1 Low-Cost Schwab ETF That Beat The Market

With around $65.7 billion in net assets, Schwab’s US Dividend Equity ETF (SCHD) is one of the most popular funds among investors seeking dividend income from their portfolios.

In the last year, SCHD has even beaten out the S&P 500 by delivering a 27.1% market price return compared to 25.0% from the S&P.

The question now is whether SCHD is still a good buy or if the fund will lag this year? » Read more about: 1 Low-Cost Schwab ETF That Beat The Market »

Read More

Is This Former High Flyer a Screaming Buy?

Nvidia, a leading manufacturer of graphics processing units (GPUs), had a record-breaking year in 2022 with annual revenue reaching north of $26 billion, an increase of over 60%.

Earnings also improved by over 120%, totaling $3.85 per share. One of the major contributors to this success was the Data Center segment, which accounted for 40% of the company’s overall sales in the fiscal year and has seen a CAGR of 66% over the past 5 years.

» Read more about: Is This Former High Flyer a Screaming Buy? »

Read More

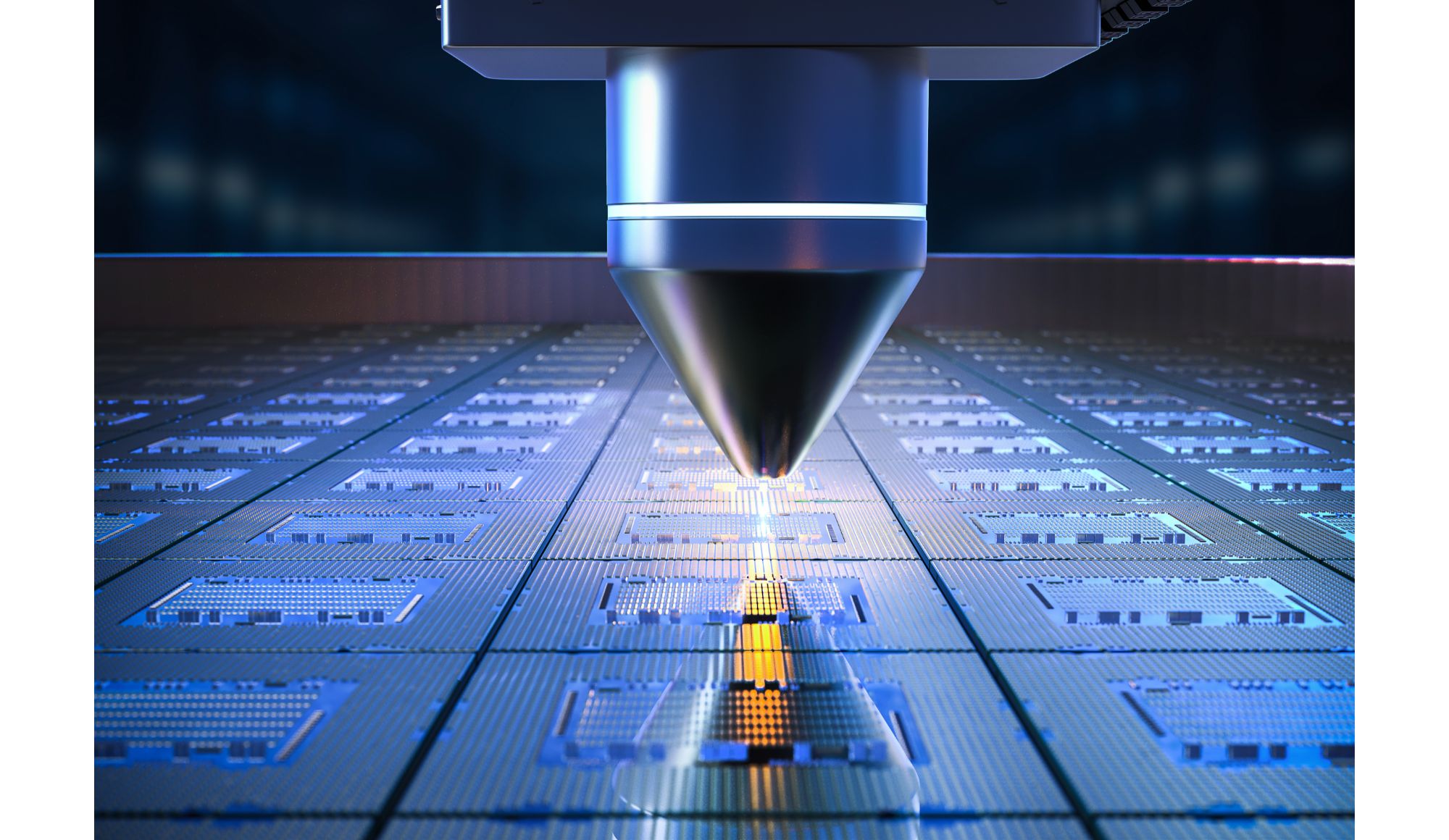

3 Hot Semiconductor Stocks on Sale Now

[1] 36% Upside to $103 for Buffett’s Favorite Chip Stock

Taiwan Semiconductor (TSM) is a leading Asian manufacturer of advanced chips that supplies boutique chip design houses as well as major product manufacturers, like Apple. Recently, TSM garnered attention from investors worldwide when Berkshire Hathaway, led by Warren Buffett, announced a multi-billion dollar stake in the company.

» Read more about: 3 Hot Semiconductor Stocks on Sale Now »

Read More

How Long Will The Bear Market Last?

A bear market is characterized by a decline in stock prices and negative investor sentiment. It can be a difficult time for investors as they watch their portfolio values decrease and may be unsure about when the market will recover. So how long do they usually last? How far do share prices usually fall? And what can you expect after the bear market ends?

» Read more about: How Long Will The Bear Market Last? »

Read More

Will This Spinoff Unlock Massive Wealth?

In a pre-holiday surprise announcement, management at FedEx (NYSE:FDX) released news of a plan to spin off FedEx Freight into a standalone entity that also would be publicly traded.

Given the headwinds the firm has faced from pricing to cost-sensitive customers, the spinoff offers a potential boon to existing shareholders. FedEx Freight handles less-than-truckload shipping for the company,

» Read more about: Will This Spinoff Unlock Massive Wealth? »

Read MoreThe Burst

1 Super Obvious Buffett Stock to Buy Now

Back in 1850 when American Express was originally founded, it was a mere express mail service. Today, it’s one of the most prominent financial services companies globally and has won Warren Buffett’s favor as a long-term investor.

That’s in large part due to its stunning business model that features four major categories: U.S.

» Read more about: 1 Super Obvious Buffett Stock to Buy Now »

Read MoreThe Spotlight

CLEAR to Take Off: 1 Stock with Massive Market Size

Clear Secure, or CLEAR, is a member-centric secure identity platform that is striving to revolutionize how people verify their identity wherever they go.

CLEAR generates revenue through its consumer aviation subscription service, CLEAR Plus, which provides members with fast and predictable experiences at airport security checkpoints across the country through the use of touchless biometric verification technology.

» Read more about: CLEAR to Take Off: 1 Stock with Massive Market Size »

Read MoreThe Daily

Warren Buffett reveals the 5 books that shaped his investment mindset and why reading 500 pages a day can change your life

Warren Buffett investing strategy books: For decades, investor and philanthropist Warren Buffett has repeated one simple message: that if a person wants to succeed, then they must read daily.

Warren Buffett’s Simple Rule for Success: Read Every Day

When he spoke to MBA students at Columbia Business School in 2000,