Spotlight: The Next Bloomberg Terminal?

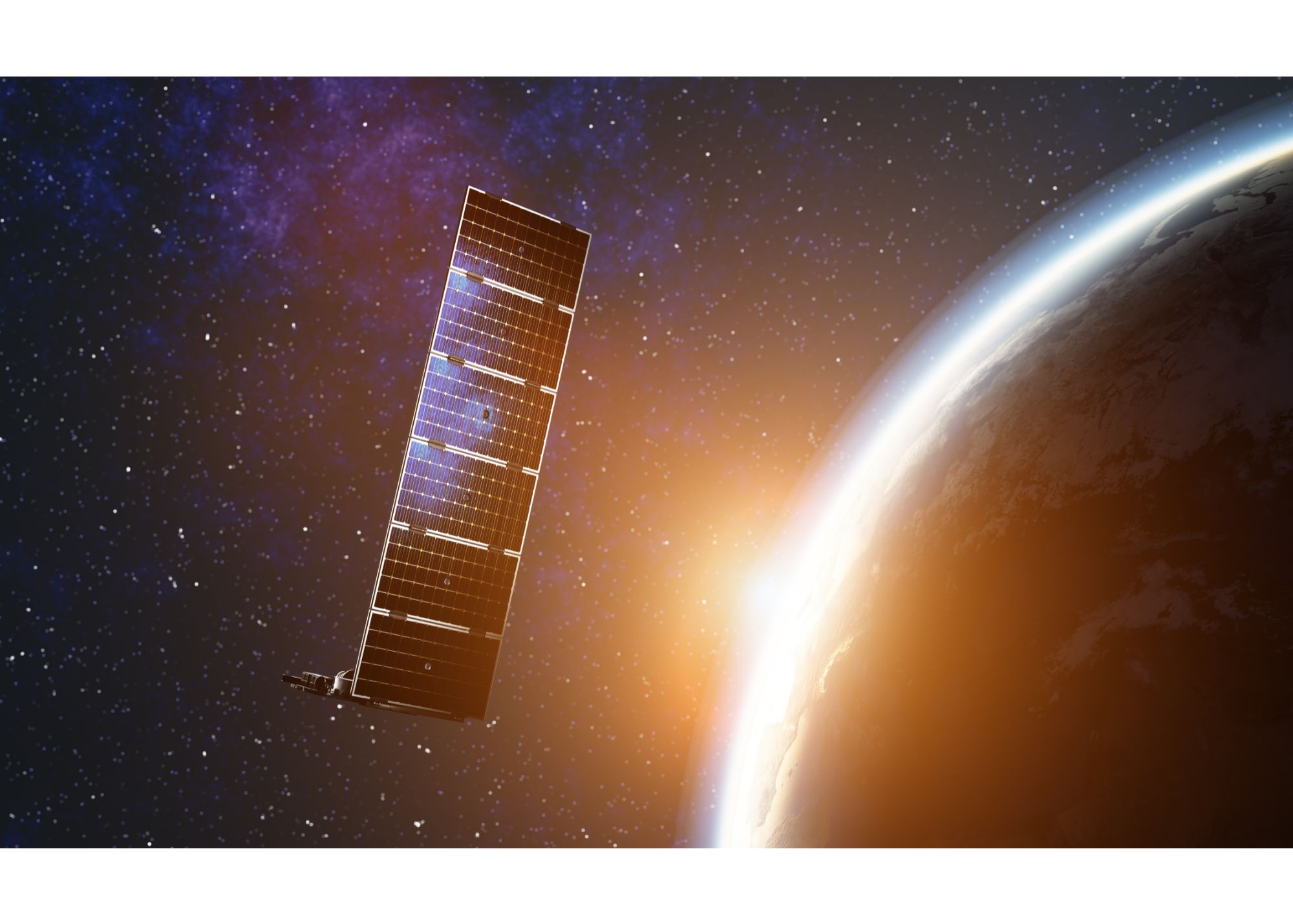

Did you know that every 24 hours, Planet Labs captures imagery of every corner of the Earth? This trove of data is so extensive that it helped track a rogue Chinese spy balloon all the way back to its point of origin.

Similar to a search engine, Planet Labs aims to organize massive amounts of Earth-related data. The company’s CEO, Will Marshall, often likens it to a Bloomberg terminal, but for Earth data.

Unlike Bloomberg, which aggregates data from various sources, Planet Labs owns its information, giving it a robust edge. The company’s fleet of satellites takes snapshots of the Earth, generating vast data sets useful for different sectors, from tracking Amazon deforestation to monitoring global military movements.

Key Points

- Despite a 50% drop in share price this year, Planet Labs has usually hit its financial forecasts and has $50+ million in quarterly revenues.

- The company’s revenue growth has slowed to 11.0% in the most recent quarter, causing investor concern. It has also operated at a loss for three years but holds over $350 million in liquid assets, providing a generous safety net.

- Analysts see the stock as undervalued by at least 35%, with a market value under 2x its annual sales of $200 million.

Financial Ups and Downs

At first glance, Planet Labs might seem like an investor’s nightmare, with its share price plummeting by over 50% this year alone. But there’s more to the story.

Unlike many early stage companies that overpromise and underdeliver, Planet Labs has consistently hit its financial forecasts.

With $50+ million in quarterly revenues from just shy of 1,000 customers, and a long pipeline of potential 7-figure clients, Planet Labs is a high prospect early-stage firm.

So what’s going on that’s causing the stock to stay muted this year?

The pace of revenue growth has decelerated to a mere 11.0% in the most recent quarter. Institutional owners never appreciates a growth slowdown, which partly explains the share price slump. Moreover, the company has been operating at a loss for 3 years straight, intensifying investor worries.

Yet, with over $350 million of liquid assets on the balance sheet, Planet Labs has a cushion to pivot its strategy before profitability becomes an urgent issue.

A Bargain or a Trap?

When it comes to valuation, analysts covering the stock consider it to be undervalued and think it could more than double. Using a discounted cash flow analysis, the stock appears undervalued by at least 35%.

The market currently values this $200 million-a-year business, with its cutting-edge technology and pipeline of substantial deals, at under 2x sales. Notably, renowned investors like Steve Jurvetson have been backing the company since its inception, even before formal incorporation.

Wrap-Up: Is Planet Labs a Buy?

Despite its recent hiccups, Planet Labs checks several boxes for long-term success. It has big names like Jurveton and Benioff as investors, and its business model is highly scalable. It also boasts a proprietary data set that it can leverage for years to come and compounds daily.

The company does face challenges. Its growth has slowed, and the user experience must be enhanced to accelerate B2B sales. Nonetheless, the firm has already surmounted formidable obstacles such as building high-resolution satellites and securing top-tier funding. With its share price at all-time lows, now is as good as any to consider this space stock given its unique positioning and strong assets.