The $1 Trillion Buyback Boom, Who’s Spending Most to Boost Their Stock?

In February 2025 alone, corporate America saw an explosion of stock buybacks. More than 160 companies announced fresh repurchase plans—more than double the previous month’s tally. But the real story isn’t just the sheer volume; it’s who is leading the charge.

Goldman Sachs projects that S&P 500 buybacks will hit a record-breaking $1 trillion in 2025,

» Read more about: The $1 Trillion Buyback Boom, Who’s Spending Most to Boost Their Stock? »

Read More

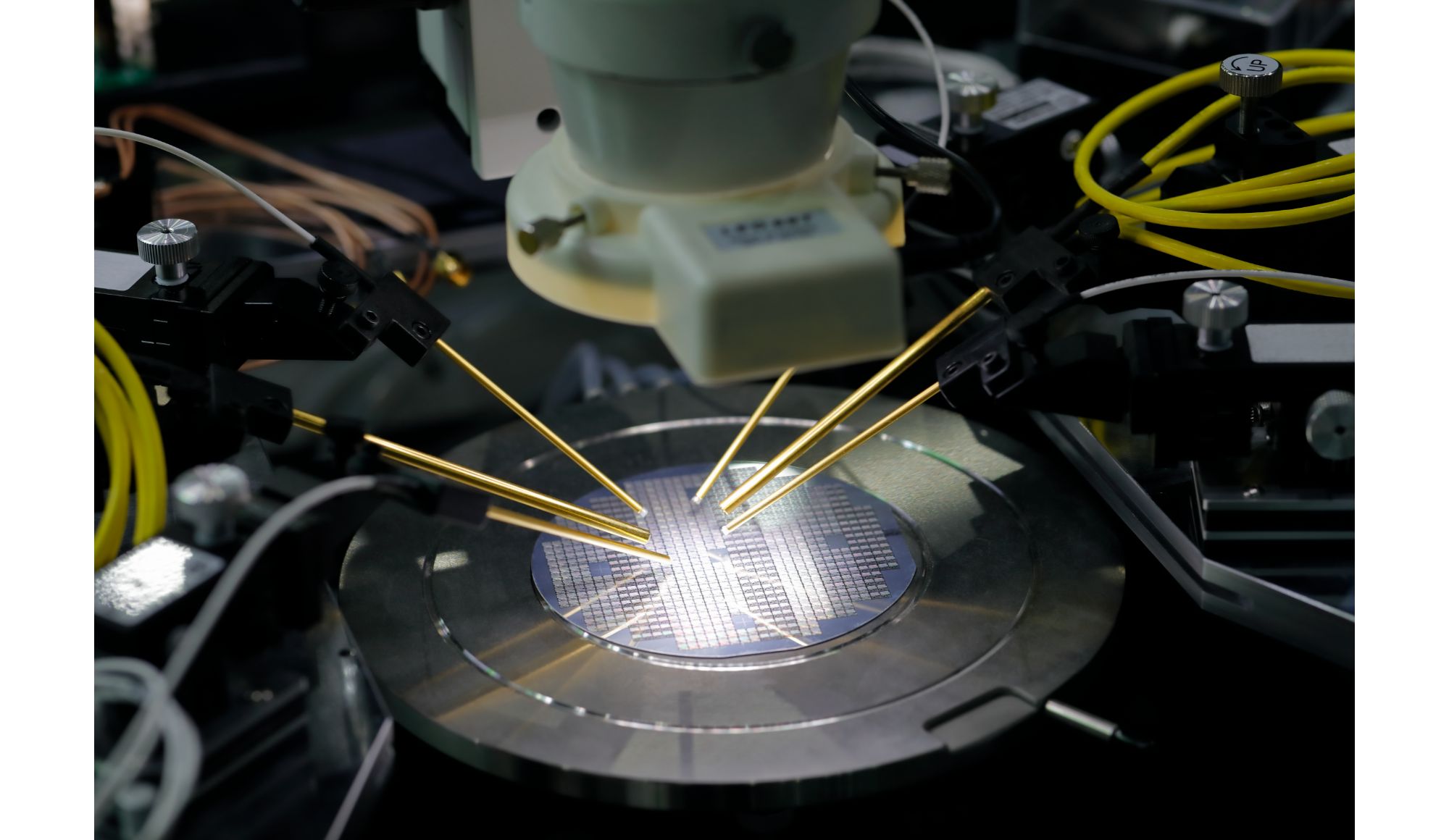

Market Commentary: Hot Semi Stock with 38.6% Upside

Semiconductor stocks have been especially popular this year due to their role in the emerging AI industry, and SMART Global Holdings (SGH) stock is no exception. The company produces computing platform solutions, computer memory solutions, and LED chips and components through multiple brands.

Read More

Market Commentary: Billionaire Investment Memo Secrets Revealed

Howard Marks is the billionaire founder of Oaktree Capital, which oversees $164 billion. Last we looked his net worth eclipsed $2.2 billion. That kind of wealth isn’t accumulated by accident. So what’s his formula for success?

We jumped down the rabbit hole to explore what secrets lay within his investment memos and here is a list that could be helpful in building enormous wealth over the long-term.

» Read more about: Market Commentary: Billionaire Investment Memo Secrets Revealed »

Read More

Market Commentary: 32.1% Upside in Under-the-Radar Cannabis Stock

Investment Alert: Buy SNDL (SNDL) Under $1.40/share

Disclaimer: Investment Alerts have a medium to long-term time horizon. These do not constitute financial advice and you should contact a financial advisor before deciding whether it is appropriate for your individual circumstances.

Read More

Is This Cathie Wood Stock The Next Big Thing?

Tempus AI (NASDAQ:TEM) has seen its stock run all over the board since its IPO last year. The 52-week range for TEM shares runs from a low of $22.89 to a high of $91.45. This is perhaps unsurprising because Tempus is a young, innovative AI startup.

Since the start of 2025,

» Read more about: Is This Cathie Wood Stock The Next Big Thing? »

Read MoreThe Burst

Is This Fintech Set To Explode?

Fintech lender and financial services provider SoFi (NASDAQ:SOFI) was among the companies hit hard by the stock crash of 2021. At its peak, the company’s shares traded at over $25. Today, the stock is priced under $10 per share.

Recent developments, however, have given SoFi some renewed momentum and opened up the strong possibility of a turnaround.

» Read more about: Is This Fintech Set To Explode? »

Read MoreThe Spotlight

Spotlight: Will This Weed Stock Get Your Portfolio High?

Canopy Growth was at the forefront of the cannabis industry just a few years ago. But the Canadian cannabis producer has faced significant struggles that have reduced its valuation from billions to millions, as revenues have declined and losses have piled up.

In 2018, Canopy stock pushed past $50 per share, but investors have gradually given up on the stock since then.

» Read more about: Spotlight: Will This Weed Stock Get Your Portfolio High? »

Read MoreThe Daily

Cathie Wood says Bitcoin is solution for incoming AI deflation chaos

Ark Invest CEO Cathie Wood argues that Bitcoin is not only a hedge against inflation, but also a hedge against rapid deflation caused by technological acceleration.

Cathie Wood spoke with Anthony Pompliano at Bitcoin Investor Week to discuss a myriad of different economic topics. The focal point of their conversation,

» Read more about: Cathie Wood says Bitcoin is solution for incoming AI deflation chaos »