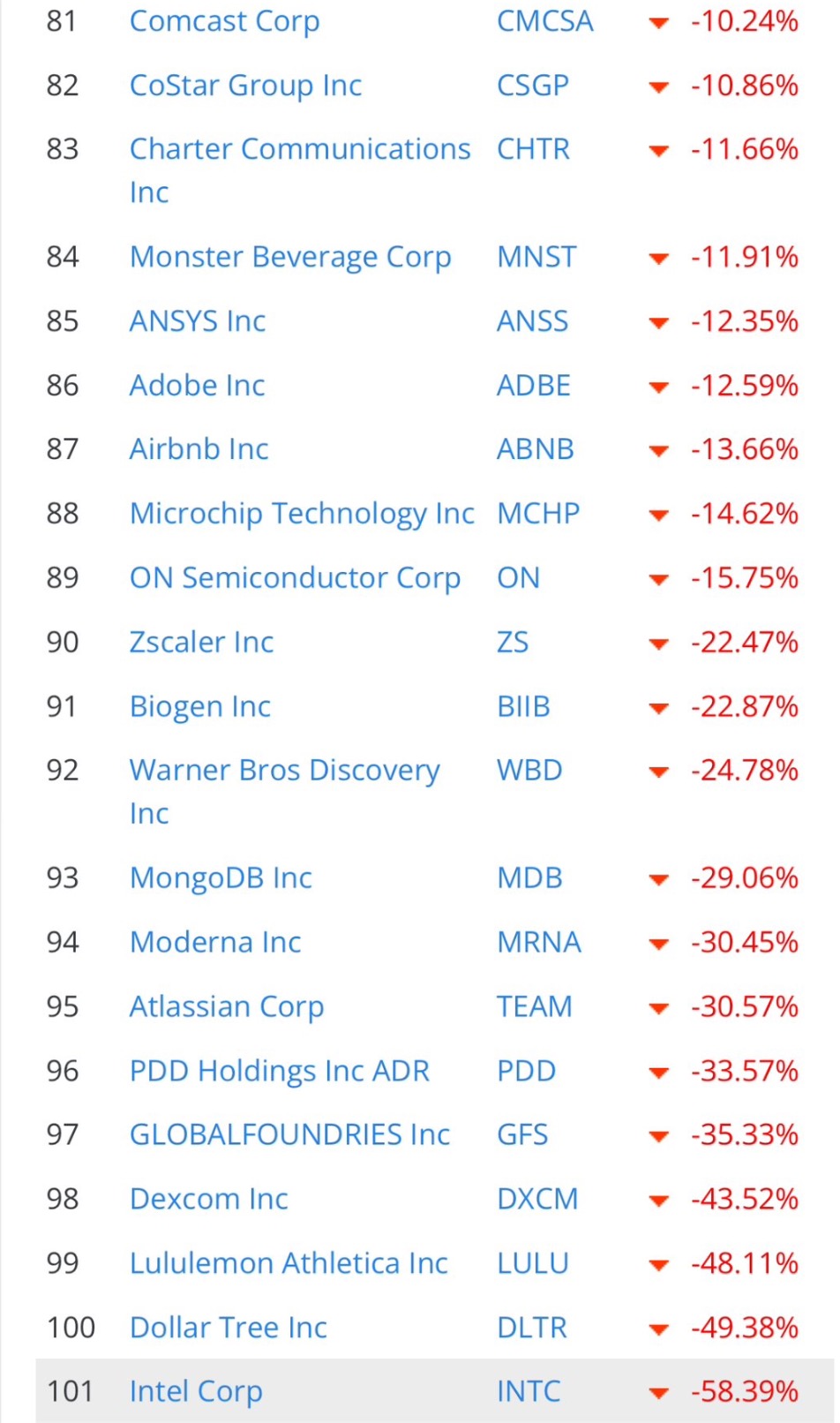

100 Worst Performing Stocks, But 1 Is a Buy?

In a list of the worst performing NASDAQ 100 stocks this year, Intel ranks about as poorly as any. Even after its monumental selloff, analysts only see upside to $26 per share.

But there is another stock on the list that may be a bit more interesting for bulls. If our analysis is right, this former high-flying stock may have huge upside potential when it finally rebounds.

Can you spot it on the list here?

Credit: Wasteland Capital

Key Points

- Lululemon’s stock is down nearly 50% this year as inflation and rising interest rates reduce consumer discretionary spending, hurting sales.

- Increased competition and aggressive discounting from rivals, along with rising costs and expansion investments, are pressuring its market share and margins.

- Despite challenges, analysts see the stock as undervalued with significant upside, indicating a potential buying opportunity.

Which Stock Could Rally Big Time?

Near the bottom of the list is Lululemon, down 48.11% for the year. It’s not entirely a surprise why the luxury brand has hit a few speed bumps.

With persistent inflation and rising interest rates, consumers are becoming more cautious about their discretionary spending and Lululemon’s premium market status is particularly susceptible to shifts in consumer sentiment.

Or in other words, when consumers tighten their budgets, they tend to shy away from luxury and opt for lower-cost alternatives, affecting Lululemon’s sales growth.

Lululemon is also being torpedo attacked by competitors, like Sweaty Betty and Ola. Indeed many athleisure competitors have been offering aggressive promotions and discounts, which may have pressured Lululemon to follow suit or risk losing market share.

The concern among investors is that margins will compress. It’s fair to say that Lulu’s margins have faced pressure on several fronts, including rising costs for raw materials, increased labor costs, as well as supply chain slowdowns.

Management has invested heavily in its direct-to-consumer business and expanding its international footprint, which has also weighed on its margins.

But we’re getting to the stage where the bad news is baked in.

How High Can Lulu Stock Go?

Although the numbers have slowed, Lululemon remarkably has continued to post year-over-year growth in each and every quarter of the past twelve.

Earnings before interest and taxes also shine brightly to the tune of hundreds of millions in each quarter over the past 3 years too.

And all those margin concerns, well, they can’t be dismissed but last quarter Lulu still posted a 59.2% gross margin, an enormous figure for an apparel brand.

What it translates to is an attractive valuation, particularly when the price-to-earnings ratio is compared to near-term earnings growth. The current PE ratio is just 19.9x while earnings growth is forecast to come in at 9.2% annually over the next 5 years.

When we look to analysts estimates, they are substantially more bullish than the market is pricing in right now with fair value pegged at $315 per share, way above the current share price.

A discounted cash flow analysis also features substantial upside possibility to $371 per share, which would correspond to 39.8% upside.

So while growth has slowed and the market is punishing the stock accordingly, it may well be that the worst of the bad news has been baked in and when the technical trend turns, it’s time to buy this premium athleisure play once again.