Is David’s Dividend Strategy Perfect For Today’s Market?

David Bahnsen – founder of The Bahnsen Group and author of The Case for Dividend Growth – centers his investment philosophy on dividend growth investing.

In his view, a fundamental mentality shift is needed where investors need to focus on the cash income their portfolio generates rather than obsessing over short-term market prices. » Read more about: Is David’s Dividend Strategy Perfect For Today’s Market? »

Read More

Market Commentary: Shocking 2030 Trend Will Make Millionaires

What percentage of the US population is obese? Go on, hazard a guess. What do you think the figure is without looking it up?

According to Healthline, a little over 42% of the US population is clinically obese. And that figure is expected to balloon to 50% by 2030.

Read More

Market Commentary: The Perfect Portfolio Revealed

Picking stocks is hard enough but how do you decide what amount to allocate to each stock? Portfolio construction is an art unto itself. Done well, a portfolio can withstand economic storms. Done poorly, the results can be catastrophic.

For two contrasting perspectives, look no further than Berkshire Hathaway versus ARK Invest during 2022.

» Read more about: Market Commentary: The Perfect Portfolio Revealed »

Read More

Market Commentary: Did AI Create The Perfect Portfolio?

What stocks would artificial intelligence select to produce outsized returns over the next 20 years?

That’s the question I wanted to ask ChatGPT, the breakthrough AI product from OpenAI, and the results were stunning.

Read More

Will NVIDIA 2x Over The Next Year?

The introduction of the Chinese generative AI model has created a storm on Wall Street, and tall trees are the first to bear the brunt of it. Big tech names have shown weaknesses and AI-related stocks have faced issues as the fear of the new-gen AI model, DeepSeek, and circumstances surrounding its creation spread through the market.

» Read more about: Will NVIDIA 2x Over The Next Year? »

Read MoreThe Ivy

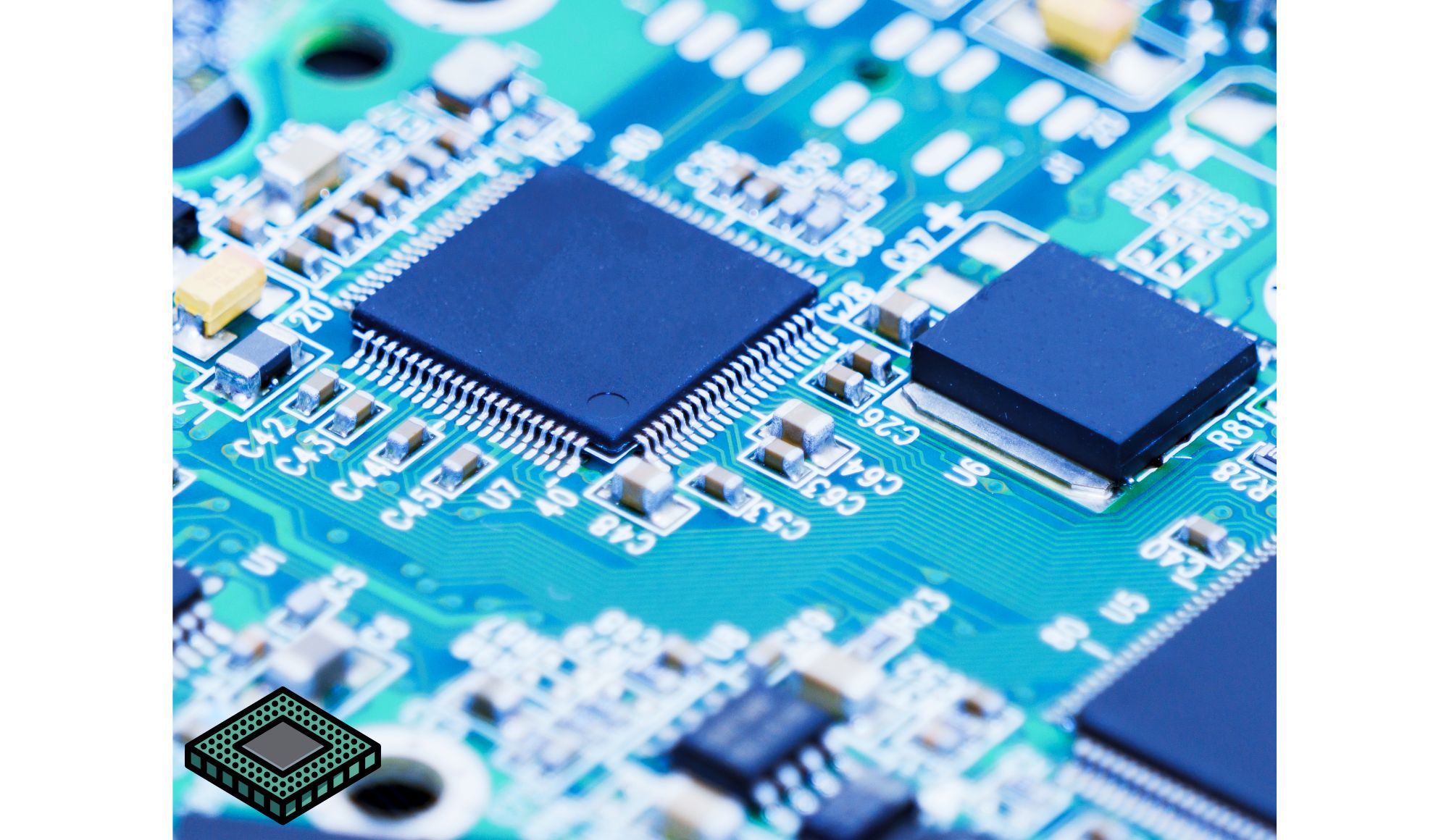

1 Company You’ve Probably Never Visited But Touch Every Day

At first glance, TSMC might look like just another chipmaker. But that’s like calling Lamborghini just another car company. TSMC doesn’t design chips, it builds them, using some of the most advanced manufacturing technology in existence.

TSM’s fabrication facilities, or “fabs,” can etch transistors smaller than viruses onto silicon wafers. That’s not hyperbole;

» Read more about: 1 Company You’ve Probably Never Visited But Touch Every Day »

Read MoreThe Spotlight

Will This $20 Million Bet Pay Off?

A report just came out that one trader bet a massive $20 million on a single stock rising by 30% on its next earnings report. That stock is, drumroll, artificial intelligence favorite, Nvidia.

The bet was made by purchasing strike 1180 call options on Nvidia for the June expiration, meaning if NVDA share price rise were to rise above that level on expiration day,

» Read more about: Will This $20 Million Bet Pay Off? »

Read MoreThe Daily

There's a Rout in Tech Stocks. What's Going On?

Investor concerns about the impact of AI are growing.

Look at a heat map of the S&P 500 index over the past week and you’ll see that the technology sector is bright red, indicating major losses. Some of tech’s biggest names are flirting with double-digit losses or are already well into them —

» Read more about: There's a Rout in Tech Stocks. What's Going On? »