2 Energy Giants Practically Mint Cash

Unlike upstream drillers who live by the barrel, Energy Transfer and Kinder Morgan quietly rake in stable cash flows by simply moving, storing, and processing hydrocarbons. Their businesses are mostly fee-based, and that makes them unusually resilient, especially in a market that punishes volatility.

Let’s dig into why these two midstream powerhouses are in a class of their own when it comes to cash generation,

» Read more about: 2 Energy Giants Practically Mint Cash »

Read More

Will Archer Aviation Make Flying Taxis a Reality?

For decades, flying cars have been the stuff of science fiction. But now, they’re inching closer to becoming part of our everyday lives and Archer Aviation (NYSE: ACHR) is one of the startups trying to make that future take off.

Archer is building what’s known as eVTOLs, electric vertical takeoff and landing aircraft.

» Read more about: Will Archer Aviation Make Flying Taxis a Reality? »

Read MoreThis Tiny AI Stock May Triple by 2030, Almost No One’s Watching

SoundHound AI isn’t the biggest name in artificial intelligence right now, not when companies like Nvidia and Microsoft are grabbing all the headlines.

But SoundHound may very well turn out to be one of the most surprisingly valuable small-cap AI stocks by the time 2030 rolls around. There’s a real story unfolding here and it’s starting to show up in the numbers.

» Read more about: This Tiny AI Stock May Triple by 2030, Almost No One’s Watching »

Read More

Can Netflix Double in Value in 5 Years?

Netflix (NASDAQ: NFLX) is back in the spotlight again. Not because it just dropped a new hit series but because investors are wondering something bigger. Can the stock double in the next five years?

It’s a fair question. After all, Netflix isn’t the underdog anymore. It’s not fighting Blockbuster. It is the blockbuster.

» Read more about: Can Netflix Double in Value in 5 Years? »

Read More

Forget Tesla, This EV Stock Just Got a Billion-Dollar Lifeline

If you’ve spent any time watching the electric vehicle space, chances are you’ve already dug into Tesla. But as Tesla enters its next phase of maturity, investors with an eye for disruption might want to turn their attention to a different name, one that’s flying under the radar but could be setting up for a breakout.

» Read more about: Forget Tesla, This EV Stock Just Got a Billion-Dollar Lifeline »

Read MoreThe Ivy

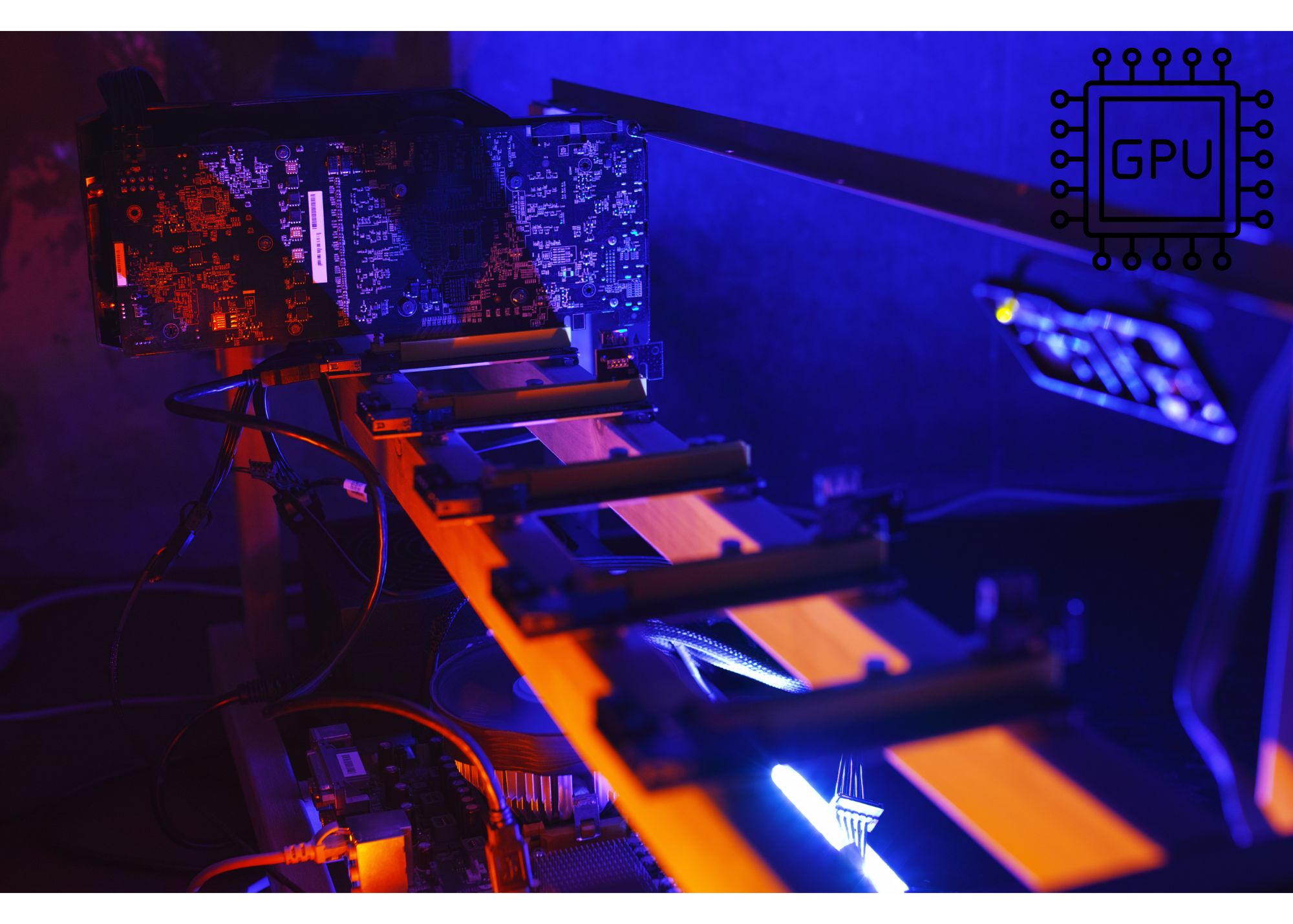

Time to Buy Leveraged NVIDIA? The Double-Edged Sword

NVDL is shorthand for the GraniteShares 2× Long NVDA Daily ETF, a leveraged fund that’s designed to return twice the daily performance of NVIDIA stock.

So, is NVDL a smart play or a high-voltage hazard?

Key Points

- NVDL delivers 2× NVIDIA’s daily returns, not long-term gains.

-

Traders use NVDL to amplify short-term bets on NVIDIA without options or margin accounts.

» Read more about: Time to Buy Leveraged NVIDIA? The Double-Edged Sword »

Read MoreThe Spotlight

Paul Tudor Jones Just Dropped a Masterclass on How to Invest Now

Every fall, a tight-knit group of investors gathers for a friendly, but fiercely competitive, stock picking challenge. It’s hosted by Paul Tudor Jones, the legendary hedge fund manager. But it isn’t just for a good cause. The top picks from the event, backed by the likes of Bill Ackman and Stan Druckenmiller, would’ve returned 7x your money in just six months.

» Read more about: Paul Tudor Jones Just Dropped a Masterclass on How to Invest Now »

Read MoreThe Daily

Sensex Today | Stock Market LIVE Updates: GIFT Nifty signals a positive start; Asian shares trade higher

Global Market LIVE Updates: Asian shares post modest gains before US payrolls

Asian markets edged higher as investors looked ahead to key U.S. jobs data, taking cues from the S&P 500’s record close after former President Trump announced a trade deal with Vietnam.