Fed meeting minutes: Rates could come down further if inflation drops

Several Federal Reserve officials anticipate further interest rate cuts if inflation were to drop, while others see holding rates for “some time,” according to minutes of the central bank’s January policy meeting released Wednesday.

“Several commented that further downward adjustments to the target range for the federal funds rate would likely be appropriate if inflation were to decline in line with their expectations,”

» Read more about: Fed meeting minutes: Rates could come down further if inflation drops »

Read MoreDow Jones & Nasdaq 100: Iran Tensions Cap Gains

Later in Thursday’s session, US jobless claims will influence risk appetite. Economists expect initial jobless claims to fall from 227k (week ending February 7) to 225k (week ending February 14). Downward trends in claims would indicate a resilient US labor market, supporting a more hawkish Fed rate path. Delays to rate cuts would leave borrowing costs elevated,

» Read more about: Dow Jones & Nasdaq 100: Iran Tensions Cap Gains »

Read MoreA Federal Reserve Crisis of Confidence Threatens the Very Fabric of Wall Street — and Investors May Pay the Price

Key Points

-

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have been making history, much to the delight of investors.

-

However, historic division at America’s foremost financial institution raises doubts amid a pricey stock market.

-

Additionally,

Dow Jones, S&P 500, Nasdaq rebound after Supreme Court strikes down Trump tariffs – why US stock market is rallying today despite weak GDP data

Dow Jones, S&P 500, Nasdaq gains after Supreme Court tariff ruling: Stocks edged higher Friday after the Supreme Court ruled against US president Donald Trump’s sweeping tariffs, giving a lift to retailers and other companies that had struggled with rising import and manufacturing costs tied to the duties.

Read MoreThe Burst

The Market Just Flashed a Rare Signal

Buying great companies regularly and keeping a cool head has proven to be a time-tested winning formula in the markets.

That said, every now and then, it’s worth paying attention when a technical signal with a track record like this flashes green.

Last week, the market delivered something truly rare: the triggering of the Zweig Breadth Thrust.

» Read more about: The Market Just Flashed a Rare Signal »

Read MoreThe Ivy

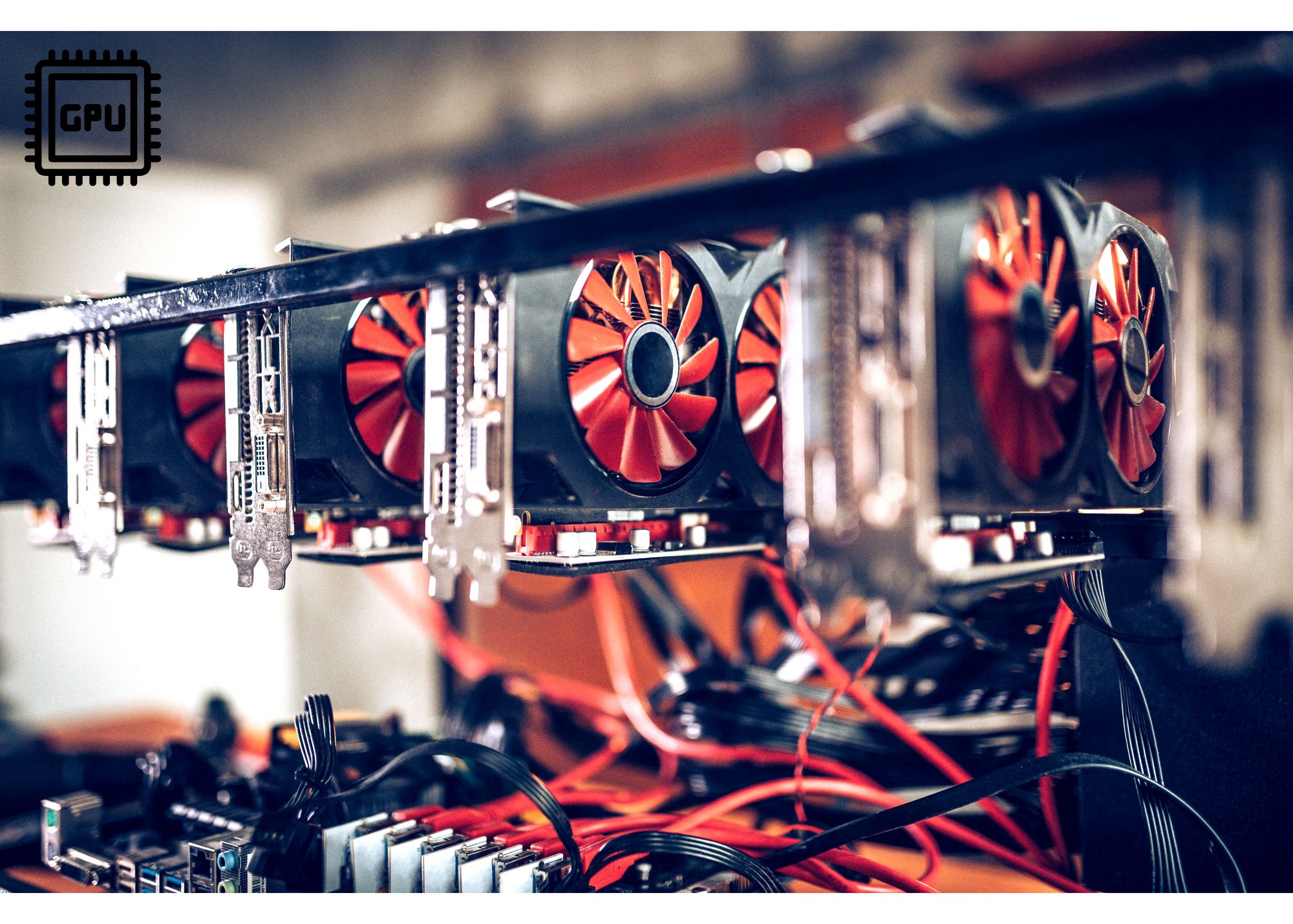

Could Nvidia Be the First $10 Trillion Company?

Nvidia might have started as a gaming chip company, but make no mistake it’s now the backbone of the AI revolution.

And if smart money projections hold up, it could become the first company to smash through the $10 trillion valuation barrier. That’s not hyperbole, it’s a plausible trajectory grounded in stunning financials,

» Read more about: Could Nvidia Be the First $10 Trillion Company? »

Read MoreThe Spotlight

How Do You Pick a Winning Stock?

Investors will often pour through dozens or even hundreds of stocks looking for the best investment options to add to their portfolios. Before doing this, however, it’s important to first understand what a good stock is.

Let’s take a look at some of the factors that define a good investment to understand what makes a potentially lucrative stock.