Warren Buffett’s Final Warning Shot

At Berkshire Hathaway, cash has swelled to levels that dwarf the market capitalizations of many household-name companies. Estimates put the pile near $400 billion, much of it parked in short-dated U.S. Treasuries.

Berkshire didn’t wake up one morning and decide to sit on mountains of cash. The buildup has been gradual,

» Read more about: Warren Buffett’s Final Warning Shot »

Read More

Is Buffett’s Biggest Bet On Sale?

Over the past 12 months, Berkshire shares have gained just under 6% less than the S&P 500.

With Warren Buffett preparing to step down as CEO at year end, investors are reassessing what Berkshire looks like in its next chapter and whether the stock offers value at today’s price.

Key Points

-

Berkshire trades at reasonable levels but not at prices that signal clear undervaluation,

» Read more about: Is Buffett’s Biggest Bet On Sale? »

Read More

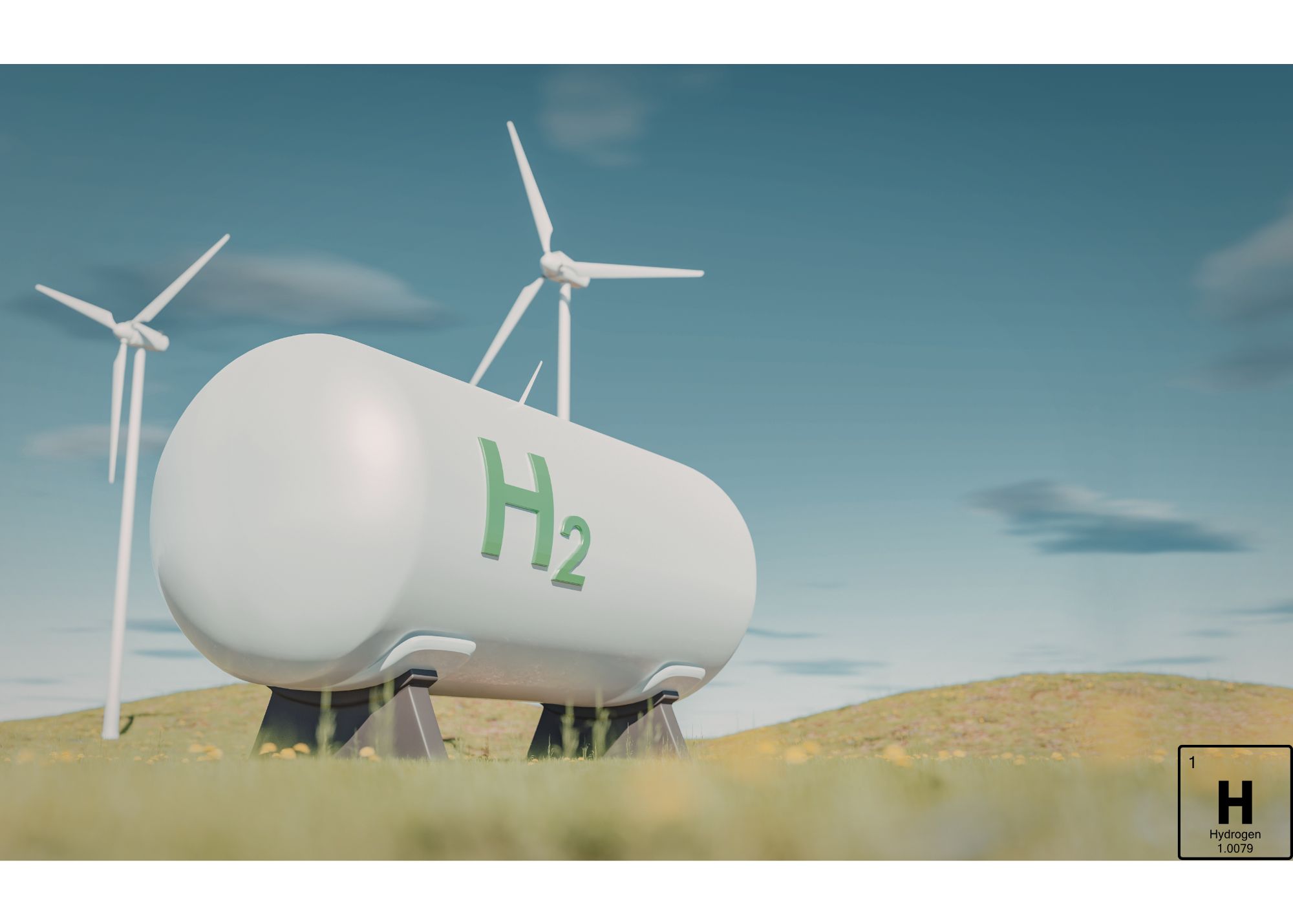

This Hydrogen Stock Is Becoming Critical AI Infrastructure

Bloom Energy doesn’t generate power the way most people think about clean energy. Instead of relying on intermittent sources like wind or solar, Bloom’s solid oxide fuel cells convert natural gas or hydrogen into electricity on-site, 24 hours a day.

There’s no combustion, no dependence on weather, and critically for enterprise customers no exposure to grid instability.

» Read more about: This Hydrogen Stock Is Becoming Critical AI Infrastructure »

Read More

Is IonQ The Best Bet on the Future of Quantum?

IonQ has been one of the biggest beneficiaries of renewed excitement around next-generation computing. Shares are up roughly 3x the S&P 500 this year as investors increasingly view quantum computing as moving closer to real-world use rather than remaining a purely academic pursuit.

The key question is whether IonQ’s rally reflects genuine long-term potential,

» Read more about: Is IonQ The Best Bet on the Future of Quantum? »

Read More

Tesla’s Big Bet on Robotaxis Is Getting Pricier

CEO Elon Musk has made it clear that Tesla’s future won’t be defined by cars alone. The company wants to become a dominant force in autonomous transportation and mass-produced robotics, with Musk floating the idea of producing up to one million Optimus robots annually by the end of the decade.

The ambition is enormous.

» Read more about: Tesla’s Big Bet on Robotaxis Is Getting Pricier »

Read MoreThe Burst

Billionaire Sells Major AI Stock

Over three decades, Druckenmiller compounded capital at roughly 30% a year without a single losing year, a record I am not sure is matched by anyone, anywhere Buffett included. So what’s this investing maestro doing now?

In the third quarter, Druckenmiller exited Broadcom entirely, a company that is a tollroad in the chip wars of AI.

» Read more about: Billionaire Sells Major AI Stock »

Read MoreThe Spotlight

Wall Street Gave Up, The Business Didn’t

Most people still think of Docusign as a digital signature tool. That’s a mistake, and it’s exactly the gap management is trying to exploit.

Over the last year, Docusign has rolled out its Intelligent Agreement Management platform, which aims to solve a much bigger and more expensive problem: what happens after a contract is signed.

» Read more about: Wall Street Gave Up, The Business Didn’t »

Read MoreThe Daily

Why the Nasdaq Is Holding Up Better Than the Dow and S&P 500 On Friday

Key Points

-

Escalating conflict in Iran has blocked shipping lanes at the Strait of Hormuz, sending crude oil prices up about 35% for the week.

-

Financial stocks and basic materials producers took the biggest hits on Friday as investors priced in ongoing disruptions to global trade.

» Read more about: Why the Nasdaq Is Holding Up Better Than the Dow and S&P 500 On Friday »