Why Billionaires Are Betting Big on This Bitcoin ETF

Recently, a surprising number of billionaire hedge fund managers have been buying a single ETF. This fund, the iShares Bitcoin Trust ETF (IBIT), is a spot Bitcoin ETF that tracks the performance of the world’s largest cryptocurrency.

Managers such as Ken Griffin and Israel Englander have decided to buy this fund despite their proven acumen in picking individual stocks that outperform the market. » Read more about: Why Billionaires Are Betting Big on This Bitcoin ETF »

Read More

Market Commentary: $25 Billion Stock On Sale 90% Lower?

One of Warren Buffett’s old favorites, Brazil’s StoneCo, has emerged with a strategy that may create a U-turn in it share price. What was once a $25 billion company has crashed to just $3 billion and change in market capitalization.

Yet StoneCo hasn’t been knocked out for the count yet. It surprised investors with an announcement that signaled it was bullish on its own company via a R$300 million (approximately $58.2 million) share repurchase program.

» Read more about: Market Commentary: $25 Billion Stock On Sale 90% Lower? »

Read More

1 Odd Stock Set To Skyrocket?

Oddity Technology, a company at the intersection of consumer artificial intelligence, beauty, wellness, and now, even biotechnology, has largely flown under the radar but perhaps not for much longer. That’s because, unlike many AI stocks, Oddity isn’t growing like a weed at the expense of hefty losses.

Instead it’s reported soaring revenues and turning the bottom line positive in the process.

» Read more about: 1 Odd Stock Set To Skyrocket? »

Read More

Alert: Down 52% Is This Energy Stock a Roaring Buy?

Investment Alert: Buy Enphase (ENPH) Under $125/share

Disclaimer: Investment Alerts have a medium to long-term time horizon. These do not constitute financial advice and you should contact a financial advisor before deciding whether it is appropriate for your individual circumstances.

Enphase Energy (NASDAQ:ENPH) has carved out a substantial economic…

Read More

Alphabet’s $32 Billion Bet: Smart Move or Costly Mistake?

Alphabet tripled its price per share over the past 5 years thanks to Google Search, which has the largest share of the search engine market, Android the largest mobile operating system in the world and YouTube the dominant video-sharing platform.

But now it sits at a crossroads, and the question for investors is has the time come to sell the Search giant?

» Read more about: Alphabet’s $32 Billion Bet: Smart Move or Costly Mistake? »

Read MoreThe Ivy

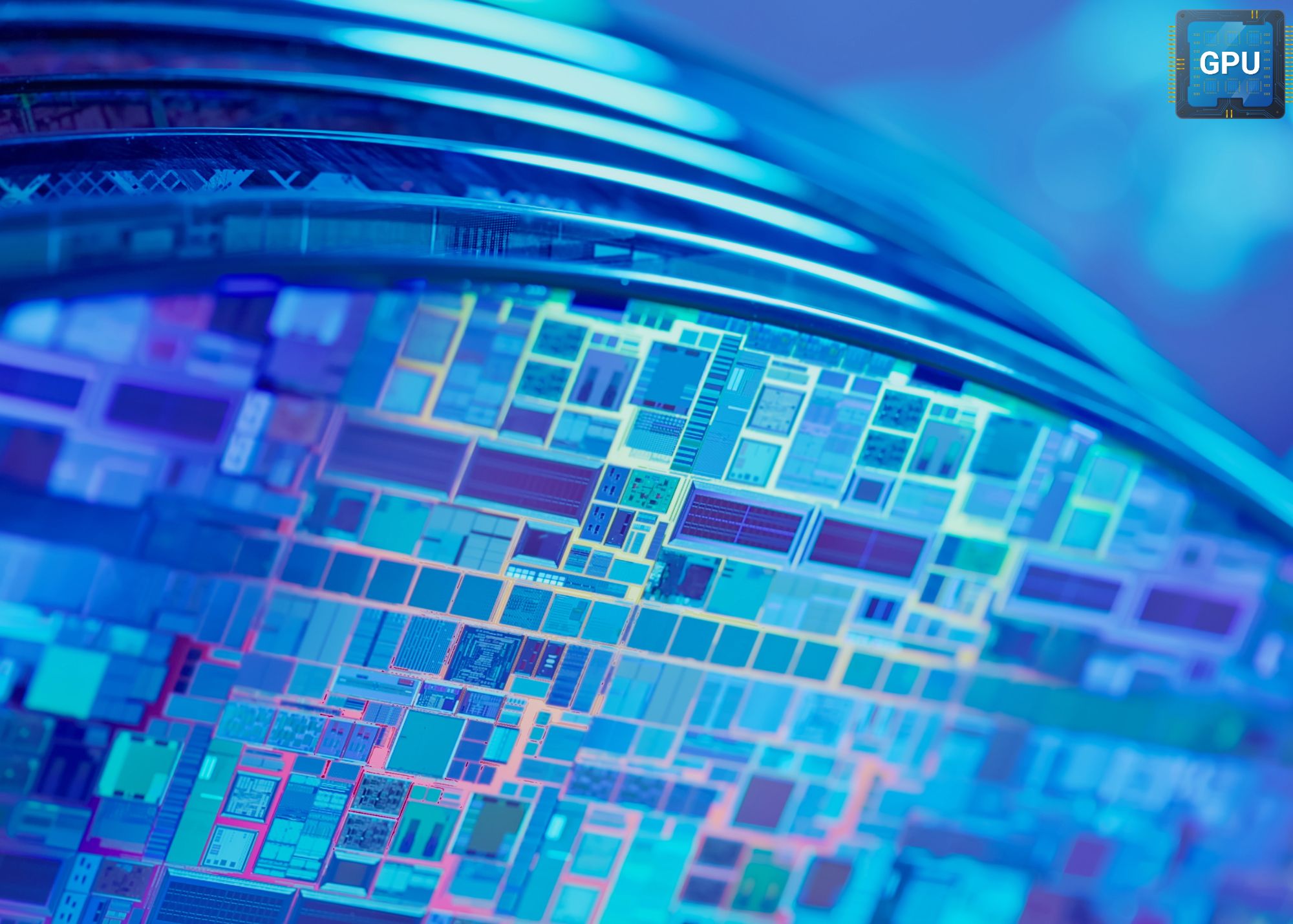

Nvidia Still Dominates AI, But the Ground Beneath It Is Shifting

Nvidia has been the undisputed king of the AI hardware empire.

But even monarchs can be overthrown, especially when their biggest allies start eyeing the throne.

Who’s threatening NVIDIA now and will they win?

Key Points

-

Nvidia still leads AI hardware, but growth is slowing and major clients are building their own chips.

» Read more about: Nvidia Still Dominates AI, But the Ground Beneath It Is Shifting »

Read MoreThe Spotlight

Hyper Rich Politician Buys A Boatload Of..

Nancy Pelosi is among the highest earners in Congress with a salary of $223,000 yet her stock portfolio has grabbed the attention of watchers for its performance relative to the market and size.

Her portfolio has some grown to an astonishing $223 million. In the words of one X user, what started as a mockery,

» Read more about: Hyper Rich Politician Buys A Boatload Of.. »

Read More