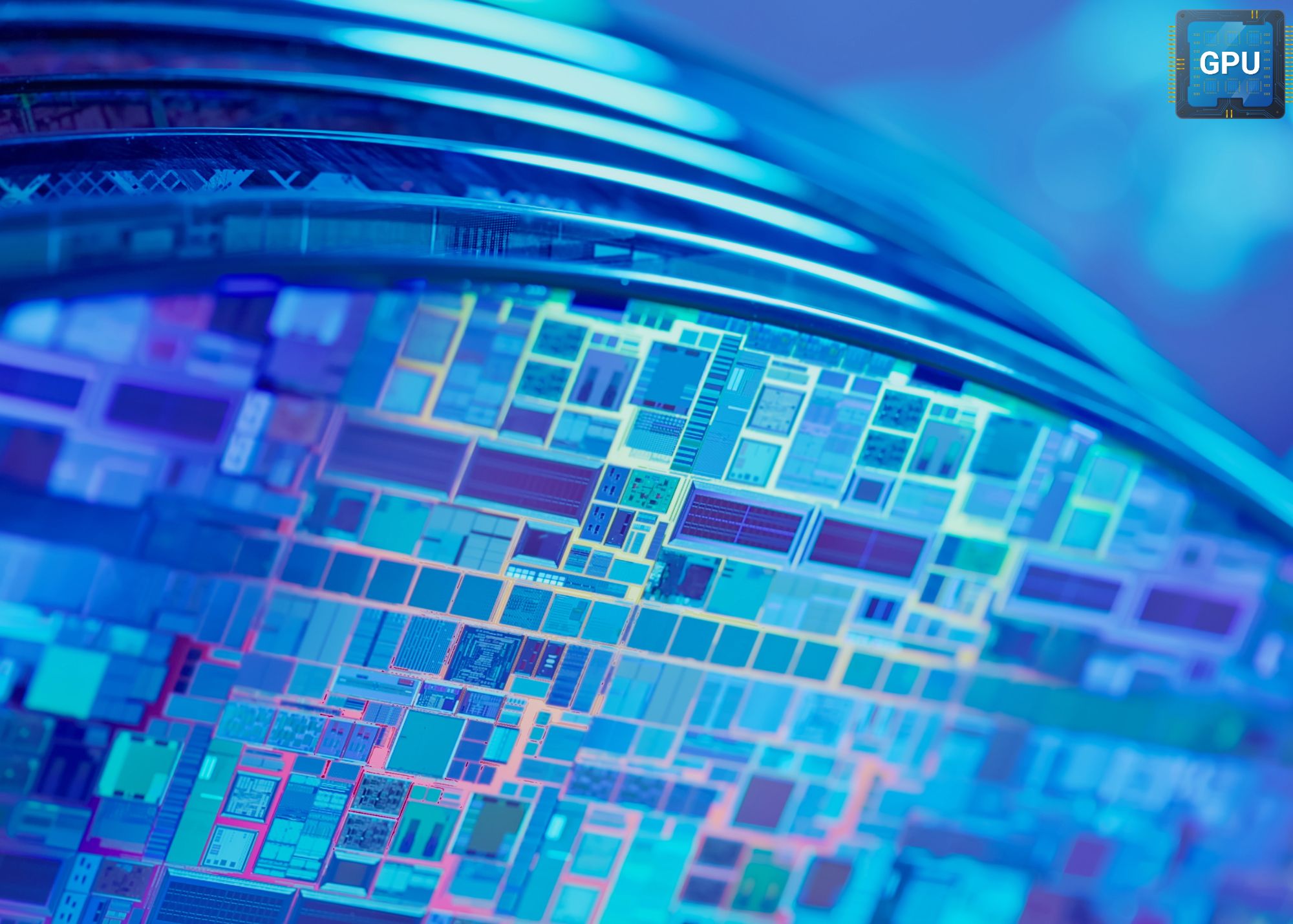

Nvidia Still Dominates AI, But the Ground Beneath It Is Shifting

Nvidia has been the undisputed king of the AI hardware empire.

But even monarchs can be overthrown, especially when their biggest allies start eyeing the throne.

Who’s threatening NVIDIA now and will they win?

Key Points

-

Nvidia still leads AI hardware, but growth is slowing and major clients are building their own chips.

» Read more about: Nvidia Still Dominates AI, But the Ground Beneath It Is Shifting »

Read More

110 Year Old Firm Crushing Wall Street

Imagine you had a checklist for when to buy a stock and as you look down it, every line item is check, check, check. That wouldn’t be too far away from the experience we had looking down through the Brady Corp metrics.

To begin with what on earth is Brady? Not many investors are in fact aware of this company that has a century plus long history.

» Read more about: 110 Year Old Firm Crushing Wall Street »

Read More

1 Under-$100 Billion Growth Stock To Join Trillion Dollar Club?

Airbnb (NASDAQ: ABNB) isn’t even two decades old but it has made more than a splash in disrupting the travel and hospitality industry. Famously, one tag line announced that the largest taxi firm in the world owns no taxis (Uber) and the largest accommodation in the firm (Airbnb) owns no real estate.

With a market cap still under $100 billion yet pumping out an astonishing $3.8 billion in free cash flow alone last year,

» Read more about: 1 Under-$100 Billion Growth Stock To Join Trillion Dollar Club? »

Read More

If Trump Were Assassinated, What Would Happen?

The near assassination of former President Donald Trump plunged the country into a perilous situation. It’s unclear what the reaction would have been had Trump been struck lethally but as you can see, the proximity to death was a hair’s breath away.

Some estimate the final turn of his head, a 0.05 second movement was what saved his life.

» Read more about: If Trump Were Assassinated, What Would Happen? »

Read More

Mastercard Might Be the Most Underrated $500 Billion Juggernaut in the Market

It’s not every day you find a company bigger than Bank of America, American Express, and Goldman Sachs combined. Yet sitting near the top of the S&P 500 leaderboard is Mastercard (NYSE: MA), a payments powerhouse with a market cap hovering around half a trillion dollars.

In fact, Mastercard’s valuation puts it ahead of household names in finance and on par with tech icons,

» Read more about: Mastercard Might Be the Most Underrated $500 Billion Juggernaut in the Market »

Read MoreThe Burst

Why Billionaires Are Betting Big on This Bitcoin ETF

Recently, a surprising number of billionaire hedge fund managers have been buying a single ETF. This fund, the iShares Bitcoin Trust ETF (IBIT), is a spot Bitcoin ETF that tracks the performance of the world’s largest cryptocurrency.

Managers such as Ken Griffin and Israel Englander have decided to buy this fund despite their proven acumen in picking individual stocks that outperform the market.

» Read more about: Why Billionaires Are Betting Big on This Bitcoin ETF »

Read MoreThe Spotlight

Hyper Rich Politician Buys A Boatload Of..

Nancy Pelosi is among the highest earners in Congress with a salary of $223,000 yet her stock portfolio has grabbed the attention of watchers for its performance relative to the market and size.

Her portfolio has some grown to an astonishing $223 million. In the words of one X user, what started as a mockery,

» Read more about: Hyper Rich Politician Buys A Boatload Of.. »

Read MoreThe Daily

Nvidia Stock Investors Just Got Good News From Amazon, Google, Meta Platforms, and Microsoft

Hyperscalers are likely to spend much more on AI infrastructure in 2026 than Wall Street initially estimated.

Nvidia (NVDA 2.21%) has been a cornerstone of the artificial intelligence (AI) trade since OpenAI introduced ChatGPT in late 2022. Shares have advanced 1,180% since early 2023,