Is Buffett’s Biggest Bet On Sale?

Over the past 12 months, Berkshire shares have gained just under 6% less than the S&P 500.

With Warren Buffett preparing to step down as CEO at year end, investors are reassessing what Berkshire looks like in its next chapter and whether the stock offers value at today’s price.

Key Points

-

Berkshire trades at reasonable levels but not at prices that signal clear undervaluation,

» Read more about: Is Buffett’s Biggest Bet On Sale? »

Read More

Brand Name Stock with Room to Run

Entertainment may have expanded well beyond Los Angeles, but its center of gravity hasn’t moved. From its base in Burbank, The Walt Disney Company continues to operate a global engine that spans film, television, streaming, sports, parks, merchandise, and travel. Competitors like Warner Bros.

Discovery and Skydance may circle potential mergers, but even a combined entity wouldn’t approach the depth or global reach Disney has spent generations building.

» Read more about: Brand Name Stock with Room to Run »

Read More

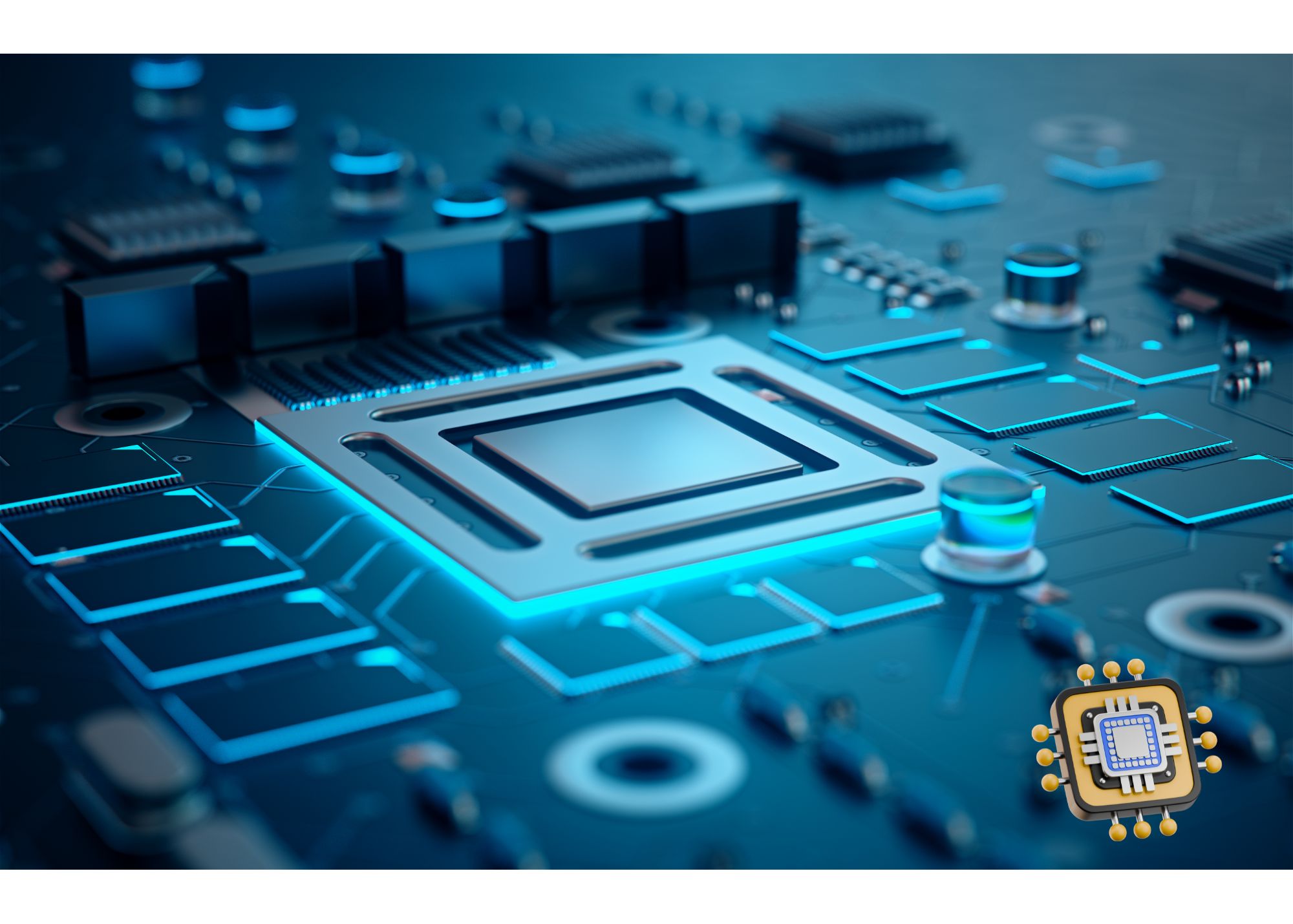

Nvidia’s Next Leg of Growth Could Be Massive

Over the past three years, demand for Nvidia’s GPUs has ballooned so fast that the company has entered a rare feedback loop. Every architecture upgrade sparks a new wave of orders from hyperscalers, which funds even faster improvement, which attracts even more demand. How long can this last?

If Jensen Huang is right,

» Read more about: Nvidia’s Next Leg of Growth Could Be Massive »

Read More

1 Infrastructure Specialist That’s Suddenly on Sale

Once investors saw how fast CoreWeave revenues were accelerating, hesitation disappeared. Shares didn’t just climb, they exploded, rising more than 4x in a matter of weeks.

That kind of surge rarely lasts forever, and over the past month CoreWeave has given back roughly 35%. The pullback has left investors wondering whether something fundamental has changed or whether this is simply the kind of temporary reset that follows massive gains.

» Read more about: 1 Infrastructure Specialist That’s Suddenly on Sale »

Read More

Why Nvidia Still Looks Like The #1 AI Stock

Nvidia didn’t become the centerpiece of the AI revolution by accident. Its advantage goes well beyond having fast chips. The company spent more than a decade positioning itself as the default computing layer for advanced workloads long before AI became a mainstream investment theme.

Naturally, that raises an uncomfortable question: after a run like this,

» Read more about: Why Nvidia Still Looks Like The #1 AI Stock »

Read MoreThe Burst

Alphabet’s Comeback Wasn’t Luck, But Classic Mispricing

The speed of Alphabet’s reversal has surprised many investors, but the more interesting story is how such a dominant business ever became that cheap in the first place, and why the momentum it regained isn’t likely to stall heading into 2026.

Key Points

-

Alphabet’s rally stemmed from deep mispricing,

» Read more about: Alphabet’s Comeback Wasn’t Luck, But Classic Mispricing »

Read MoreThe Spotlight

Is Micron the Smartest Way to Ride the AI Chip Boom?

Micron Technology has been one of the biggest winners of 2025 so far. The stock has rocketed by almost 3x year to date, as investors wake up to the fact that memory chips, once seen as boring, cyclical commodities, are now an indispensable backbone of the AI revolution.

The chipmaker’s DRAM and NAND memory chips are quietly powering the world’s largest data centers,

» Read more about: Is Micron the Smartest Way to Ride the AI Chip Boom? »

Read MoreThe Daily

College Decision Day Is Just Around the Corner. Warren Buffett Says ‘I Never Look at Where a Candidate Has Gone to School. Never!’

As “College Decision” day approaches, many students are convinced that the school they choose will determine the rest of their lives. The pressure to secure a spot at an elite institution looms, yet one of the world’s most successful investors is signaling a move in the opposite direction.

In his 2024 shareholder letter,