Market Commentary: Only 4 Times In 153 Years, Now What?

Something is rotten in the state of Denmark was a line made famous by Shakespeare, but it could be applied equally to the USA now. Why is everything so much more costly than a generation ago, and insanely more expensive than a generation before that? In a word: inflation, which is caused by an increase in the money supply.

What most people don’t see is that money supply increases so gradually that from one year to the next it’s hard to spot price differences. For a thought experiment, imagine a bag of chips that cost a dime back in the day. Inflation of 10% would be barely noticeable the next year as the bag increased in price by just a penny.

Now fast forward a generation, and the $1 bag of chips goes up by 10%, translating to $1.10 next year. In the space of a generation, a single year’s inflation has resulted in the price going up by 100% of the cost of the bag of chips in the prior generation. But from one year to the next the penny increments are barely noticeable, until they compound to become two-penny increments, and so on.

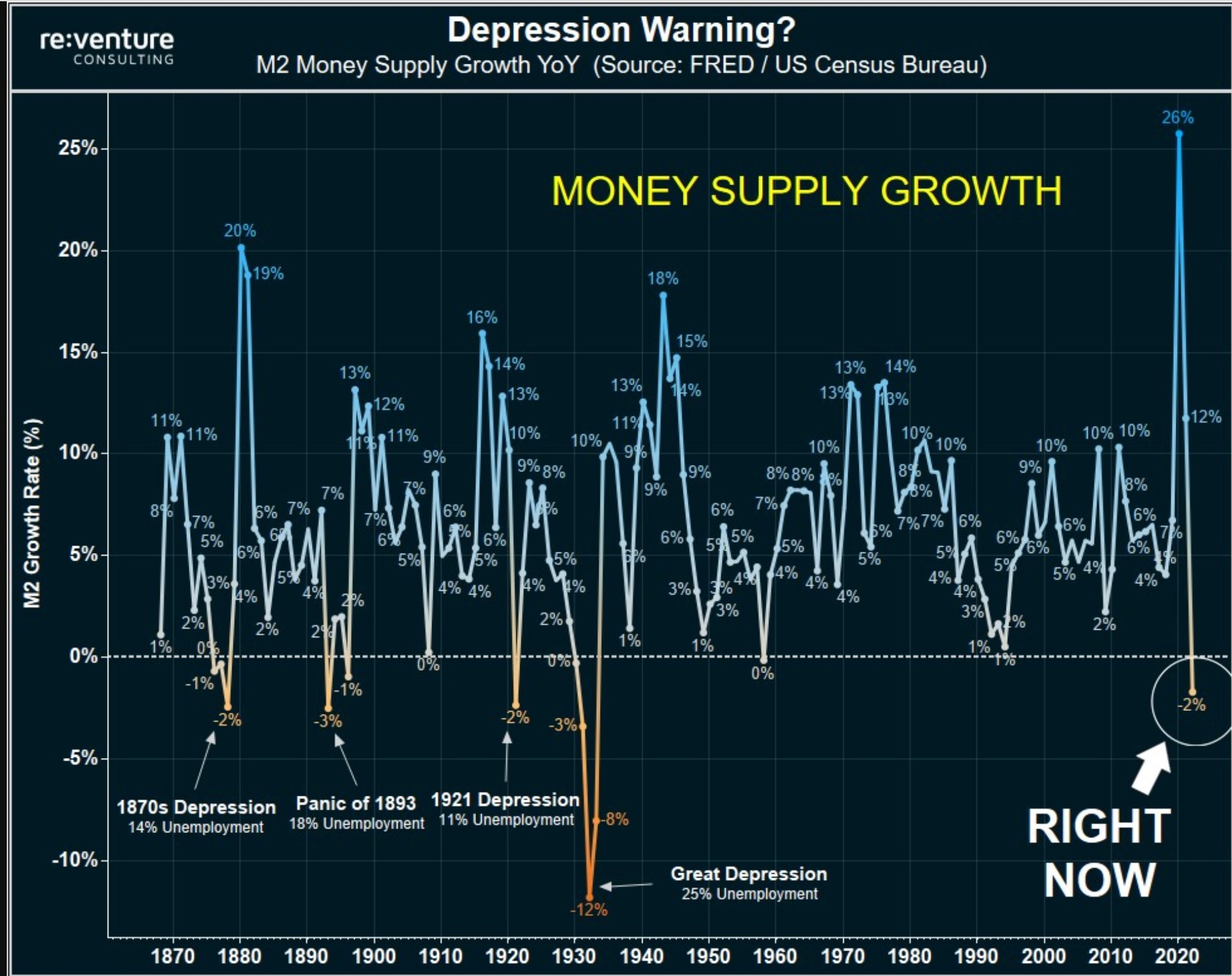

This context is helpful because a tectonic shift has taken place in money supply. In fact, one so extraordinary that it has only happened four times in the past century and a half; money supply has contracted.

This Wild Event Took Place Only 4 Times In 153 Years

Back in March, Nick Gerli posted a chart of money supply decreasing by 2%, an event so rare that it’s happened fewer than a handful of times in the past 150+ years.

So what does it mean?

Credit: Nick Gerli

To give you context on how rare this money supply contraction is, it last happened 90 years ago.

Another interesting tidbit is that, even though it contracted, it did so following an almost unprecedented increase in monetary and fiscal stimulus programs post-covid; moratoriums on paying back student debt, economic injury disaster loans, and so on. A pullback of $700 billion or so is not an outrageous contraction on the back of a 26% increase prior.

Indeed the market continued to rally through the summer months despite this potentially perilous news, highlighting how one data point should not be used to guide your investment decision-making.

What Should You Focus On?

Yes, money supply contraction is important, and historically has not been a positive indicator of what’s to come. However, if you want to know what to focus on to make smarter investment decisions, listen to Bill Ackman, who claims fundamentally the one thing to pay attention to is cash flows.

A company with a strong balance sheet that can generate good cash flows has the resilience to withstand macro pressures. Apple, Alphabet, Microsoft, and so on are all popular with institutions for good reason.

As an individual investor you can be more nimble than them and buy on technical breakouts and support levels. When you do, you have strong fundamentals as tailwinds, and good momentum on your side too.