Why This Might Still Be a Long-Term Winner

Leonardo DRS is one of those under-the-radar defense companies powering some of the most advanced military systems in the world. From sensors and tactical computing to ruggedized networking gear and combat vehicles, DRS builds much of the U.S. military’s digital backbone.

Shares are up more than 20% over the past year but have slipped nearly double digits since Q3 earnings.

» Read more about: Why This Might Still Be a Long-Term Winner »

Read More

Is SoFi Still a Once-in-a-Generation Fintech Opportunity

SoFi’s rise over the past few years has been stunning. SoFi’s stock has surged over 3x over the past 3 years, handily outpacing blue-chip tech names, even those riding the artificial intelligence wave. But that eye-popping run might be both a blessing and a curse.

Investors are now wondering whether SoFi keep up the pace?

» Read more about: Is SoFi Still a Once-in-a-Generation Fintech Opportunity »

Read More

How a $300 Mistake Opened a $1 Billion Market

Novo Nordisk, the pharmaceutical giant behind weight-loss blockbusters Ozempic and Wegovy, just let a key patent on semaglutide lapse in Canada because it forgot to pay a routine maintenance fee, the pharmaceutical equivalent of forgetting to renew your car registration.

As a result, generic versions of semaglutide, the active ingredient in both drugs,

» Read more about: How a $300 Mistake Opened a $1 Billion Market »

Read More

Could This $5 Billion Minnow Be the Next Big AI Buyout Target?

SoundHound AI isn’t chasing the same crowded lane as other AI giants. Instead of building general-purpose AI models or chasing flashy headlines, it has carved out a very specific, and potentially lucrative, niche, voice AI.

At its core, SoundHound builds sophisticated voice recognition and natural language processing software that enables real-time, conversational interactions between humans and machines.

» Read more about: Could This $5 Billion Minnow Be the Next Big AI Buyout Target? »

Read More

Is IonQ’s Meteoric Rise a Breakthrough or Bubble?

IonQ has become one of the hottest names in quantum computing. The Maryland-based firm is pioneering trapped-ion technology, which uses charged atoms to process information in ways classical computers can’t.

Since its 2021 debut, IonQ’s stock has rocketed roughly 450%, including nearly 300% over the past year. Such explosive gains raise a tough question of whether IonQ the future of computing,

» Read more about: Is IonQ’s Meteoric Rise a Breakthrough or Bubble? »

Read MoreThe Ivy

Is This The Most Reliable Passive-Income Engine?

Among the more compelling income opportunities in this corner of the market is Ares Capital, a business development company offering a nearly double-digit yield supported by one of the strongest credit platforms in the country.

That yield isn’t the main reason sophisticated investors pay attention, though. What distinguishes Ares Capital is the durability of the system generating those payouts.

» Read more about: Is This The Most Reliable Passive-Income Engine? »

Read MoreThe Spotlight

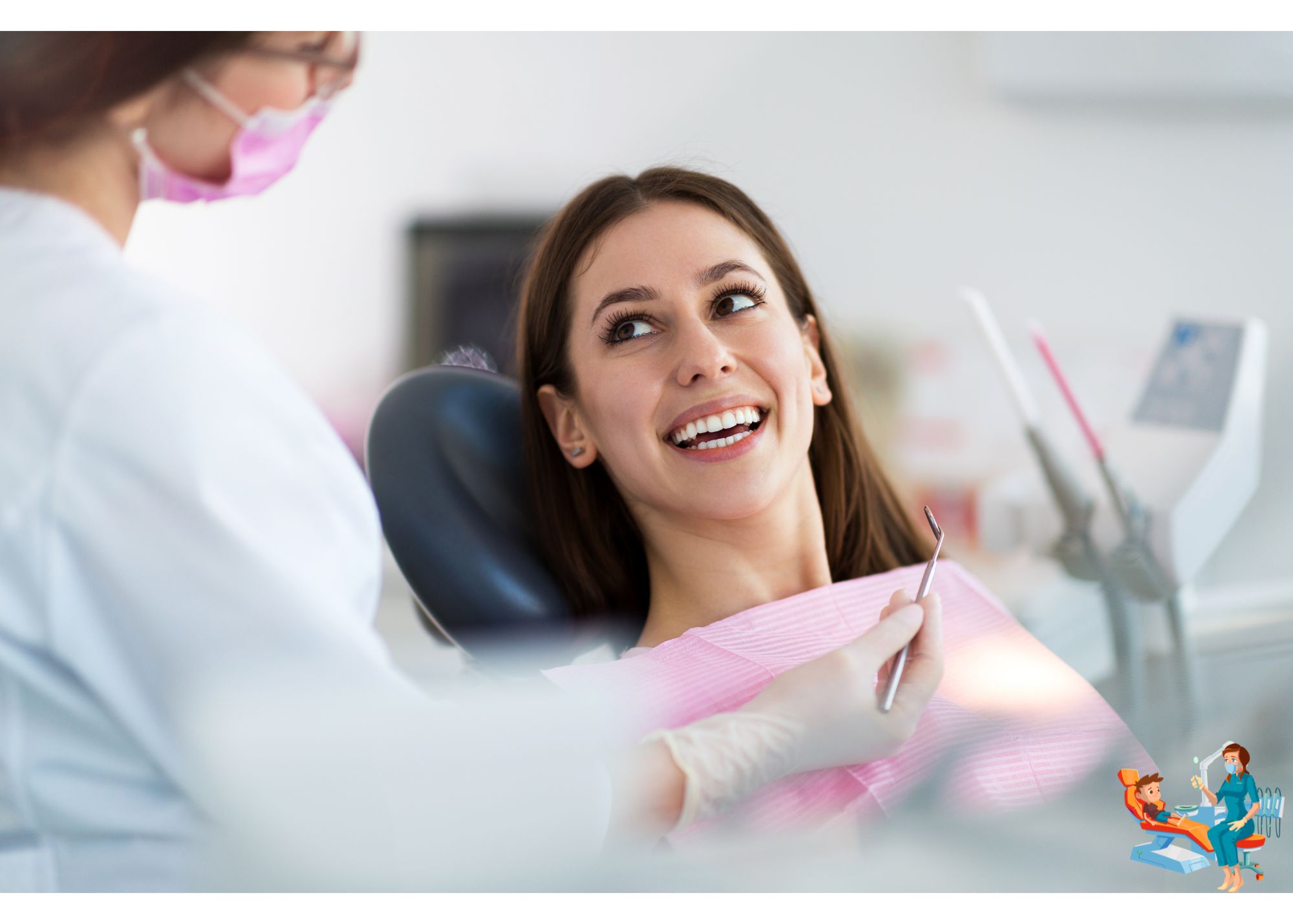

Is This Dental Stock a Stunning Bargain?

Dentsply Sirona (NASDAQ: XRAY), one of the world’s largest makers of dental equipment and supplies, was created in 2016 when Dentsply merged with Sirona Dental Systems.

Fast forward to today, and the company is battling falling sales, mounting losses, and a stock price that has been hammered by more than 44% in the past year.

» Read more about: Is This Dental Stock a Stunning Bargain? »

Read MoreThe Daily

Understanding Fill Orders in Investing: How They Work and Their Types

Key Takeaways

- A fill occurs when an order for a security or commodity is executed in the market.

- Market orders are filled quickly and are usually executed in full, given enough trading volume.

- Limit orders may not be fully executed if the set price is not reached,

» Read more about: Understanding Fill Orders in Investing: How They Work and Their Types »