Wall Street Might Be Sleeping on Nvidia, But Not for Long

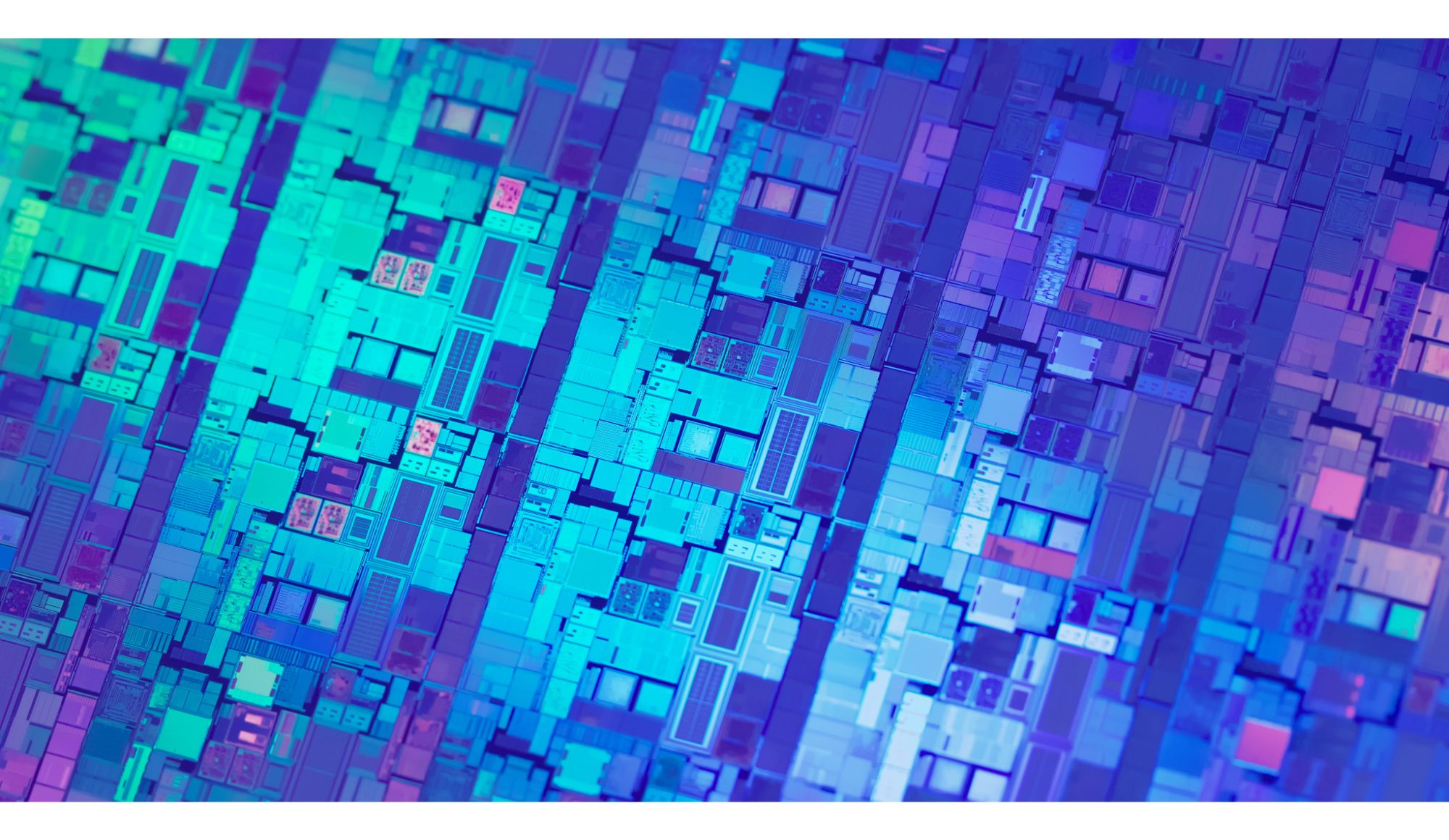

Nvidia’s stock has taken a notable dip in 2025, falling roughly 14% year-to-date. That slide has little to do with the company’s financials and everything to do with factors outside its control.

Fresh U.S. export restrictions on advanced chips, escalating trade war tensions, and worries that the boom in AI spending might cool off have all weighed on investor sentiment.

» Read more about: Wall Street Might Be Sleeping on Nvidia, But Not for Long »

Read More

1 Red Hot Latin Growth Stock

About ten years ago, MercadoLibre was a holding in Al Gore’s Generation Investment Management firm. At the time, the Latin e-commerce firm had barely made a dent on the radars of top money managers and traded around $117 per share. Now sitting close to $1,795 per share, the holding has proven to be a massive winner for the asset management firm,

» Read more about: 1 Red Hot Latin Growth Stock »

Read More

Most Undervalued Stock In Billionaire Portfolio

Third Point, founded by Dan Loeb, is no ordinary investment manager. It’s got $6.5 billion in assets under management and so when it makes a move it’s worth paying attention because you know the company has passed a lot of screens to be accepted into the portfolio.

But perhaps even more interesting is what stock in the portfolio ranks as the most undervalued of all and whether it’s a buy?

» Read more about: Most Undervalued Stock In Billionaire Portfolio »

Read More

Billionaire Bought This Under-the-Radar Chip Stock

At one time, Al Gore’s fund, Generation Investment Management, had so much conviction in Qualcomm that they bet around half a billion dollars on it.

Today, another huge investment fund founded by billionaire David Tepper has a stake in the chipmaker. What is it that these money managers see in the San Diego-headquartered firm to persuade them to risk hundreds of millions of dollars?

» Read more about: Billionaire Bought This Under-the-Radar Chip Stock »

Read More

Will Amazon Stock Make You a Millionaire In 10 Years?

Amazon isn’t just a retailer. It’s an ecosystem and it’s hard to find another company with the same mix of scale, efficiency, and stickiness across multiple trillion-dollar industries.

Start with e-commerce. Amazon’s scale gives it a cost advantage that smaller rivals simply can’t touch. After pouring tens of billions into logistics, robotics, and AI-driven warehouse optimization,

» Read more about: Will Amazon Stock Make You a Millionaire In 10 Years? »

Read MoreThe Ivy

Is It Finally Time to Buy Walgreens?

Walk into just about any town in America, and chances are you’ll spot a Walgreens. The pharmacy chain is one of the most ubiquitous retail brands in the country, with over 8,000 locations across the U.S. alone.

But while its storefronts are everywhere, the same can’t be said for investor confidence in its stock.

» Read more about: Is It Finally Time to Buy Walgreens? »

Read MoreThe Spotlight

How High Can eBay Go?

The e-commerce sector is enjoying an unprecedented rise. Customers appreciate the convenience that online retail provides, lending popularity to the sector. This is why global e-commerce revenue is projected to show an annual growth rate of 9.5% to a projected market volume of $6.48 trillion by 2029.

While the sector expands,

» Read more about: How High Can eBay Go? »

Read MoreThe Daily

Managing Interest Rate Risk in an Income-Focused Portfolio

Key Takeaways

- Interest rate changes affect bond prices and future income in opposite directions.

- Duration measures a bond’s sensitivity to rate changes, stated in years.

- Laddering bonds across different maturities reduces reinvestment risk.

- Diversifying across issuers protects against credit events and defaults.

» Read more about: Managing Interest Rate Risk in an Income-Focused Portfolio »