Forget AI Stocks: This Energy Infrastructure Stock Is the Smarter Bet

Looking for a hedge against any AI bubble that may or may not be forming? Centrus Energy is a good choice.

Image source: Getty Images

Artificial intelligence (AI) stocks, be they hardware companies like Nvidia or software companies like Alphabet,

» Read more about: Forget AI Stocks: This Energy Infrastructure Stock Is the Smarter Bet »

Read MoreThe Burst

1 Popular Stock To Flee Immediately

Airbnb has been on a tear since 2020 when it reported losses of $3 billion in a single quarter. Lockdowns sparked concerns that the company would not survive a world without travel but soon hope emerged that life would return to normal and the financials soon followed.

A full U-turn followed with the company growing the top and bottom lines at a rapid pace.

» Read more about: 1 Popular Stock To Flee Immediately »

Read MoreThe Ivy

Forget NVIDIA, Buy This AI Stock?

Oh sure, NVIDIA may get the headlines but perhaps an under-the-radar AI play is where your attention should be flowing.

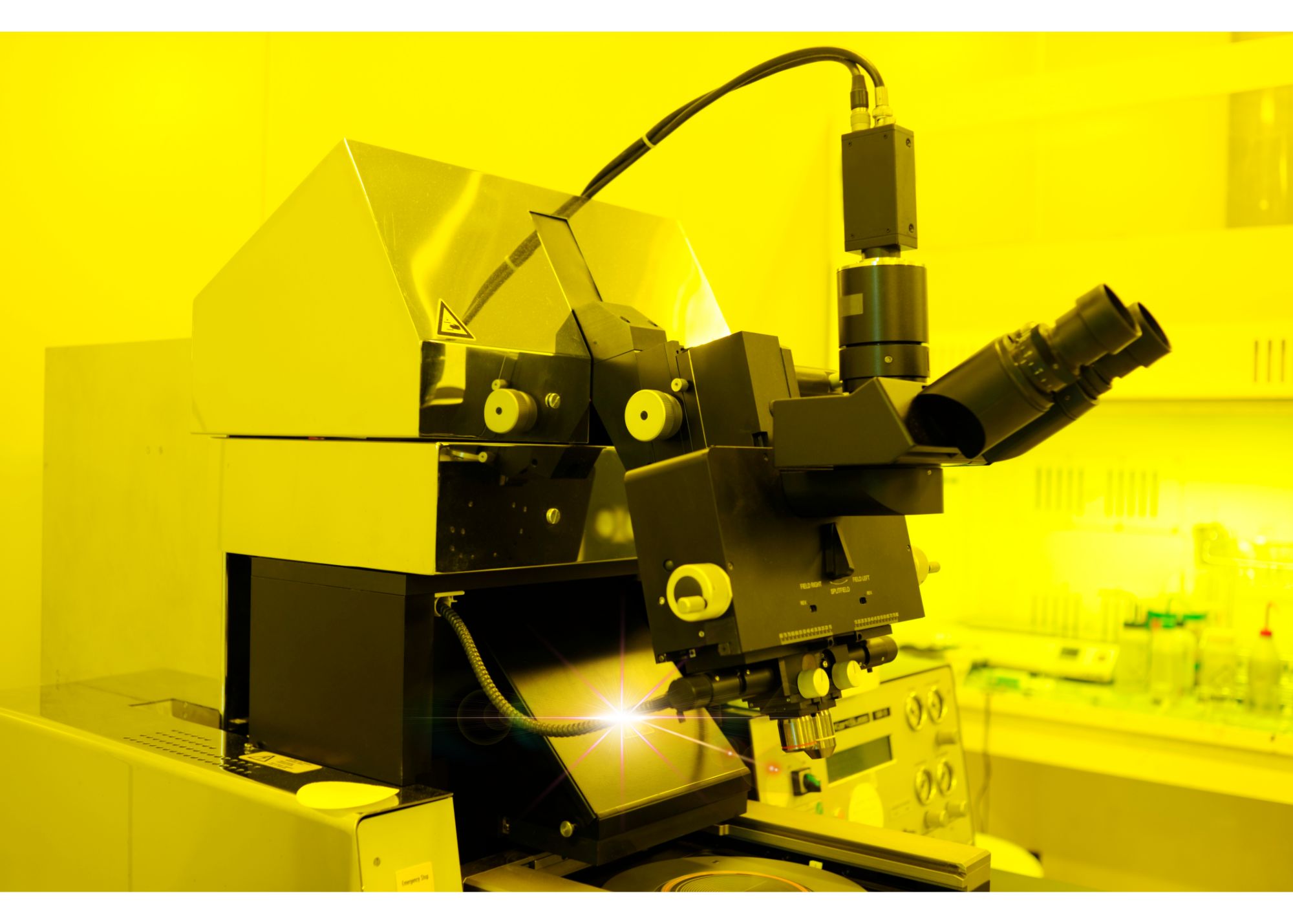

ASML (NASDAQ:ASML) is the only company in the world that produces extreme ultraviolet lithography machines, a critical technology for the most advanced semiconductor manufacturing.

For TSMC, who is crucial in the semiconductor supply chain,

» Read more about: Forget NVIDIA, Buy This AI Stock? »

Read MoreThe Spotlight

SoFi: The Trojan Horse of Banking?

This is the remarkable story of how SoFi, a firm that began as a student lender, has become the trojan horse of the banking industry.

The story begins with the stats. In the United States, 43.4 million people have outstanding federal student loans, which equates to nearly 20 percent of the nation’s adult population.