Could Nvidia Be the First $10 Trillion Company?

Nvidia might have started as a gaming chip company, but make no mistake it’s now the backbone of the AI revolution.

And if smart money projections hold up, it could become the first company to smash through the $10 trillion valuation barrier. That’s not hyperbole, it’s a plausible trajectory grounded in stunning financials,

» Read more about: Could Nvidia Be the First $10 Trillion Company? »

Read More

1 Weird Advantage NVIDIA Has Over Magnificent 7

In spite of recent share price turbulence, NVIDIA has been on an astonishing run over the past 5 years with the stock gaining a remarkable 2,317%.

To give you a sense of the magnitude of the bull run, NVIDIA’s revenues were $10 billion in 2020, but have soared to $60.9 billion in the intervening years.

» Read more about: 1 Weird Advantage NVIDIA Has Over Magnificent 7 »

Read More

1 Little-known Fund Goes All In On Semi Stock

Prospect Capital Advisors isn’t a big name fund but it’s put almost 10% of its fund into a single stock, Silicon Motion Technology.

For a fund overseeing hundreds of millions of dollars, this is quite a bet. Why risk it all on a little-known stock when you can follow the herd into Apple,

» Read more about: 1 Little-known Fund Goes All In On Semi Stock »

Read More

$8 Billion Money Manager Bets On 41% Upside

Deep down in the filings of an $8 billion money manager is a holding that has the potential to rise by as much as 41%.

William Jones isn’t a name familiar with many investors as Warren Buffett or Ray Dalio may be but the enormous assets under management demand a closer look as to what he’s picking and why.

» Read more about: $8 Billion Money Manager Bets On 41% Upside »

Read More

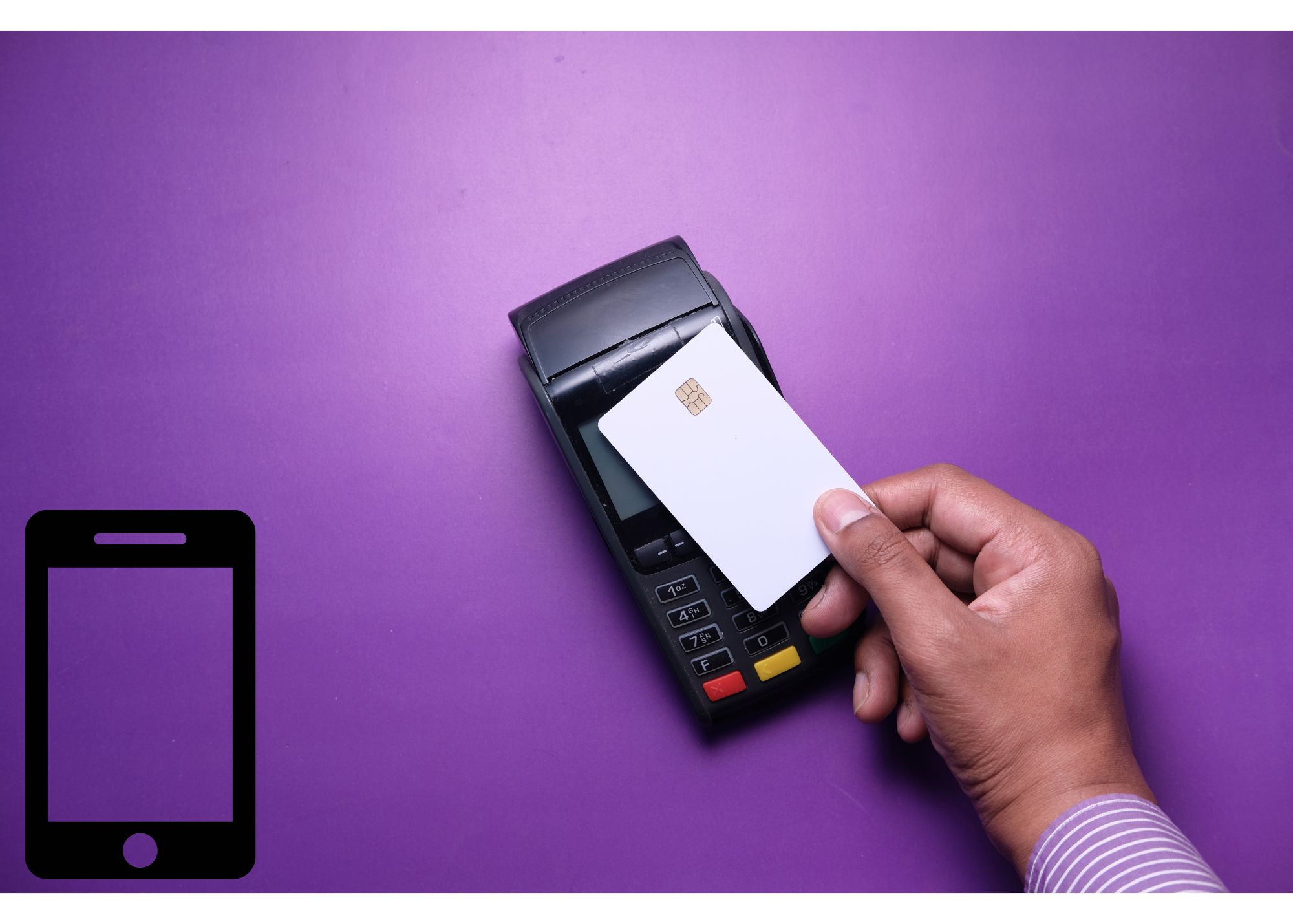

Jack’s Fintech Giant Just Quadrupled Profits

The stock market has a way of turning heroes into villains overnight, and Block is a perfect case study. Just a few years ago, it was one of the hottest names on Wall Street, riding high on the wave of digital adoption.

Fast forward to today, and the stock is trading nearly 80% below its all-time highs.

» Read more about: Jack’s Fintech Giant Just Quadrupled Profits »

Read MoreThe Burst

The Market Just Flashed a Rare Signal

Buying great companies regularly and keeping a cool head has proven to be a time-tested winning formula in the markets.

That said, every now and then, it’s worth paying attention when a technical signal with a track record like this flashes green.

Last week, the market delivered something truly rare: the triggering of the Zweig Breadth Thrust.

» Read more about: The Market Just Flashed a Rare Signal »

Read MoreThe Spotlight

How Do You Pick a Winning Stock?

Investors will often pour through dozens or even hundreds of stocks looking for the best investment options to add to their portfolios. Before doing this, however, it’s important to first understand what a good stock is.

Let’s take a look at some of the factors that define a good investment to understand what makes a potentially lucrative stock.

» Read more about: How Do You Pick a Winning Stock? »

Read MoreThe Daily

Unpacking the Latest Options Trading Trends in FormFactor

Today, Benzinga’s options scanner spotted 13 options trades for FormFactor. This is not a typical pattern. The sentiment among these major traders is split, with 23% bullish and 76% bearish. Among all …

» Read more about: Unpacking the Latest Options Trading Trends in FormFactor »