Market Commentary: Is Musk Making a Massive Mistake?

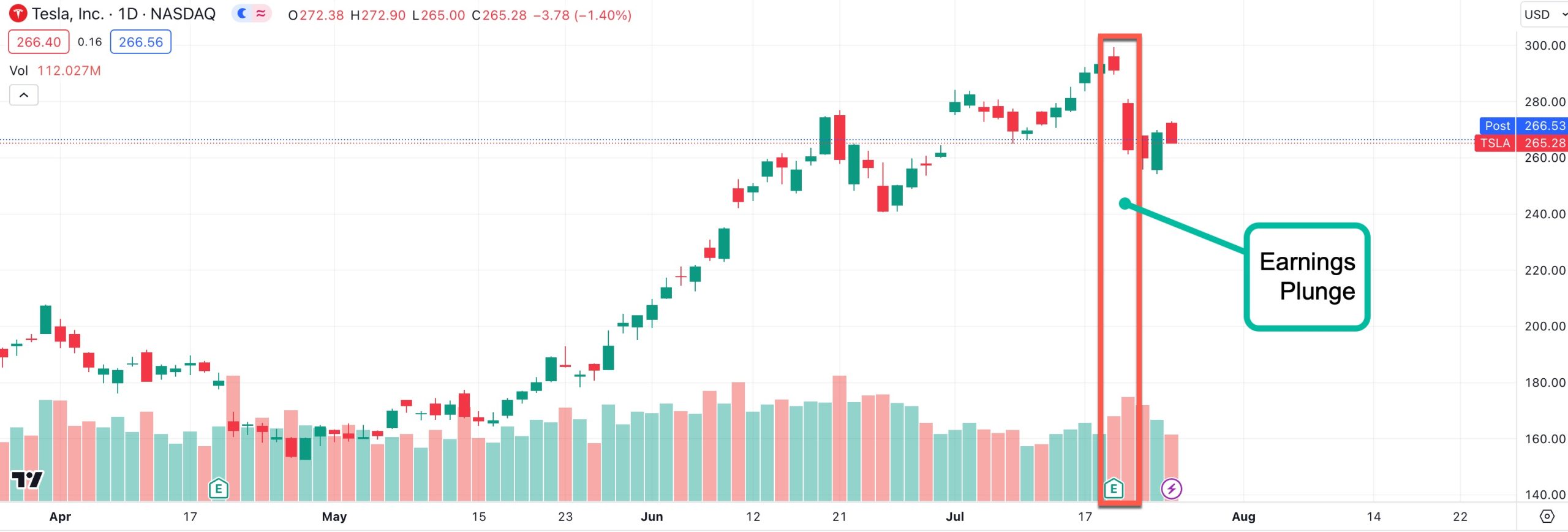

Tesla reported record profits and production in the second quarter of 2023, but its stock price fell 11%. The company’s revenue increased 47% year-over-year to almost $25 billion, and delivered just shy of 900,000 vehicles. However, Tesla’s gross margin fell by almost 7% points from 25% in the previous quarter, due to price cuts.

Tesla CEO Elon Musk said that the company is “sacrificing margins” in order to boost sales and production. He said that Tesla is aiming for a consistent annual growth rate of 50%, and that it is willing to accept lower profits in order to achieve this goal.

Is he making a massive strategic error?

Strategic Error?

Investors were not impressed with Tesla’s decision to cut prices. They are also concerned about the delays to Tesla’s Cybertruck and other projects, triggering an 11% share price dip.

The company is facing increasing competition from other electric vehicle manufacturers, and it is not clear whether it will be able to maintain its growth rate.

One thing in its favor is Tesla’s Dojo supercomputer, designed to train artificial intelligence (AI) systems for autonomous vehicle navigation.

Dojo’s architecture is designed to optimize video data processing, which is a critical element in training AI for autonomous navigation.

In addition to its processing power, Dojo also has the ability to analyze visual images. This is important because it allows the supercomputer to understand the environment around an autonomous vehicle. Dojo can identify other vehicles, pedestrians, road signs, and traffic signals, which are all important for safe navigation.

Dojo’s capabilities have been compared to other supercomputers, especially those that use Nvidia’s GPU chips. While Nvidia’s chips are used in many supercomputers, Tesla’s decision to develop its own chips for Dojo could give the company a significant advantage.

By creating its own chips, Tesla has more control over the design process. This allows the company to customize the hardware specifically for AI training. This could result in more efficient processing and shorter training times, which would give Tesla a competitive edge in the race to achieve full autonomy.

Nvidia Vs Tesla

Famously, there is a massive GPU chip shortage, and Nvidia has been benefiting from it to an unparalleled extent. The fact that Tesla has ambitions to be self sufficient should alone command a premium.

While the scale of Musk’s ambition comes with commensurate risk, it should be doubted at its peril. For a car manufacturing company, he’s overcome arguably the biggest challenges to date. Tesla’s valuation is the de facto proof of how far the company has come on its journey, and the next leap forward should not be underestimated.

So is Musk making a strategic error? I wouldn’t bet against him, or Tesla.