay less interest on your loans if you are a HENRY (high earner not yet rich) has morphed into a message more akin to check out our savings rate, and oh by the way when you do, you’ll probably find a whole lot more to like. As you can see, the data shows the model works well.

Credit: SoFi

It’s clear that the customer counts are growing but what about the stock, is it a buy?

Key Points

- SoFi’s success is driven by retaining customers and selling multiple products, boosting margins and profitability.

- Despite strong revenue growth, SoFi’s stock is down 29% this year, even with predicted net income growth.

- Investors worry about high operating expenses and slowing student lending, but SoFi’s $3 billion cash reserve and positive analyst outlook suggest potential upside.

What’s Up with SoFi?

The business model clearly seems to be a winner but the stock, not so much. SoFi share price is down 29% year-to-date, which seems surprising at first glance given that net income is predicted to grow this year.

So too has revenue been on a tear. Going back 12 quarters, we only found one where year-over-year quarterly growth dipped below 30%. That kind of fundamental strength is precisely what shareholders and Wall Street usually flocks to, so what’s going on under the hood that has investors concerned?

The issue appears rooted in the high cash burn with over half a billion spent quarterly on operating expenses and a string of losses posted up until the most recent couple of quarters.

Another concern is that student lending has formed the basis of SoFi’s model, and it has slowed down. SoFi launched with the idea that it could provide more competitive rates to students at Ivy League universities and the like, who rarely defaulted, versus say the University of Phoenix online, which had much higher default rates.

That model proved to be successful but now revenue growth in this core segment is slowing down and management forecasts that this year’s figures will be under last year’s.

So, how do we weigh up the pros and cons?

Time to Buy SoFi?

On the one hand, SoFi is clearly growing its top line consistently and succeeding in turning a profit finally. On the other hand, its core business of lending is slowing down.

With $3 billion of cash on the balance sheet and a $7.4 billion market capitalization, the operations of the firm are not being valued at much more than 1.5x sales.

Among 16 analysts the consensus remains positive overall with a price target of $8.91. If they are correct, SoFi has material upside potential of 30.6%.