Forget NVIDIA, Buy This AI Stock?

Oh sure, NVIDIA may get the headlines but perhaps an under-the-radar AI play is where your attention should be flowing.

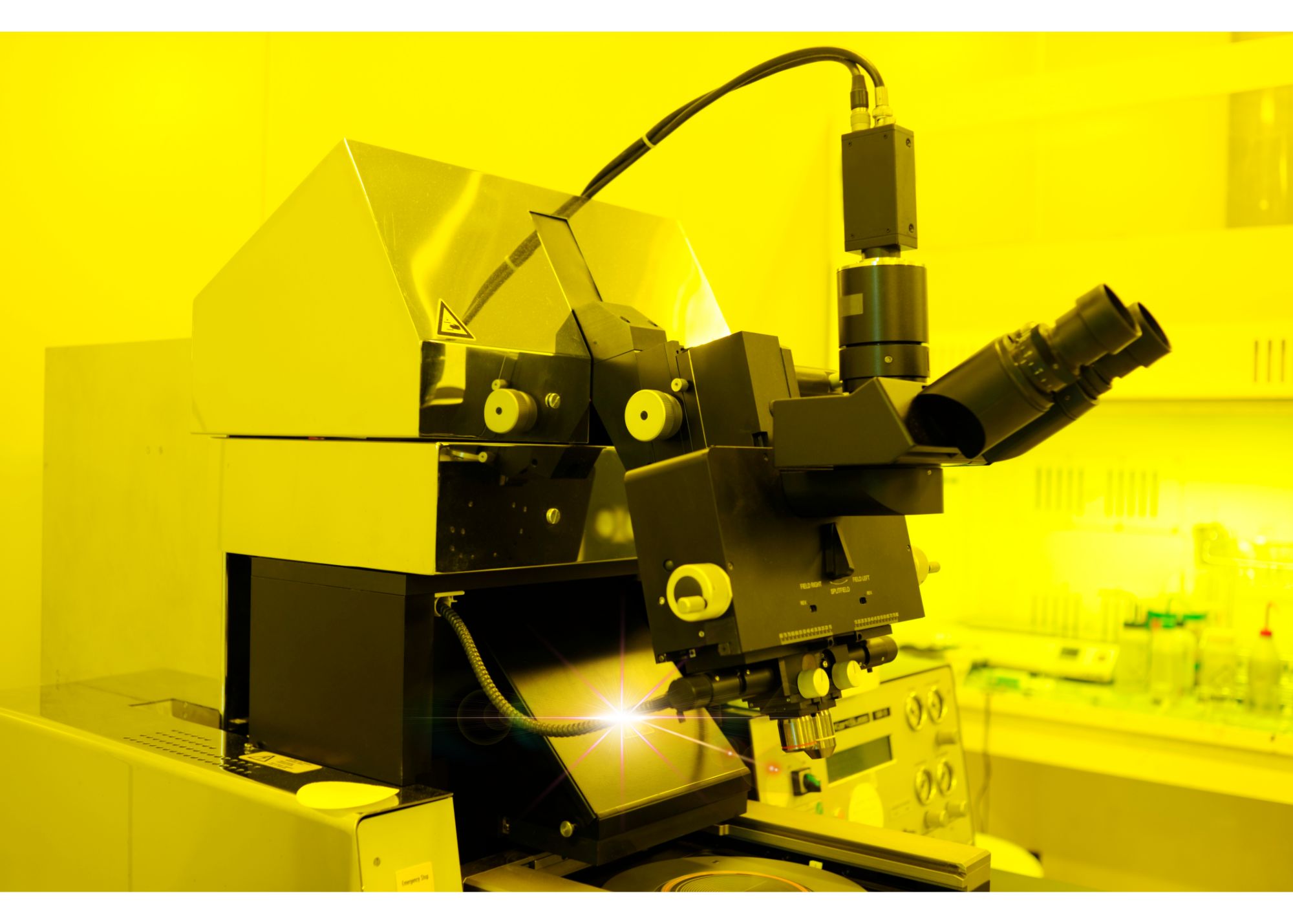

ASML (NASDAQ:ASML) is the only company in the world that produces extreme ultraviolet lithography machines, a critical technology for the most advanced semiconductor manufacturing.

For TSMC, who is crucial in the semiconductor supply chain, ASML acts as the backbone to chip production thanks to its $150 million machines.

But are they enough to make it worthwhile to buy the stock?

Key Points

- ASML is the sole supplier of essential EUV lithography machines used by major chipmakers like TSMC, Intel, and Samsung.

- ASML is in a great place to benefit from rising demand for advanced chips, driven by AI, 5G, and autonomous vehicles.

- ASML’s high valuation reflects its near-monopoly in EUV technology and strong future growth prospects, making it a solid long-term investment.

Why Is ASML So Important?

ASML is pivotal to the evolution of everything from smartphones to artificial intelligence.

The company’s lithography machines are essential for producing smaller, faster, and more efficient chips.

Given the insatiable demand for advanced chips in a wide range of industries alongside its wide economic moat, ASML’s prospects are highly promising for long-term investors.

As the sole provider of EUV lithography machines, ASML enjoys a competitive advantage like few others can imagine.

The company’s EUV technology uses extremely short wavelengths of light to etch intricate patterns onto silicon wafers, is required to manufacture chips at the 5nm and smaller process nodes.

As a result, it has become a critical supplier to the world’s largest semiconductor manufacturers, including Taiwan Semiconductor Manufacturing Company, Intel, and Samsung.

And all that dominance has translated to impressive financials. ASML reported €22.7 billion in net sales in 2023, of which over 90% came from EUV lithography systems. This segment continues to grow as foundries transition to smaller nodes like 3nm and beyond, highlighting ASML’s grip on the semiconductor industry.

Does a Brilliant Future Lie Ahead?

The demand for semiconductors is only expected to rise over the next decade, driven by several long-term trends, including AI, 5G and IoT as well as autonomous vehicles.

AI and machine learning applications require powerful processors, such as GPUs, that rely on cutting-edge chips produced with EUV lithography while 5G networks need smaller, faster, and more power-efficient chips.

Similarly, the race to develop fully autonomous driving technologies is accelerating the demand for semiconductors capable of real-time processing of enormous amounts of data.

And because the global semiconductor market is expected to grow at a compounded annual growth rate of 7.4%, reaching over $1 trillion by 2030, ASML has all the tailwinds to grow rapidly.

Is ASML Expensive?

Most recently, ASML traded at a price-to-earnings ratio of around 42x, which is relatively high compared to the broader market but this valuation reflects the company’s unique position in the semiconductor industry and the growth potential stemming from long-term trends.

It’s also noteworthy that while ASML’s P/E ratio may seem high, it is in line with other semiconductor equipment manufacturers like Applied Materials and Lam Research, which trade at P/E ratios of 30-35x.

The premium valuation can likely be justified by its near-monopoly in EUV lithography, strong financial performance, and solid demand outlook.

Given the semiconductor industry’s importance to global technological progress, ASML’s shares are likely to remain a coveted asset for long-term investors.

A Must-Have In Long-term Portfolios

ASML’s stock is ideal for long-term growth investors who want to gain exposure to the technological trends that will define the future.

Its leadership in EUV lithography, coupled with strong financials and exposure to long-term growth trends, makes it a compelling investment.

The global transition towards more advanced chips, driven by AI, 5G, and autonomous vehicles, put ASML at the epicenter of the semiconductor industry’s future. For long-term investors looking to capitalize on the demand for cutting-edge technology, ASML offers an unparalleled opportunity.