Beyond Meat’s Shocking Rebound

Few investors saw it coming. After spending most of the year circling the drain, Beyond Meat suddenly roared back to life last week, climbing more than 5x from its October lows.

At one point, the stock traded below $1, a price level that had many wondering if bankruptcy was next. Then came an eruption of retail enthusiasm that sent shares briefly rocketing toward $8.

» Read more about: Beyond Meat’s Shocking Rebound »

Read More

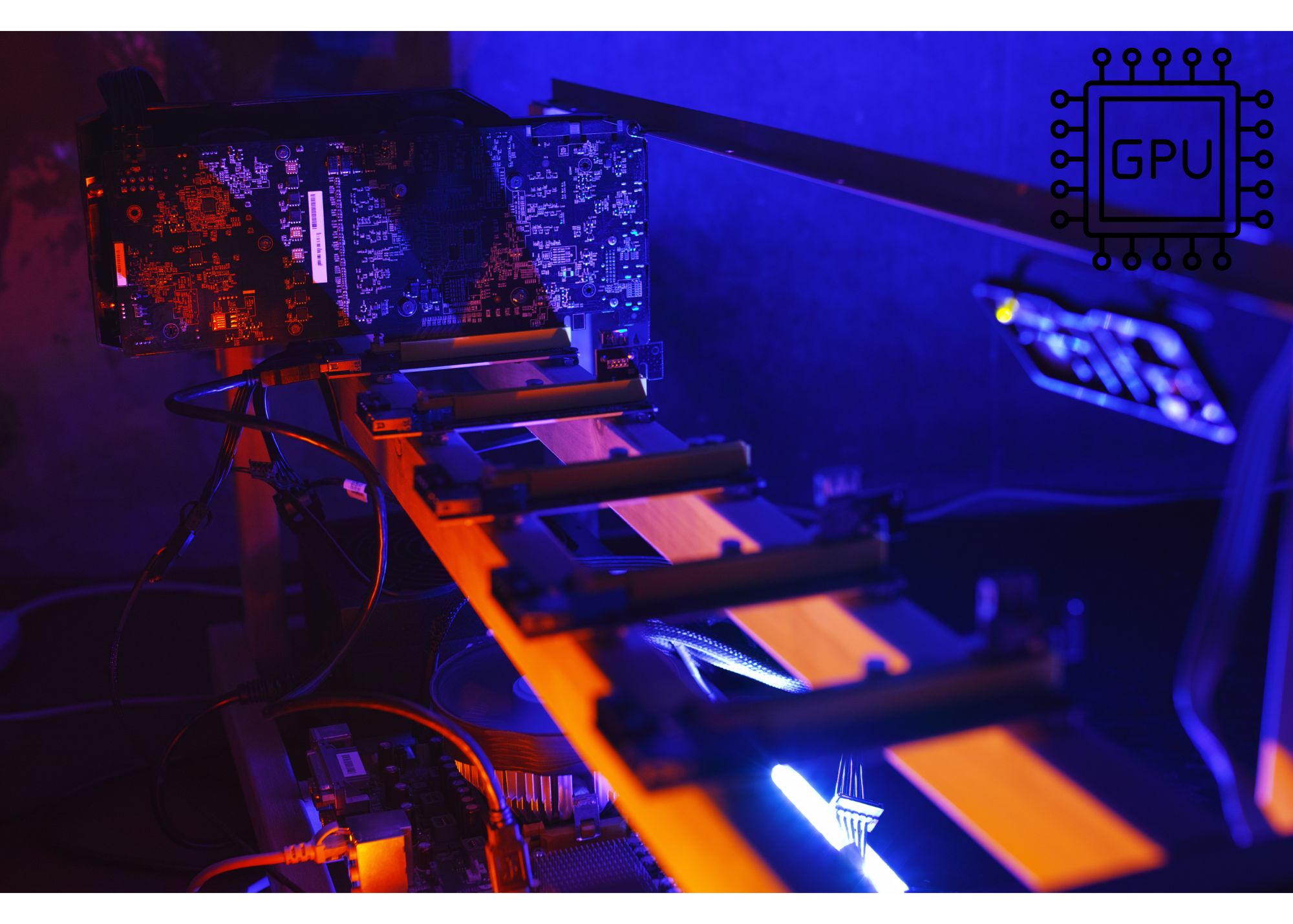

Time to Buy Leveraged NVIDIA? The Double-Edged Sword

NVDL is shorthand for the GraniteShares 2× Long NVDA Daily ETF, a leveraged fund that’s designed to return twice the daily performance of NVIDIA stock.

So, is NVDL a smart play or a high-voltage hazard?

Key Points

- NVDL delivers 2× NVIDIA’s daily returns, not long-term gains.

-

Traders use NVDL to amplify short-term bets on NVIDIA without options or margin accounts.

» Read more about: Time to Buy Leveraged NVIDIA? The Double-Edged Sword »

Read More

Why This Billionaire Loaded Up Former Deadbeat Stock

Howard Marks has built his 50‑year reputation on buying what everyone else is overlooking and waiting patiently for the narrative to swing his way. So when Oaktree Capital’s first‑quarter 2025 filing revealed a brand‑new 18.8 million‑share position in Nokia (2 % of the equity book, at roughly $5 a share) many investors did a double‑take ,telecom hardware is hardly Oaktree’s home turf.

» Read more about: Why This Billionaire Loaded Up Former Deadbeat Stock »

Read More

What Does Buffett Know?

When the rest of Wall Street was riding the AI-fueled tech rally last year, the Oracle of Omaha was quietly doing the opposite, selling more stocks than he bought and stacking cash to the tune of a staggering $347 billion. While the S&P 500 was hitting fresh highs and investors were throwing money at growth stocks,

» Read more about: What Does Buffett Know? »

Read More

Is SoFi The Next Fintech Powerhouse?

SoFi Technologies has evolved far beyond its origins as a student loan refinancer. Today, it’s a full-fledged digital financial platform offering everything from brokerage accounts to mortgages, all through a single app.

That simplicity and accessibility have made SoFi a go-to brand for Millennials and Gen Z, who increasingly prefer managing their finances entirely online.

» Read more about: Is SoFi The Next Fintech Powerhouse? »

Read MoreThe Burst

1 Home Furnishings Stock Set to Rally Hard?

Mortgage rates remain near multi-decade highs, and existing home sales are still down about 30% compared to pre-pandemic levels. That slowdown has created a ripple effect, dragging down everything tied to housing, from builders to brokers to the companies selling furniture and décor.

One name that stands out in this group is RH.

» Read more about: 1 Home Furnishings Stock Set to Rally Hard? »

Read MoreThe Spotlight

Paul Tudor Jones Just Dropped a Masterclass on How to Invest Now

Every fall, a tight-knit group of investors gathers for a friendly, but fiercely competitive, stock picking challenge. It’s hosted by Paul Tudor Jones, the legendary hedge fund manager. But it isn’t just for a good cause. The top picks from the event, backed by the likes of Bill Ackman and Stan Druckenmiller, would’ve returned 7x your money in just six months.

» Read more about: Paul Tudor Jones Just Dropped a Masterclass on How to Invest Now »

Read MoreThe Daily

A Federal Reserve Double Whammy Is 2 Months Away — and It May Mark the Tipping Point for the Stock Market

Key Points

-

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all soared due to a confluence of factors.

-

President Trump’s nomination of Kevin Warsh comes with an assortment of potential unintended consequences.

-

Additionally, a historic division has taken hold of the Federal Open Market Committee (FOMC) at the tail end of Jerome Powell’s term as Fed chair.