Why Roblox Stock Has Doubled & Might Just Be Getting Started

If you blinked, you might have missed it, Roblox (NYSE: RBLX) has turned into one of the hottest stocks of 2025.

Up over 2x year-to-date, the company’s market cap has surged past $80 billion, stunning many who once dismissed the platform as a pandemic fad. But here’s the best part, there’s reason to believe Roblox is only just getting warmed up.

» Read more about: Why Roblox Stock Has Doubled & Might Just Be Getting Started »

Read More

Will Bitcoin Hit an All-Time High Before the Election?

Will Bitcoin hit an all-time high before voters head to the polls?

While Bitcoin has demonstrated its potential to defy expectations, a new set of circumstances, including institutional support, hedge fund interest, and political influences, are converging, making the coming weeks critical for Bitcoin’s price trajectory.

So how high can Bitcoin go?

» Read more about: Will Bitcoin Hit an All-Time High Before the Election? »

Read More

1 Seriously Overlooked Healthcare Stock That Could Soar

Sometimes the seemingly most boring companies in the world produced the most extraordinary returns. One healthcare firm that hasn’t shot up – yet – but which has attracted the attention of a multi-billion dollar fund with a pristine track record may be set to do so.

Better yet, it’s trading close to the estimated price paid by the fund,

» Read more about: 1 Seriously Overlooked Healthcare Stock That Could Soar »

Read More

If You Could Only Buy 1 High-Income Fund, What Would It Be?

Options trading is sometimes viewed as risky and that reputation is well-earned, especially when selling calls and puts naked. But when combined with stock ownership in the form of a covered call, it can be quite a conservative strategy.

Similar to the popular ETFs that track indexes like the S&P 500, a covered call ETF can be bought and sold like a stock,

» Read more about: If You Could Only Buy 1 High-Income Fund, What Would It Be? »

Read More

Why This Schwab ETF Is a Favorite Among Retirees

For retirees or anyone focused more on stability than swing-for-the-fences growth, the S&P 500 isn’t always the most comforting choice. It’s heavily weighted toward large-cap tech names, and when those names fall out of favor, the whole index can wobble.

That’s why many investors approaching retirement gravitate toward dividend-focused funds. And one ETF in particular has emerged as a go-to is the Schwab U.S.

» Read more about: Why This Schwab ETF Is a Favorite Among Retirees »

Read MoreThe Burst

Why Warren Buffett Loaded Up on Heico

Berkshire Hathaway quietly raised its stake in Heico by over 11% last quarter, bringing its total position to about 1.3 million shares. That move turned heads because Heico isn’t a typical Buffett pick. It’s not cheap by traditional value metrics, and it doesn’t sell iconic brands like Coca-Cola or Geico.

So why did Berkshire,

» Read more about: Why Warren Buffett Loaded Up on Heico »

Read MoreThe Ivy

1 Infrastructure Specialist That’s Suddenly on Sale

Once investors saw how fast CoreWeave revenues were accelerating, hesitation disappeared. Shares didn’t just climb, they exploded, rising more than 4x in a matter of weeks.

That kind of surge rarely lasts forever, and over the past month CoreWeave has given back roughly 35%. The pullback has left investors wondering whether something fundamental has changed or whether this is simply the kind of temporary reset that follows massive gains.

» Read more about: 1 Infrastructure Specialist That’s Suddenly on Sale »

Read MoreThe Daily

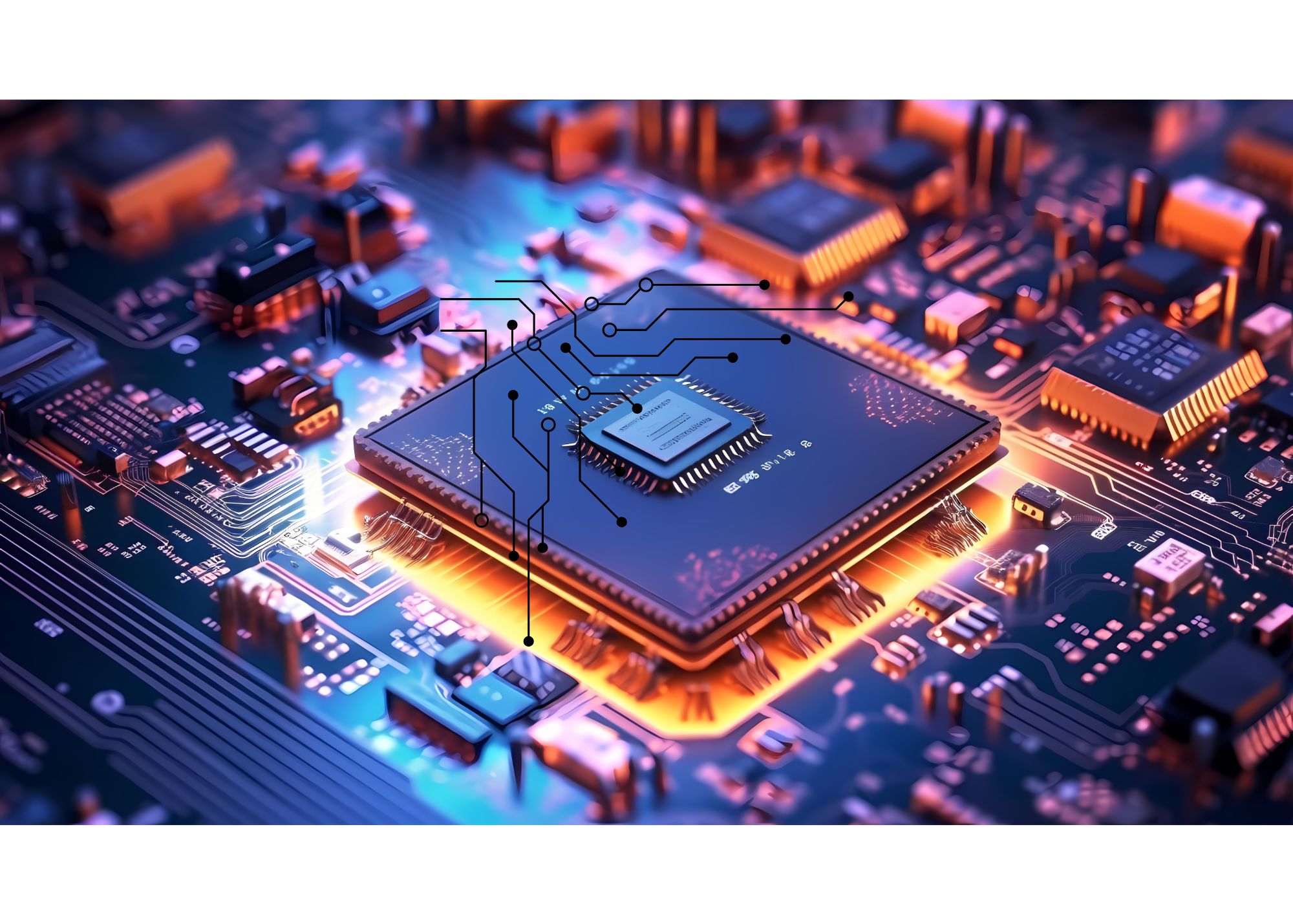

CEO Jensen Huang Just Handed Down Incredible News for Nvidia Stock Investors

The AI chipmaker is growing like gangbusters.

When it comes to powering artificial intelligence (AI), there’s Nvidia (NVDA +1.41%), then there’s everyone else. As the leading provider of graphics processing units (GPUs) that underpin AI, Nvidia is viewed as a bellwether for AI adoption.

» Read more about: CEO Jensen Huang Just Handed Down Incredible News for Nvidia Stock Investors »