Is Planet.com A Hidden Gem?

Space stocks have been incredibly popular among retail investors and traders as of late, and for a good reason. Driven by Tesla’s Elon Musk, Amazon’s Jeff Bezos, and Virgin’s Richard Branson and their respective ventures into space travel and exploration, the cost of launching a satellite has dropped from $200 million or more a decade ago down to $60 million or less today. This massive price drop is only expected to continue in the coming years, eventually predicted to reach as low as $5 million in just a few years’ time.

This innovation has led to the commercialization of space on a massive scale, and, as a result, the development of several promising space-themed stocks on the New York Stock Exchange.

Planet.com, also known as Planet Labs, is one such stock. But Planet Labs is not just one of the many — it’s a major standout from the crowd. It’s not sending astronauts into space. Instead it’s a data play and could well be a hidden gem.

What Does Planet.com Do?

Planet Labs Inc. — once known as Cosmogia, Inc. — is a one-of-a-kind satellite imaging company based out of San Francisco, California.

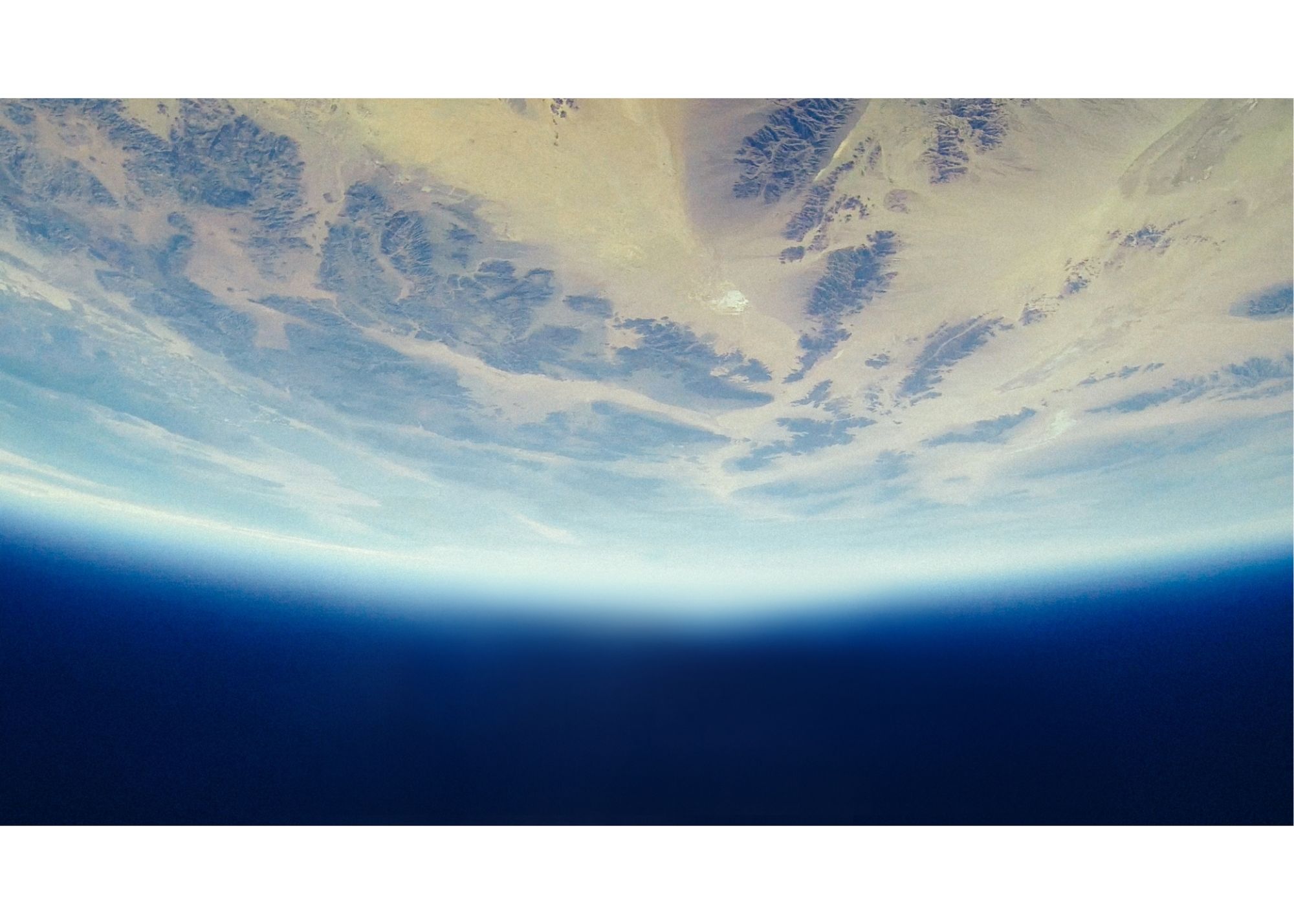

Planet Labs uses its fleet of satellites to image the entire planet once a day, every day in an effort to better monitor trends and track changes.

In order to do this, Planet uses miniature satellites known as Doves. The Doves are put into orbit during larger, unrelated rocket launches where they’re included as secondary payloads.

Each Dove has its own high-quality telescope and camera to constantly scan and image the surface of the Earth, providing the most up-to-date information on climate change, predicted crop yield, weather patterns, urban planning and development, disaster response roll-out, and countless other observable phenomena.

The images being gathered and the data being sent back by Planet Labs and its satellites are unlike anything else currently on the market today — not even Google Earth can compare to what Planet Labs is doing. It’s a big part of what sets the company apart.

What Sets Planet.com Apart?

Truth be told, Planet Labs stands far ahead of any other company operating today. There’s no doubt that it has a moat: The company is growing increasingly faster with each new quarter, its long list of features and its immense amount of data gathered on the daily means its use cases are practically endless, and its growth rates are forecast to be through the roof (which we will discuss further shortly).

In short, no one is doing what Planet Labs is doing right now. Even its closest competitors — like Maxar Intelligence, EarthDaily Analytics, and Orbital Insight — are years and years away from reaching where Planet Labs is today.

Given the company’s rapid growth, Planet.com will be even further ahead by that point. Planet Labs has more than 200 satellites — more than 10 times the size of any competitor constellation — are the largest Earth imaging fleet in history, and its fleet won’t be slowing anytime soon.

Planet.com’s Financials

Planet Labs has been around for over a decade now, but it just recently went public on the New York Stock Exchange. The company IPO valued it at $2.8 billion dollars.

Planet Labs went public via a merger with the SPAC DMY Technology Group Inc IV, a special purpose acquisition company listed as DMYQ. Planet Labs ticker symbols is PL.

Since going public, PL share price has almost halved. That offers potentially an attractive entry point given that PL annual revenues for the fiscal year 2021 exceed $110 million. Sales stem from over 700 subscription-based clients throughout agriculture, defense, government, mapping, forestry, energy, finance, and insurance industries across the globe.

What’s more, the capital gained from going public will only accelerate Planet Labs’ growth rates even more.

Planet.com’s Growth Rates

There are multiple factors driving Planet.com’s growth rates. That’s because the company finds itself in a fascinating position: It’s scaling in pre-existing verticals like investment in sales, marketing and software solutions. Further, it is expanding into new verticals in software as well as establishing a platform ecosystem through its apps. Moreover, Planet.com is meeting market demand with new proprietary sensors and data.

Beyond these growth factors, there are additional ones — like Planet Labs’ advanced predictive analytics and modeling, long-tail adoption, fusion of novel data sets, and strategic acquisitions — that have the potential to significantly accelerate the company’s already rapid growth rates. As it stands, Planet Labs expects to see a growth rate of 40% over the next five years. The company has seen over 100% growth year-over-year across its entire line of products.

The Bottom Line: Is Planet.com A Hidden Gem?

It’s estimated that the global space industry will be worth a trillion dollars in revenue by 2040. Presently, the industry earns $350 billion annually (and rising). Planet Labs and its future on the stock market is just one part of a major shift toward space stocks going on right now. Planet.com has little analyst coverage from the major research houses like Morgan Stanley and Goldman Sachs, but once word gets out expect a pop.

Planet.com checks a lot of boxes, not only fast growth and a moat that is widening but also a sustainability play that will attract money managers with hundreds of billions to deploy like Blackrock as well as smaller ESG-focused funds like Generation Investment Management.

All in all, though, looking at Planet Labs’ moat, its rapid growth ahead of all other competitors, its long list of use cases, and its high valuation, one can confidently say that the company is definitely a hidden gem in the making.