1 Infrastructure Specialist That’s Suddenly on Sale

Once investors saw how fast CoreWeave revenues were accelerating, hesitation disappeared. Shares didn’t just climb, they exploded, rising more than 4x in a matter of weeks.

That kind of surge rarely lasts forever, and over the past month CoreWeave has given back roughly 35%. The pullback has left investors wondering whether something fundamental has changed or whether this is simply the kind of temporary reset that follows massive gains.

» Read more about: 1 Infrastructure Specialist That’s Suddenly on Sale »

Read More

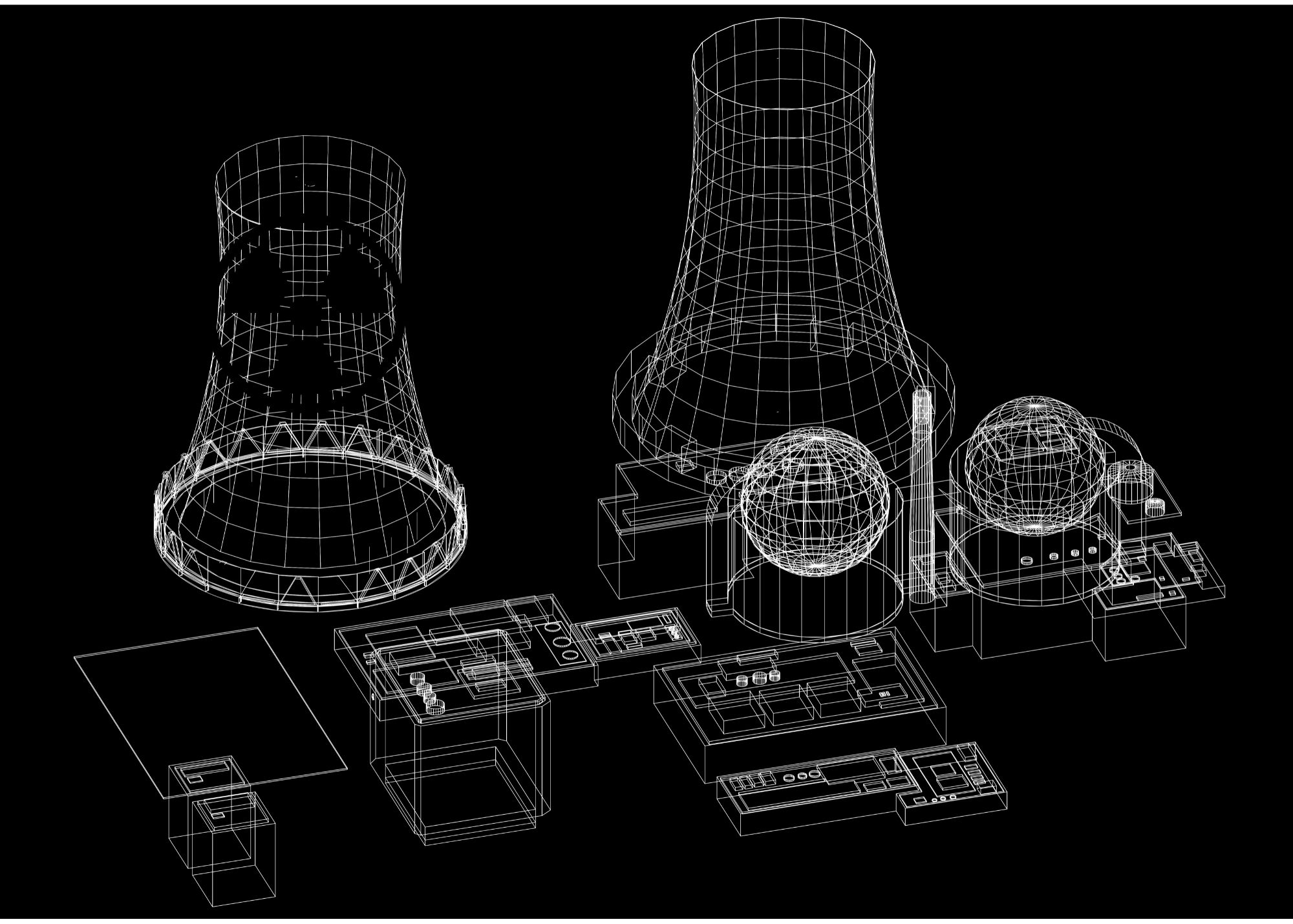

Why Nuclear’s Next Frontier Could Be 240,000 Miles Away

This year, nuclear energy stocks have been some of the market’s best performers. Small modular reactor (SMR) developers like NuScale Power (SMR) and Oklo (OKLO) have been announcing a steady stream of partnerships, and Donald Trump, has pushed fresh executive orders aimed at accelerating the sector’s development.

Investors have plenty of reason to be excited but a surprising new catalyst has emerged,

» Read more about: Why Nuclear’s Next Frontier Could Be 240,000 Miles Away »

Read More

Will Buffett’s 23-Quarter Streak Start Again?

For more than half a decade, Warren Buffett’s Berkshire Hathaway accumulated the same stock quarter after quarter, 23 straight times, to be exact. Then, without warning, the buying stopped last year.

It wasn’t because Buffett lost faith in the company. In fact, his recent moves suggest he’s been biding his time, waiting for the numbers and the price to line up again.

» Read more about: Will Buffett’s 23-Quarter Streak Start Again? »

Read More

Will Apple Catch Up To The Mag 7?

Apple shares climbed late last week on Wall Street’s growing belief that the company may have defused one of its biggest political risks, the ongoing tariff standoff with the Trump administration.

The breakthrough comes after Apple announced an eye-popping $600 billion investment in the United States, a figure that instantly turned heads in Washington and on Wall Street.

» Read more about: Will Apple Catch Up To The Mag 7? »

Read More

Has This Mag 7 Stock Got More Fuel In the Fire?

Amazon shares surged nearly 9% within a week of its latest earnings report, extending a 31% gain over the past year.

The strong results reignited investor confidence but the real story goes beyond quarterly numbers to Amazon’s growing role at the center of the AI boom.

Key Points

-

Amazon’s earnings beat was impressive,

» Read more about: Has This Mag 7 Stock Got More Fuel In the Fire? »

Read MoreThe Burst

Why Warren Buffett Loaded Up on Heico

Berkshire Hathaway quietly raised its stake in Heico by over 11% last quarter, bringing its total position to about 1.3 million shares. That move turned heads because Heico isn’t a typical Buffett pick. It’s not cheap by traditional value metrics, and it doesn’t sell iconic brands like Coca-Cola or Geico.

So why did Berkshire,

» Read more about: Why Warren Buffett Loaded Up on Heico »

Read MoreThe Spotlight

Why Roblox Stock Has Doubled & Might Just Be Getting Started

If you blinked, you might have missed it, Roblox (NYSE: RBLX) has turned into one of the hottest stocks of 2025.

Up over 2x year-to-date, the company’s market cap has surged past $80 billion, stunning many who once dismissed the platform as a pandemic fad. But here’s the best part, there’s reason to believe Roblox is only just getting warmed up.

» Read more about: Why Roblox Stock Has Doubled & Might Just Be Getting Started »

Read MoreThe Daily

How Your Spousal Social Security Benefits Change After a Spouse's Death

When a spouse dies, the number of decisions you have to make is staggering. The questions swirling around your mind can be numbing. However, amid it all, you must face the financial reality of life without your spouse, and that’s no easy feat.

If you’ve been collecting Social Security spousal benefits,

» Read more about: How Your Spousal Social Security Benefits Change After a Spouse's Death »