Nvidia Still Dominates AI, But the Ground Beneath It Is Shifting

Nvidia has been the undisputed king of the AI hardware empire.

But even monarchs can be overthrown, especially when their biggest allies start eyeing the throne.

Who’s threatening NVIDIA now and will they win?

Key Points

-

Nvidia still leads AI hardware, but growth is slowing and major clients are building their own chips.

-

High margins make Nvidia a target, pushing hyperscalers to seek cheaper in-house alternatives.

-

Sovereign AI is a new growth path, with Nvidia partnering with governments to build national AI systems.

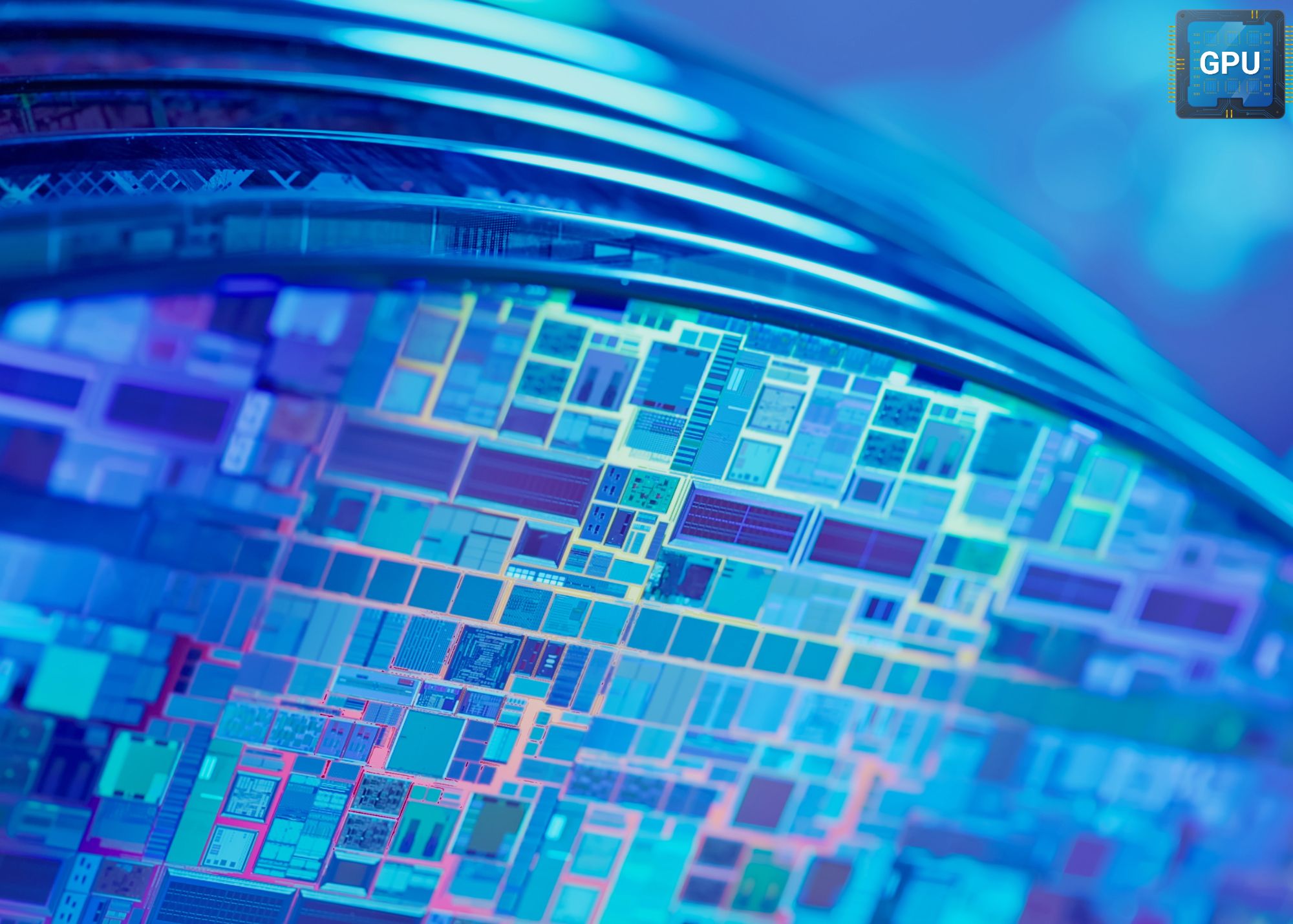

Nvidia Owns the Battlefield For Now

There’s no sugarcoating it, Nvidia owns the AI training chip space. Depending on the source, NVIDIA market share sits somewhere between 80% and 90%.

That includes both training large language models and running them in production, known as inference.

NVDA hardware powers the boom in generative AI, from ChatGPT to image and video models.

Part of what makes Nvidia so dominant is that it’s more than just a chip company. Its CUDA software ecosystem is a fortress, and its community of developers is deeply entrenched in its tools. That lock-in effect is hard to replicate.

But when you’re already this far ahead, you’re the target. Everyone behind you is figuring out how to close the gap, or go around you entirely.

Growth Is Slowing But It’s Not a Crash

Nvidia isn’t in trouble today. Far from it. In the most recent quarter, revenue surged 69% year over year to $44.1 billion. That’s a massive number, powered by early shipments of its next-gen Blackwell chips.

But investors with sharp memories will note that’s a steep drop from the 262% growth rate Nvidia clocked a year earlier. And the story behind that slowdown isn’t just about weak macro trends or some passing China headwinds.

In fact, Nvidia took a $4.5 billion impairment charge tied to excess inventory of chips destined for China, largely a result of U.S. export restrictions targeting its H20 AI chips. That inventory may never find a buyer.

When Your Customers Turn Into Competitors

Nvidia’s gross margins are so good, hovering around 70%, that they’ve drawn envy from the software industry. But those margins are tempting Nvidia’s customers to build their own alternatives.

OpenAI is a prime example. Earlier this year, it was reported that the company is working with Taiwan Semiconductor Manufacturing to fabricate a custom AI chip, one that would help it break its reliance on Nvidia entirely.

The goal is more control, better efficiency, and lower cost. OpenAI expects to roll these out by 2026.

They’re not alone because Google already deploys its own custom TPU chips in its cloud, and Amazon’s AWS offers clients access to its proprietary Inferentia and Trainium chips, often in parallel with Nvidia’s hardware. These in-house chips are designed for specific workloads, which can deliver better performance-per-dollar than Nvidia’s general-purpose offerings.

If you’re a hyperscaler spending billions a year on Nvidia GPUs, building your own chips becomes a high-ROI project.

The Rise of “Sovereign AI” Could Be a Lifeline

Just as Nvidia faces pushback from its largest private sector customers, it’s planting seeds in a less saturated space, national governments.

The idea is called “sovereign AI.” The premise is simple but powerful whereby countries want to control their own AI infrastructure, everything from the data to the hardware and models, without relying too heavily on U.S. tech giants.

So far, Nvidia’s push here is gaining traction. In Europe, it’s working with local partners to deploy thousands of Blackwell systems across France, Italy, and the U.K. The Middle East is another focal point.

The Saudi deal alone is speculated to involve as many as 5,000 Blackwell GPUs. That’s a major deployment. If sovereign AI takes off globally, Nvidia could secure a second wind of growth, offsetting the plateau in U.S. enterprise demand.

What Investors Should Watch Now

Nvidia’s future still looks bright, but it’s not the same path investors might have expected even six months ago.

Yes, the company is still innovating rapidly. Yes, its chips are world-class. But the competitive dynamics are evolving. Its customers want cheaper alternatives. Its growth is slowing. And its geopolitical exposure is rising.

At the same time, Nvidia’s sovereign AI strategy could carve out a new moat, one that competitors will find hard to replicate because it hinges on diplomacy and trust, not just specs.

The AI arms race is only getting started. But the battlefield is shifting, and Nvidia will need more than brute force to stay on top.