Smart Money Pours Into ONE Forgotten Stock

If following smart money translates to making money, now might well be the time for one company to start bouncing substantially. That’s because not only is one big money investor snapping up shares but a whole plethora of them are, and they are doing so collectively for the first time in about 3 years.

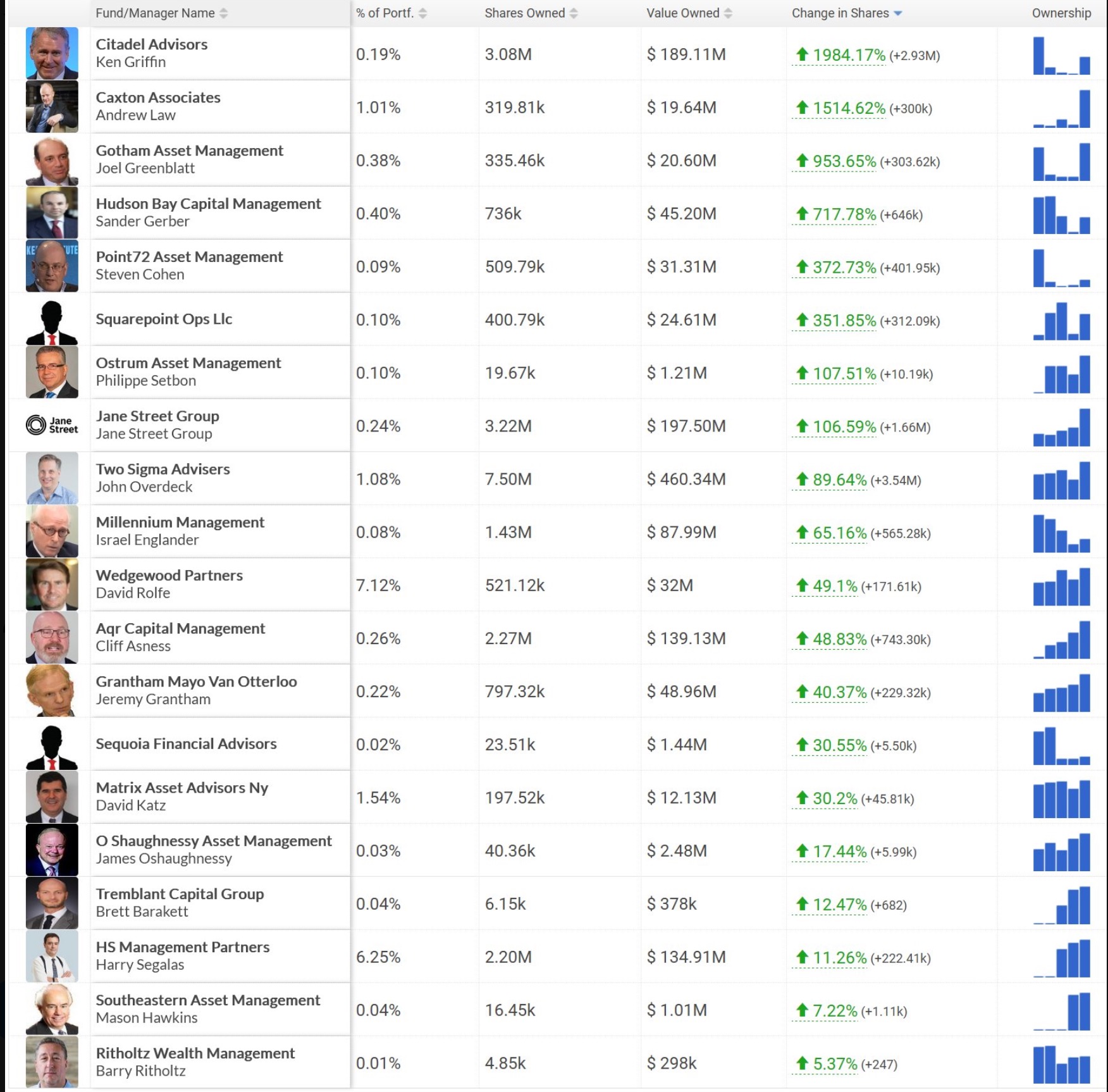

The stock in question is payments leaders, PayPal. As you can see below, a veritable who’s who own shares in the financial technology firm, from Citadel’s Ken Griffin to Steve Cohen’s Point72 Asset Management.

So, is it time for you to buy PayPal?

Credit: Derek Quick

Key Points

- Smart money investors have jumped on board the PayPal value play story, and so too has management.

- PayPal’s price-to-earnings relative to its forecast earnings growth rate is very attractive.

- On a valuation basis, the company is attractive, not least because of its monster cash flows.

What Next for PayPal?

What is it that the smart money has seen in PayPal given that 20 analysts have revised their estimates lower for the coming quarter?

It seems that, in spite of the revisions, PayPal’s valuation is compelling. Trading at just a 16x price-to-earnings ratio, PayPal is a compelling value play on that key profitability metric alone.

But arguably the more intriguing part of the story is how earnings are forecast to grow in coming years, making the price-to-earnings ratio relative to growth seem highly attractive.

Net income is forecast to grow at a 17.7% annual rate over the next 5 years while revenue is expected to climb by 10.9% annually over the next five years.If those numbers are correct, the future looks very bright for PayPal, particularly at present valuation levels.

Clearly, smart money investors aren’t the only ones to cotton on to the discrepancy between price and value. We see that management has a share buyback in place too.

But how high can PayPal go?

Will PayPal Go Up?

Trading below $70 per share still, PayPal remains muted relative to fair value, even though it’s up substantially in recent months from a low in the high $50 range.

A discounted cash flow forecast analysis reveals that PayPal can climb to as high as $84 per share, suggesting as much as 27.1% upside from present levels.

It’s that dichotomy between price and value that likely has caught the eyes of smart investors and sparked their interest in snapping up shares.

In addition, PayPal is highly profitable and continues to be a monster cash flow generator, producing $4.2 billion last year alone and consistently generating billions each and every year over the past five. Indeed not a single year in the past decade did the stock report FCF less than $1 billion, a remarkable achievement.

And yet in spite of the key line item being so strong, PayPal stock has been decidedly underwhelming. Over the past 5 years, it’s down by 34% and trades with a $69 billion market capitalization, meaning that it’s got about a 17x multiple to FCF, far lower than most companies.

It’s no wonder that hedge funds and big institutions alike are buying the stock. Eventually that FCF is returned to shareholders or drives future growth. It acts as a buoyancy aid to support the market capitalization and don’t be surprised if the share price continues its march higher in the coming years.