1 Semiconductor Stock Set To BLAST Higher?

It’s no secret that the market has been struggling over recent quarters. During downtrends, savvy investors search for companies with great potential on sale. One company that might fit the bill is Cohu. As you’ll see, it has compelling financial metrics and some serious upside potential.

Cohu Is Critical to Chip Manufacturers

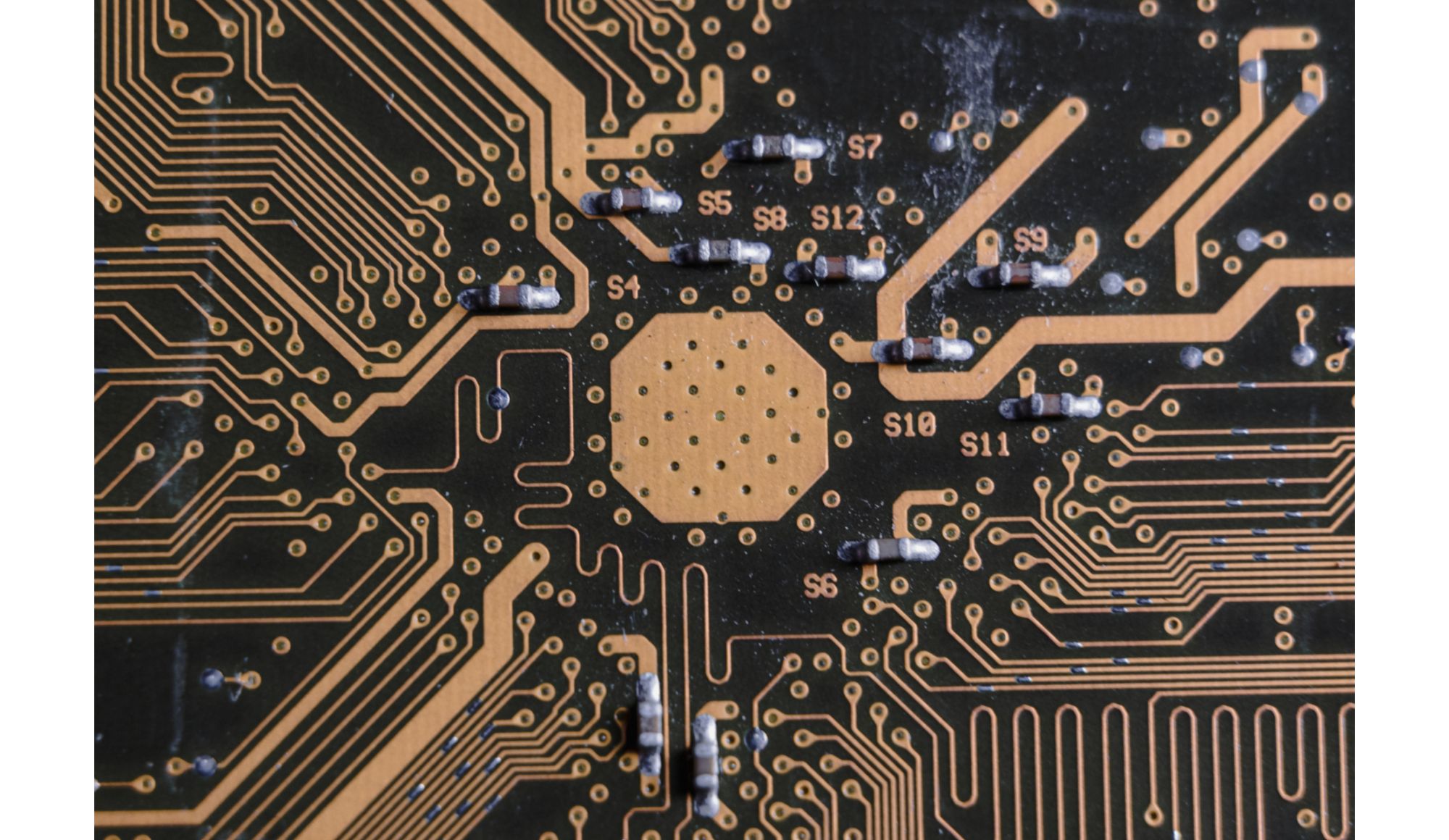

Cohu, Inc. is a global leader in test and handling equipment, thermal subsystems, interface solutions, vision inspection & metrology, and MEMS test solutions supplying the semiconductor industry and its test subcontractors. The company provides data analytics products that provide real-time online performance monitoring and process control.

Over the past few years, the stock hit a high of around $43 per share in December 2020. However, over the last year and a half, it has been on a continued downtrend. So what does the future hold for COHU stock as the Federal Reserve begins to raise interest rates to combat high inflation?

Despite the uncertainty surrounding the economy, Cohu is likely to remain successful as it provides critical manufacturing equipment to the world’s largest chip producers. The financials have improved over time and the tone expressed by management on earnings calls is very optimistic.

What Does the Future Hold for Cohu?

Cohu provides critical manufacturing equipment to the world’s largest chip producers, meaning the company is here to stay for the foreseeable future. While it is possible that business for Cohu could slow a bit in the short term, the company is still on track to generate around $1 Billion in annual revenue in the next few years.

In 2021, Cohu recorded a record-high $887 Million in revenue and $3.20 in non-GAAP earnings per share. During the Cohu 2021 Q3 Earnings Call, company executives outlined what they believe the future holds for Cohu. Jeff Jones, the Chief Financial Officer of Cohu, relayed messages to shareholders about the company’s financial health. Jones told shareholders, “Cohu again delivered strong revenue and profitability in the quarter. Q3 revenue was $225.1 million, an increase of 49% compared to Q3 of 2020.”

Jones went on to say, “During the third quarter, two automotive segment customers each accounted for more than 10% of sales. In the third quarter, Cohu’s gross margin was 42.3%, and in line with our guidance, operating expenses were $49.5 million and lower than guidance due to some one-time credits and tight management of expenses. Third-quarter non-GAAP operating income was 20.2% of revenue, and adjusted EBITDA was 21.8%. Return on invested capital in the third quarter was 51%, well-above target ROIC of 30% or higher.”

Looking at 2021 Q4, Jones relayed the messages, “Entering the typical seasonally low Q4, Cohu’s business model is projecting to deliver strong profitability on revenue between $182 million and $195 million.”

In terms of company growth, CEO Luis Miller told shareholders about Cohu’s future plan. Miller told shareholders, “As the need for data analytics grows, we plan to continue expanding DI-Core offerings to help improve quality and yield and to continue to increase value-add differentiation of our systems.”

Is COHU Stock a Buy, Sell, or Hold?

Looking to the past, top line growth has been extraordinary for a semiconductor company:

- 2017: 25.0%

- 2018: 28.1%

- 2019: 29.1%

- 2020: 9.0%

- 2021: 39.5%

The company is trading at a healthy 11.5x P/E ratio and has a remarkable Piotroski Score of 8, suggesting very healthy financials. It is currently trading near a 5 year low when it comes to price-to-book value, sitting at 2.1x. And EBIT forecasts continues to march higher.

Running an analysis on the company’s financial statements, we ended up with a discounted cash flow forecast that pegged fair value at $40.09 per share, representing, 41.6% upside from current levels at the time of research.