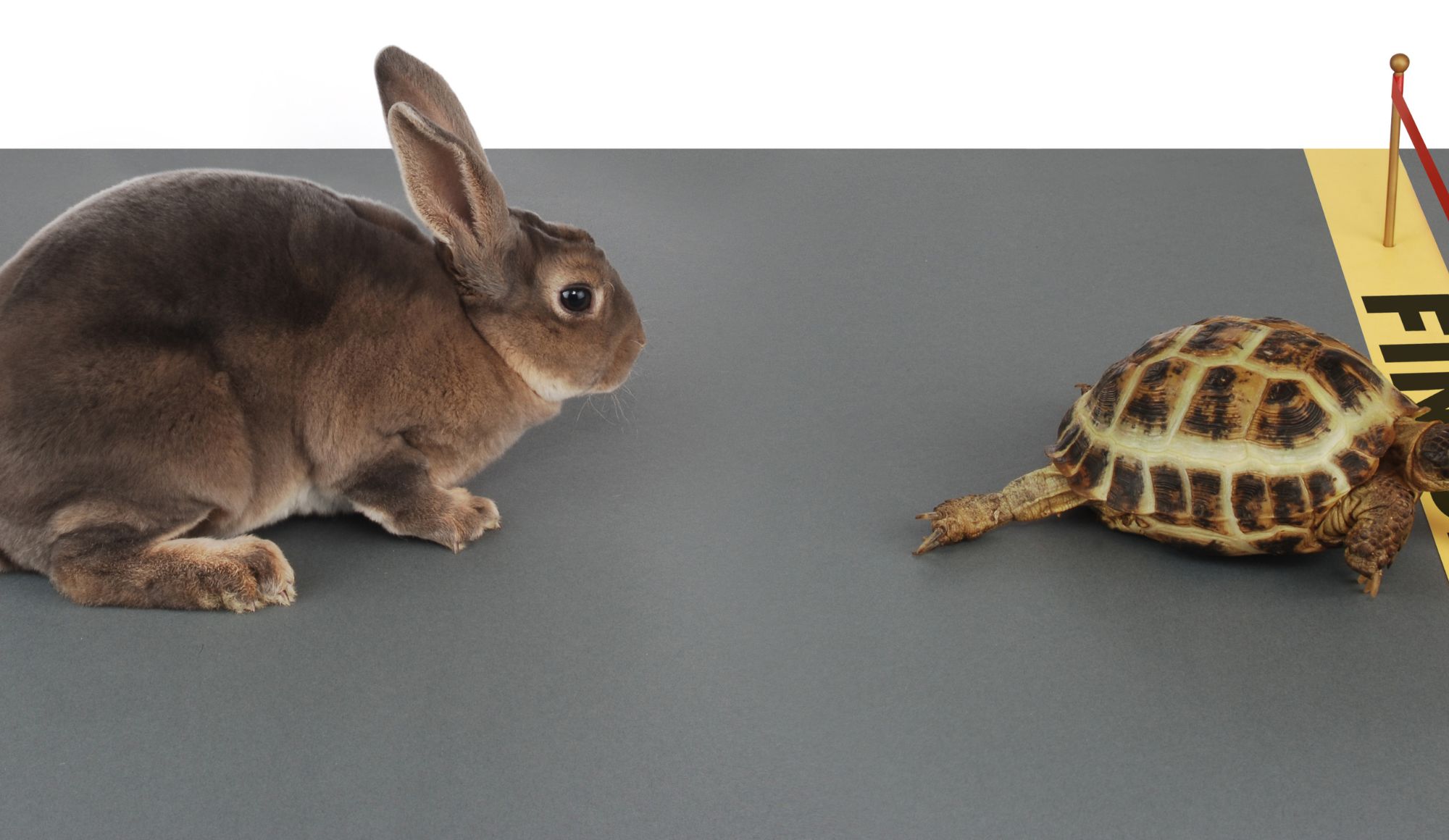

Buffett Wins the Hare vs Tortoise Race, Again

ARK Invest (ARKK) was a darling of Wall Street for several years. It focused on disruptive technologies and its promise to outperform the market attracted enormous interest. Then interest rates rose and growth stocks fell out of favor. Since then, Berkshire Hathaway (BRK.A)(BRK.B) has been slowly but surely overtaking ARK Invest, with the latter seeing a 67% drop since last November.

So which is the better bet now? Buy ARKK on the dip, or stick with the slow-and-steady Berkshire?

Berkshire Hathaway’s investing philosophy

Berkshire Hathaway is a conglomerate with many businesses, ranging from insurance and utility companies to manufacturing and retail. Its CEO, Warren Buffett, is one of the most successful investors in history. A large part of this is owed to Buffett’s investing philosophy that is based on value investing.

Value investing is a strategy that focuses on finding stocks that are trading at a discount to their intrinsic value. Value investors are typically contrarian in nature, meaning they are not afraid to go against the herd and buy stocks that are unpopular or out of favor. They believe that, over the long run, the market will eventually recognize the true worth of these companies and reward them with higher stock prices.

Criteria to pick value stocks include:

- Calculate a company’s intrinsic value accurately: This can be done by looking at factors such as earnings, book value, and discounted cash flows.

- Select companies with a wide moat: A wide moat is a competitive advantage that makes it difficult for competitors to take market share away from a company.

- Experienced and competent management teams: Look no further than Satya’s leadership and turnaround at Microsoft as an example.

- Long history of profitability and strong fundamentals: Strong fundamentals include a healthy balance sheet, a history of consistent earnings growth, and a low debt-to-equity ratio.

- Be patient: Value stocks can take years to achieve their full potential. Patience is vital when investing in them.

This strategy has served Berkshire Hathaway well over the years, with the company’s stock price increasing by an average of 20.1% compounded annual gain from 1965 to 2021.

ARK’s investing philosophy

Led by CEO Cathie Wood, ARK Invest has taken a different investment approach. Rather than focus on value stocks, ARK invests in companies at the forefront of disruptive technologies. These businesses are changing or can potentially change how we live and work. The legitimacy of this investing strategy was validated in 2020 when ARK’s ETF brought in staggering returns of 150%.

Some companies in ARK’s portfolio include Tesla, Zoom, and Coinbase.

The thinking behind this investment strategy is that these companies will continue to grow exponentially as they revolutionize their respective industries. This growth will be reflected in their share prices, eventually.

If you can find a company with strong fundamentals and fast growth prospects, you could see serious returns on your investment.

Some criteria for picking growth stocks are:

- High returns on invested capital (ROIC): This measures how efficiently a company uses its money to generate profits. The higher the ROIC, the better.

- Solid tailwinds: This refers to favorable industry trends working in the company’s favor. For example, the rise of electric vehicles is a tailwind for Tesla.

- Sustainable competitive advantage: This gives a company an edge over its rivals and helps it maintain its profitability over the long term. For example, Twilio’s users must incur switching costs to move to a different provider and retrain their staff, making it difficult for competitors to take away their market share.

Why Berkshire Hathaway is outperforming ARK Invest

Berkshire Hathaway has been outperforming ARK Invest lately for a few reasons:

- Macroeconomic uncertainty: The stock market has been volatile lately due to concerns about the global economy. This has benefited value stocks, which tend to be more defensive.

- The performance of specific companies: Some companies in Berkshire’s portfolio, such as Chevron (up 59.89% since last November) and Occidental Petroleum (up 132.54% since last November), have performed well recently. In contrast, some companies in ARK’s portfolio, such as Zoom (down 68.08% since last November) and Shopify (down 78.24% since last November), have seen their stock prices fall since 2020.

- Potential interest rate hikes: There is a strong expectation that interest rates will rise further, prompting investors to continue to move away from growth stocks and into value stocks. With a more risk-averse attitude, this will likely translate to investors switching their riskier (e.g. tech) stocks to more conservative (e.g. utility stocks) which are generally safer.

- ARK’s significant investments were pandemic plays: Many of ARK’s significant investments were companies that benefited from the pandemic, such as Zoom and Teladoc. With people starting to return to normal life, these remote working and learning companies may not see the same growth in the future.

Which investing strategy is better in the long run?

There is no simple answer to this question. Both value and growth investing have the potential to generate strong returns over the long term. However, each strategy has its risks and rewards.

Value investing tends to be more stable and predictable, but it can also underperform in periods of economic expansion. Growth investing is more volatile, but it has the potential to generate much higher returns.

In a recessionary environment, value is generally the better choice. In a booming economy, growth stocks are often the preferred play. In short, for now, Berkshire is the better reward to risk option over ARK, even after the latter’s pullback.