AI Powerhouse Sees 853% Increase From Connecticut Billionaire

Nvidia (NASDAQ: NVDA) has rapidly cemented its place as one of the most sought-after stocks after seizing the role of toll road through which all big tech must travel to enter the artificial intelligence ecosystem.

Recently, Nvidia drew interest from billionaire investor Paul Tudor Jones, who raised his position by a staggering 853% to 273,294 shares, » Read more about: AI Powerhouse Sees 853% Increase From Connecticut Billionaire »

Read More

How to Survive a Crypto Winter

After hitting all-time highs in the fall of 2021, the crypto market has been on a precipitous decline. For a time in November 2021, Bitcoin was trading at over $67,000 per coin. By mid-2022, it had fallen to under $20,000 per coin.

While these lower prices have some investors itching to buy,

» Read more about: How to Survive a Crypto Winter »

Read More

Is This Stock Immune to a Recession?

We have officially entered a bear market and the odds are we haven’t hit bottom yet. With a recession on the horizon, how should you allocate your money?

While high growth technology stocks have been hit hard, other bellwether tech stocks may be somewhat immune to a recession. How is this possible? In a word: moat.

» Read more about: Is This Stock Immune to a Recession? »

Read More

3 Compelling Reasons to Buy Google’s Parent

Google is the most visited website on earth, attracting billions of users who rely on it to carry out their daily searches. However, Google’s parent, Alphabet (NASDAQ:GOOGL), is much more than just a search engine. From Gmail to Google Drive, Google provides a host of tools and apps — many of which reinvented how we access information.

» Read more about: 3 Compelling Reasons to Buy Google’s Parent »

Read More

1 Titan Health Stock Is Way Too Cheap

Merck & Co. (NYSE: MRK) might be best known for its drugs like Keytruda and Gardasil, but those blockbusters haven’t been enough to get shareholders excited as the share price has fallen under water this year, down 6%.

It may well be a pharmaceutical powerhouse but recent price weakness suggests that Merck may be flying under the radar for investors,

» Read more about: 1 Titan Health Stock Is Way Too Cheap »

Read MoreThe Burst

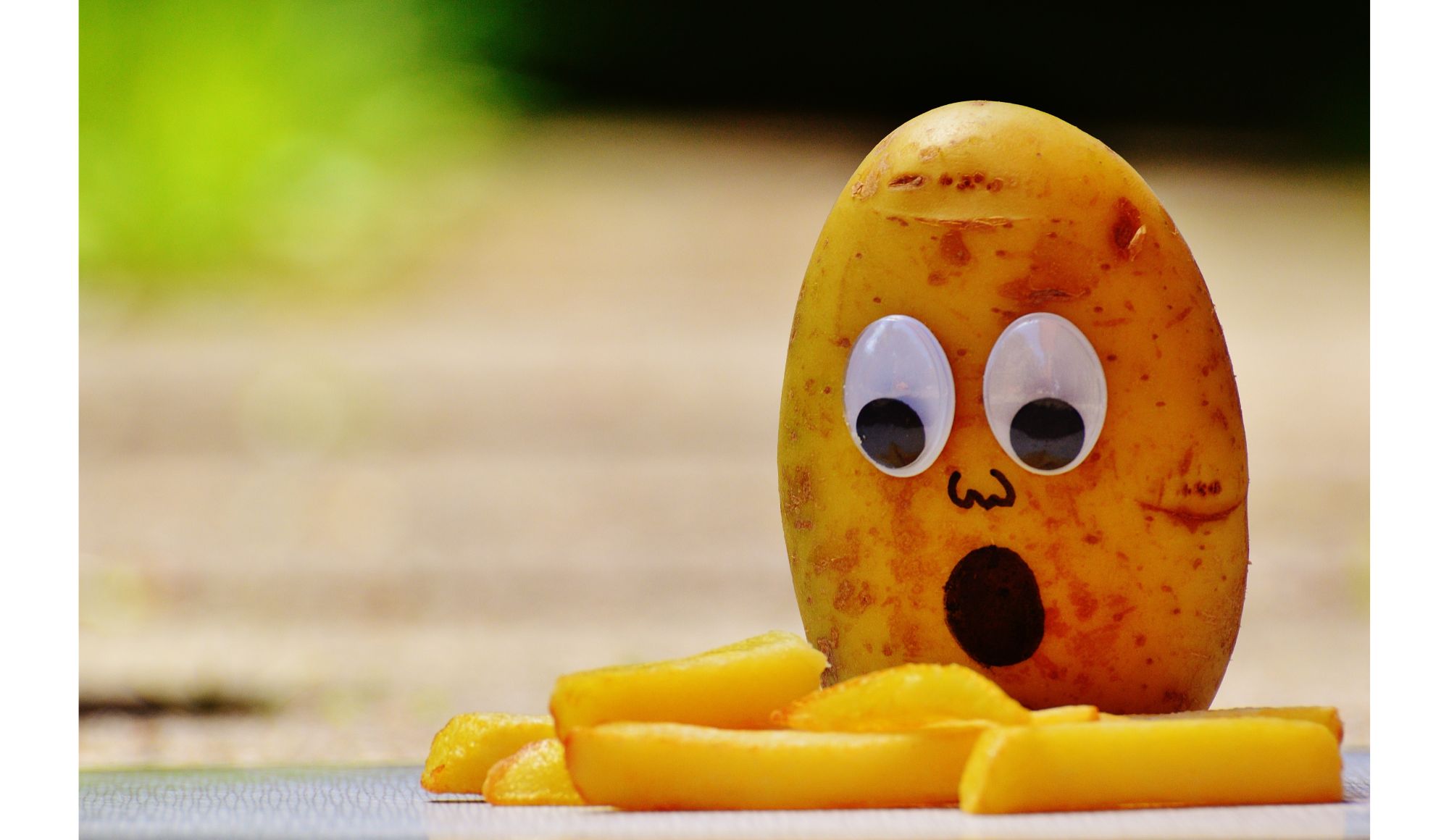

1 Weird Seasonal Trend Starting Now

Some things can’t easily be explained in the stock market and seasonal trends rank right up there among the conundrums that puzzle even the smartest investors.

Take for example the case of frozen potato processor Lamb Weston that has a weird seasonal trend starting now. It’s a bit difficult to understand precisely why such a powerful force starts at this time of year for the firm,

» Read more about: 1 Weird Seasonal Trend Starting Now »

Read MoreThe Spotlight

1 Underrated Tech Stock to Beat the Market

The CPaaS, or communication platform as a service, market is seeing tremendous growth. According to Juniper Research, the CPaaS industry could hit the $10 billion revenue mark globally by the end of 2022. And if businesses continue adopting APIs for business-to-customer and customer-to-business interactions, it could reach $35 billion by 2026. One underrated company serving this industry has the potential to beat the market: Twilio (NYSE:TWLO).

» Read more about: 1 Underrated Tech Stock to Beat the Market »

Read MoreThe Daily

Top High-Yield Savings Rates Today, Feb. 12, 2026 — APYs Still Available up to 5.00%

The Annual Percentage Yield (APY) is accurate as of 2/1/2026. The base and promotional interest rate and corresponding APY for Axos ONE® Checking is variable and is set at our discretion. The base and promotional interest rate and corresponding APY for Axos ONE® Savings is variable and is set at our discretion. Axos ONE® Savings is a tiered variable rate account.