Forget NVIDIA, Buy This AI Stock?

Oh sure, NVIDIA may get the headlines but perhaps an under-the-radar AI play is where your attention should be flowing.

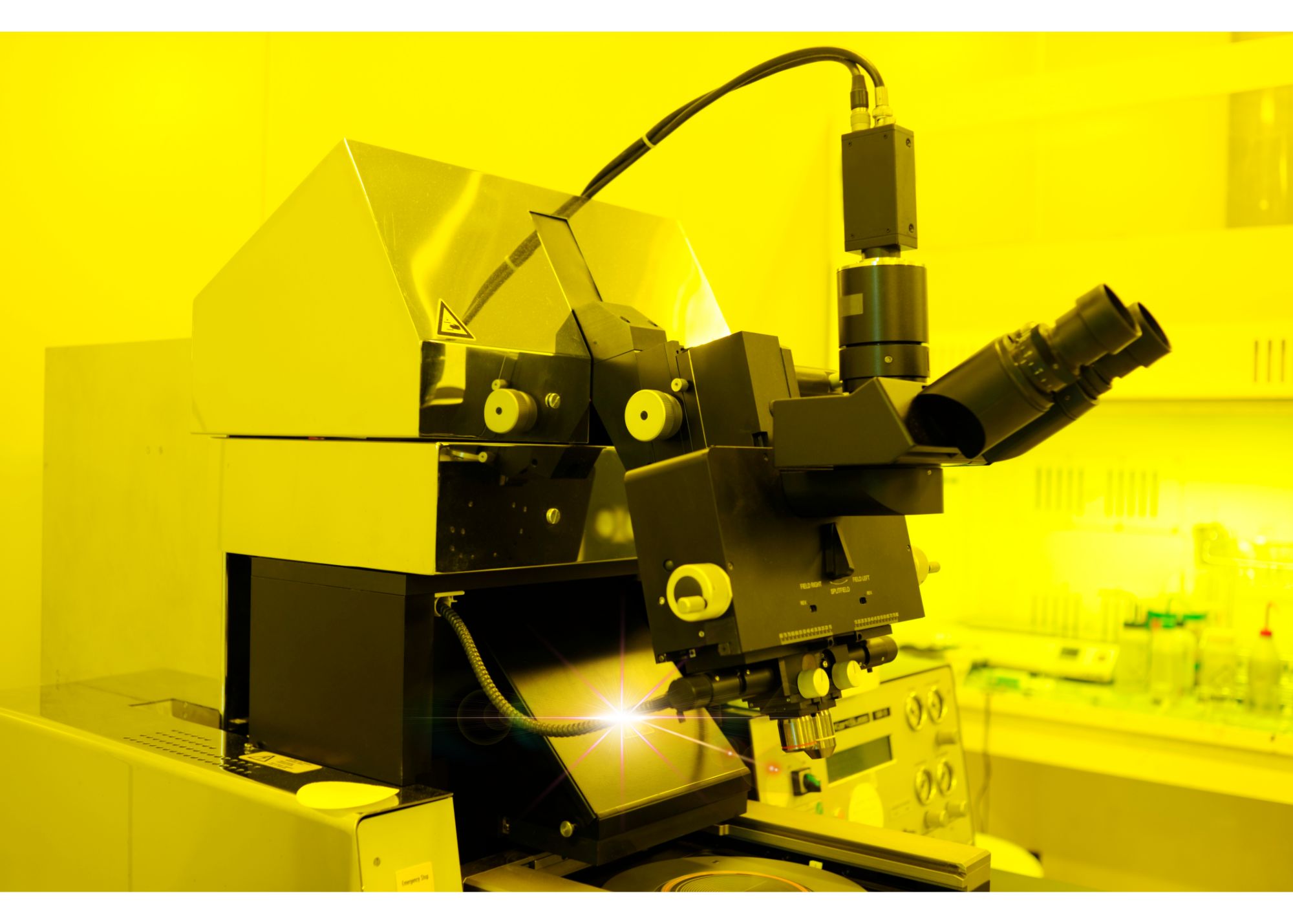

ASML (NASDAQ:ASML) is the only company in the world that produces extreme ultraviolet lithography machines, a critical technology for the most advanced semiconductor manufacturing.

For TSMC, who is crucial in the semiconductor supply chain, » Read more about: Forget NVIDIA, Buy This AI Stock? »

Read More

1 No Brainer Apparel Stock To Buy

The Canadian-American apparel manufacturer Lululemon Athletica looked to be a model success story for the fast-growing clothing sector at the end of 2021. The company saw its share price hit an all-time high of $485 in November, having already risen 390% since 2017.

As its store footprint grew to 552 outlets, the business also thrived,

» Read more about: 1 No Brainer Apparel Stock To Buy »

Read More

Worried About Inflation: Buy This Stock

Recent talk of the highest U.S. annual inflation rate since the 1970s has many investors spooked, and these worries are not solely based in the United States. A global inflation surge is upon us, which is why it’s more important than ever to consider stocks like Johnson &

» Read more about: Worried About Inflation: Buy This Stock »

Read More

3 High Yield Dividend Stocks Buffett Owns

The Oracle of Omaha – Warren Buffett – is known as one of the most successful stock investors on the planet. He not only aims to buy undervalued companies but he also targets ones that pay generous dividends. Indeed, he has a long history of owning high-yield dividend stocks that meet his investment criteria.

» Read more about: 3 High Yield Dividend Stocks Buffett Owns »

Read More

Massive Buy Sign Flashing In Magnificent 7 Stock

If one trader with an awesome track record is right, a Magnificent 7 stock is about to start a rip roaring rally that will last for some time.

Remarkably, it’s also been one of the poorest performers this year, down 4% so far against a market rally in the S&P 5oo of 20%.

» Read more about: Massive Buy Sign Flashing In Magnificent 7 Stock »

Read MoreThe Burst

1 Popular Stock To Flee Immediately

Airbnb has been on a tear since 2020 when it reported losses of $3 billion in a single quarter. Lockdowns sparked concerns that the company would not survive a world without travel but soon hope emerged that life would return to normal and the financials soon followed.

A full U-turn followed with the company growing the top and bottom lines at a rapid pace.

» Read more about: 1 Popular Stock To Flee Immediately »

Read MoreThe Spotlight

SoFi: The Trojan Horse of Banking?

This is the remarkable story of how SoFi, a firm that began as a student lender, has become the trojan horse of the banking industry.

The story begins with the stats. In the United States, 43.4 million people have outstanding federal student loans, which equates to nearly 20 percent of the nation’s adult population.

» Read more about: SoFi: The Trojan Horse of Banking? »

Read MoreThe Daily

Stock Market Live – March 5, 2026: S&P 500 (SPY) Drops on Gushing Oil Prices

Live Updates

Live

According to Rothschild & Co. Redburn, American Airlines is most at risk with rising jet fuel costs.

As noted by the firm, “Putting all this together,

» Read more about: Stock Market Live – March 5, 2026: S&P 500 (SPY) Drops on Gushing Oil Prices »