Why Some Social Security Payments Will Not Be Sent in March

Millions of Americans who rely on federal benefits may notice something unusual this March: no Supplemental Security Income (SSI) payment will be sent during the month.

The shift is not a benefit cut. Instead, it’s the result of a calendar quirk that is reshaping Social Security payment timing throughout 2026.

» Read more about: Why Some Social Security Payments Will Not Be Sent in March »

Read MoreStock Market Live February 19, 2026: S&P 500 (SPY) Up Ahead of Key Fed News

Live Updates

Live

After a rough few weeks, shares of AMZN appear to have finally bottomed out and are just starting to pivot higher. It’s also oversold on RSI, MACD, Williams’ %R,

» Read more about: Stock Market Live February 19, 2026: S&P 500 (SPY) Up Ahead of Key Fed News »

Read MoreJacob Funds Bets on Prime Medicine (PRME), a Next-Generation Gene Therapy Company

When Jeff Bezos said that one breakthrough technology would shape Amazon’s destiny, even Wall Street’s biggest analysts were caught off guard.

Fast forward a year and Amazon’s new CEO Andy Jassy described generative AI as a “once-in-a-lifetime” technology that is already being used across Amazon to reinvent customer experiences.

Read MoreStocks get tech boost amid strong economic reports

A slew of data showing the US economy is holding up drove stocks higher, with the market also gaining amid easing jitters around artificial-intelligence disruption. Bonds retreated. Oil jumped.

About 350 shares in the S&P 500 climbed, with the US equity benchmark up nearly 1%. Following a tech selloff fueled by worries over the outlook for AI,

» Read more about: Stocks get tech boost amid strong economic reports »

Read MoreStock Market Today, Feb. 20: Kosmos Energy Surges After Ghana Extends Licenses to 2040 and Details $2B Drilling Plan

Kosmos Energy rallied after Ghana extended its key offshore licenses through 2040 and the company outlined a 20-well drilling expansion.

Kosmos Energy

Today’s Change

(22.03%) $0.39

Current Price

$2.16

Key Data Points

Market Cap

$847M

Day’s Range

$1.97 –

The Burst

Why Billionaires Are Betting Big on This Bitcoin ETF

Recently, a surprising number of billionaire hedge fund managers have been buying a single ETF. This fund, the iShares Bitcoin Trust ETF (IBIT), is a spot Bitcoin ETF that tracks the performance of the world’s largest cryptocurrency.

Managers such as Ken Griffin and Israel Englander have decided to buy this fund despite their proven acumen in picking individual stocks that outperform the market.

» Read more about: Why Billionaires Are Betting Big on This Bitcoin ETF »

Read MoreThe Ivy

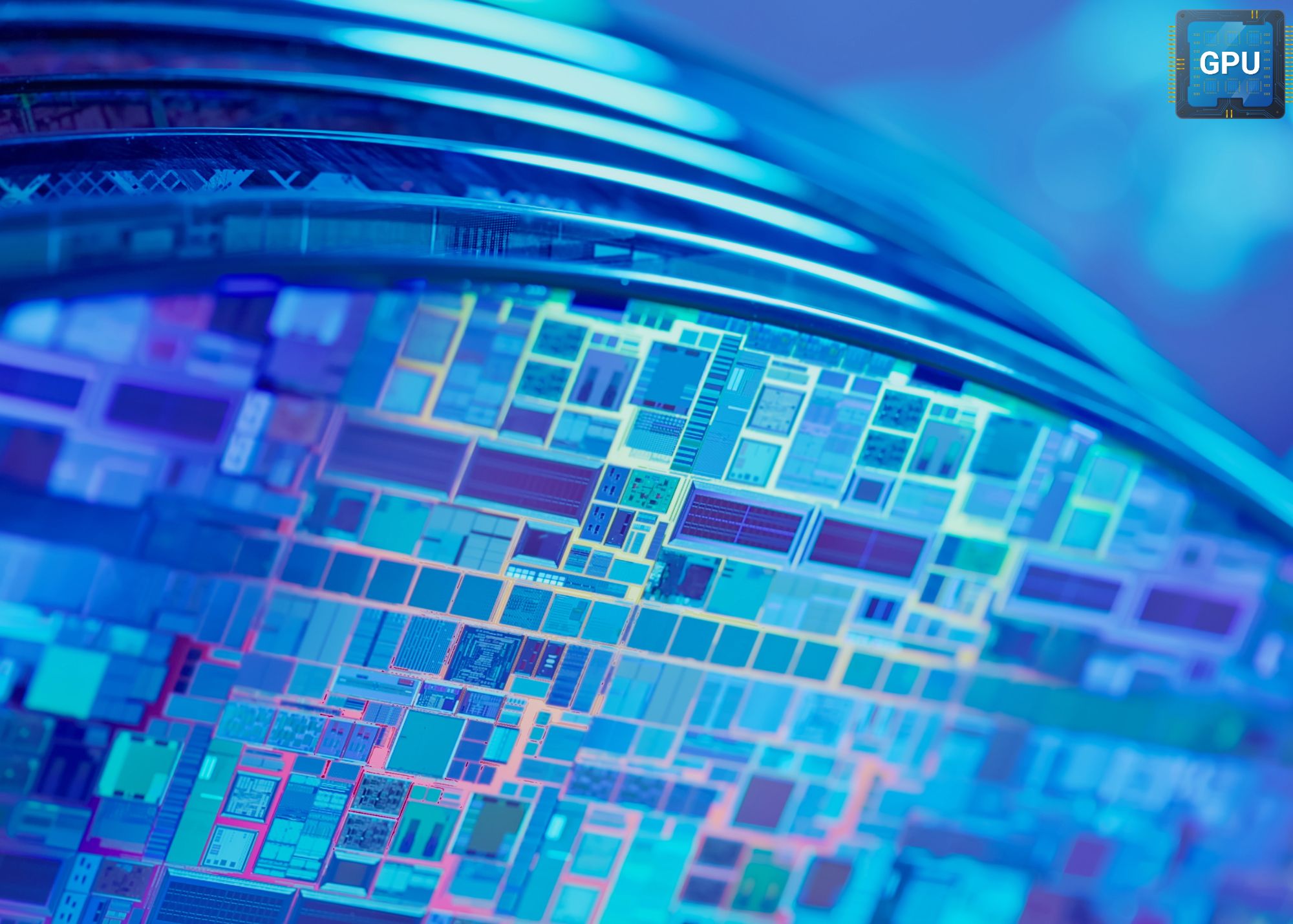

Nvidia Still Dominates AI, But the Ground Beneath It Is Shifting

Nvidia has been the undisputed king of the AI hardware empire.

But even monarchs can be overthrown, especially when their biggest allies start eyeing the throne.

Who’s threatening NVIDIA now and will they win?

Key Points

-

Nvidia still leads AI hardware, but growth is slowing and major clients are building their own chips.

» Read more about: Nvidia Still Dominates AI, But the Ground Beneath It Is Shifting »

Read MoreThe Spotlight

Hyper Rich Politician Buys A Boatload Of..

Nancy Pelosi is among the highest earners in Congress with a salary of $223,000 yet her stock portfolio has grabbed the attention of watchers for its performance relative to the market and size.

Her portfolio has some grown to an astonishing $223 million. In the words of one X user, what started as a mockery,

» Read more about: Hyper Rich Politician Buys A Boatload Of.. »