Gold ETFs shine brighter than equities

Gold’s appeal as a safe investment

With markets feeling shaky and global tensions rising, more people are turning to gold as a safe bet.

Gold ETFs now make up their biggest share ever of mutual fund assets at 2.3%.

This shift shows how retail investors and new buyers across age groups are increasingly participating and looking for stability and new ways to protect their money when things get unpredictable.

» Read more about: Gold ETFs shine brighter than equities »

Read MoreStock Market Today, Feb. 18: Palantir Technologies Rises After Mizuho Upgrade Highlights AI Growth Potential

Palantir Technologies (NASDAQ:PLTR), a data integration and analytics specialist, closed Wednesday at $135.38, up 1.77%. The stock moved higher as investors responded to a Mizuho upgrade, fresh AI partnerships, and its Miami headquarters relocation, while watching how these shifts translate into sustained commercial growth.

Trading volume reached 58.4 million shares,

Dave Ramsey Reveals How He Finds Mutual Funds To Invest In, Says His Portfolio 'Pretty Much Always' Beats The Market

Personal finance expert Dave Ramsey has long made the case for mutual funds as a wealth-building tool. But with thousands of funds available, the real challenge is figuring out which ones to invest in.

Sharing how he chooses mutual funds on “The Ramsey Show,”

Read MoreWarren Buffett Dumped Shares of Amazon, Apple, and Bank of America, and Added One Brand-New Stock in His Final Quarter Before Retirement

The Oracle of Omaha’s final quarter as Berkshire Hathaway CEO revealed more significant net selling activity, and one curious $352 million purchase.

Data is the fuel that keeps Wall Street running — and few announcements are more telling than the quarterly filing of Form 13F with the Securities and Exchange Commission. A 13F provides investors with a road map of the stocks that Wall Street’s savviest money managers bought and sold in the latest quarter.

Overpaid by Social Security? You Might Be Allowed to Keep It If You Do This.

Key Points

-

You can ask the SSA to let you keep the overpayment if it wasn’t your fault.

-

It will not attempt to collect from you while it’s considering your request.

-

If that doesn’t work, you can request a lower overpayment recovery rate.

» Read more about: Overpaid by Social Security? You Might Be Allowed to Keep It If You Do This. »

Read MoreThe Burst

Can Netflix Double in Value in 5 Years?

Netflix (NASDAQ: NFLX) is back in the spotlight again. Not because it just dropped a new hit series but because investors are wondering something bigger. Can the stock double in the next five years?

It’s a fair question. After all, Netflix isn’t the underdog anymore. It’s not fighting Blockbuster. It is the blockbuster.

» Read more about: Can Netflix Double in Value in 5 Years? »

Read MoreThe Ivy

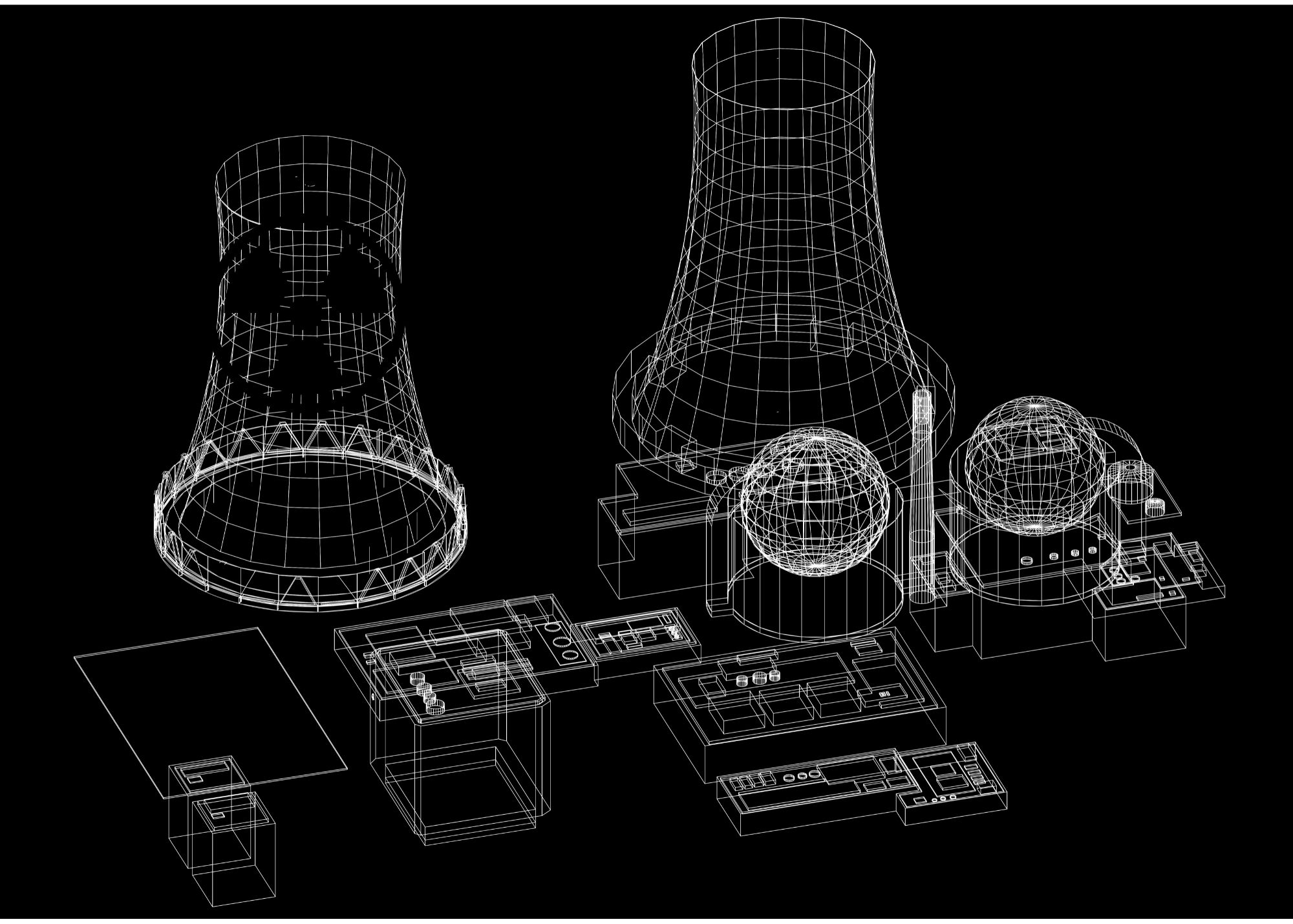

Why Nuclear’s Next Frontier Could Be 240,000 Miles Away

This year, nuclear energy stocks have been some of the market’s best performers. Small modular reactor (SMR) developers like NuScale Power (SMR) and Oklo (OKLO) have been announcing a steady stream of partnerships, and Donald Trump, has pushed fresh executive orders aimed at accelerating the sector’s development.

Investors have plenty of reason to be excited but a surprising new catalyst has emerged,

» Read more about: Why Nuclear’s Next Frontier Could Be 240,000 Miles Away »

Read MoreThe Spotlight

Will Bitcoin Hit an All-Time High Before the Election?

Will Bitcoin hit an all-time high before voters head to the polls?

While Bitcoin has demonstrated its potential to defy expectations, a new set of circumstances, including institutional support, hedge fund interest, and political influences, are converging, making the coming weeks critical for Bitcoin’s price trajectory.

So how high can Bitcoin go?

» Read more about: Will Bitcoin Hit an All-Time High Before the Election? »