The Danger Is Still High, Here’s Why

After a face-ripping rally Wednesday, markets took a breather yesterday. Futures were pointing lower, which, frankly, wasn’t all that surprising given how sharply things ripped higher.

But while some have pointed to a bottom, the reality is the danger is still high. Look no further than how the rally failed at the downtrending resistance line.

» Read more about: The Danger Is Still High, Here’s Why »

Read More

Market Commentary: The Downside Is Huge Now

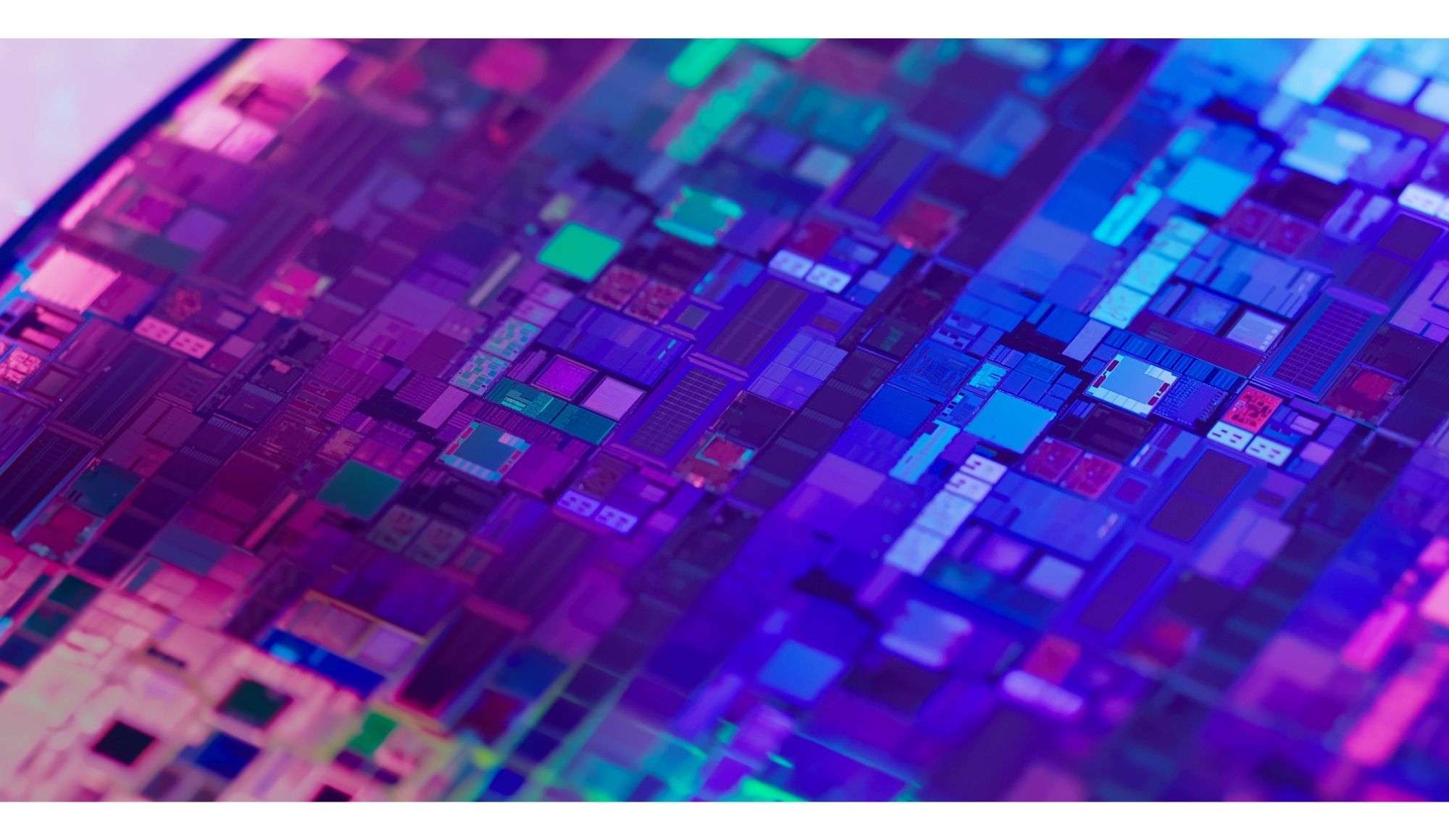

It’s not widely known that Nvidia once designed its chips to specifically fall just below U.S. export restrictions, ensuring they remained marketable in China. Unfortunately for them, that loophole just got sealed, and it has big implications for investors.

Nvidia share price hit choppy waters after new U.S. export restrictions aimed to sever the chipmaker’s ties with China.

» Read more about: Market Commentary: The Downside Is Huge Now »

Read More

Market Commentary: 1 Premier Bank Stock Bursts Higher

Despite its role as a low-fee trailblazer, 2023 has been a really rough year for Schwab, down 34% year-to-date. But recent developments hint at the fog of uncertainty lifting. Indeed, Schwab CEO Walt Bettinger described the company’s current struggles as a “dense fog.” This opacity primarily stems from deposit outflows, unrealized losses on securities, and rising interest rates.

» Read more about: Market Commentary: 1 Premier Bank Stock Bursts Higher »

Read More

Market Commentary: What Chipotle’s Bold Move Means For You

Chipotle has managed to do what few food companies ever achieve, keep prices low, win over customers with taste, and maintain high quality offerings. But recently one of those three ingredients was forsaken because the company hiked prices to combat inflation, which has a knock-on effect not only to you and me but to the broader economy.

» Read more about: Market Commentary: What Chipotle’s Bold Move Means For You »

Read More

This Airline Just Made a Huge Change, Will It Pay Off for Investors?

Southwest Airlines (NYSE:LUV) is one of America’s major air transportation companies. Recently, under pressure to deliver improved value for shareholders and renewed growth, the company announced a slate of changes that could, if successful, increase both its top and bottom lines in the years to come.

Today, let’s take a look at Southwest Airlines to see if LUV is a buy,

» Read more about: This Airline Just Made a Huge Change, Will It Pay Off for Investors? »

Read MoreThe Burst

1 Organ Transplant Disruptor to Buy on the Dip

TransMedics (NASDAQ:TMDX) is an innovative biotechnology company that may well have the potential to disrupt the $11 billion organ transplant industry.

The company’s unique organ care system technology protects and monitors donor organs before they are transplanted into patients, resulting in improved organ health and outcomes. TransMedics also provides logistical services,

» Read more about: 1 Organ Transplant Disruptor to Buy on the Dip »

Read MoreThe Spotlight

Spotlight: 1 High-paying Dividend Stock Is Way Undervalued

Wall Street analysts seem pretty gung-ho about Realty Income, pegging an average price target at $68 per share, a significant pop from where the stock sits now. That’s in addition to a dividend yield north of 6%.

Is Wall Street right or is the recent selloff indicative of what’s to come for Realty Income?

» Read more about: Spotlight: 1 High-paying Dividend Stock Is Way Undervalued »

Read MoreThe Daily

Wall Street’s AI Paradox: Why Has NVIDIA’s Stock Flatlined as Hyperscaler Spend Explodes?

Here’s the paradox keeping Wall Street analysts up at night: Tech giants are pouring $700 billion into AI infrastructure, yet Nvidia (NASDAQ:NVDA | NVDA Price Prediction) stock has gone cold. Bloomberg’s headline on Friday captured it perfectly: “Nvidia Shares Go Cold Even as Big Tech Spending on AI Balloons.” The stock that was supposed to be the ultimate AI beneficiary is seeing limited gains while its customers announce record spending sprees.