Warren Buffett Just Dumped This Stock, Should You?

Warren Buffett will tell you he can’t time the market but he has a pretty good history of doing just that. He has famously been quoted as saying his favorite holding time is forever, so when his firm, Berkshire Hathaway, buys a stock and quickly offloads it, you need to pay attention.

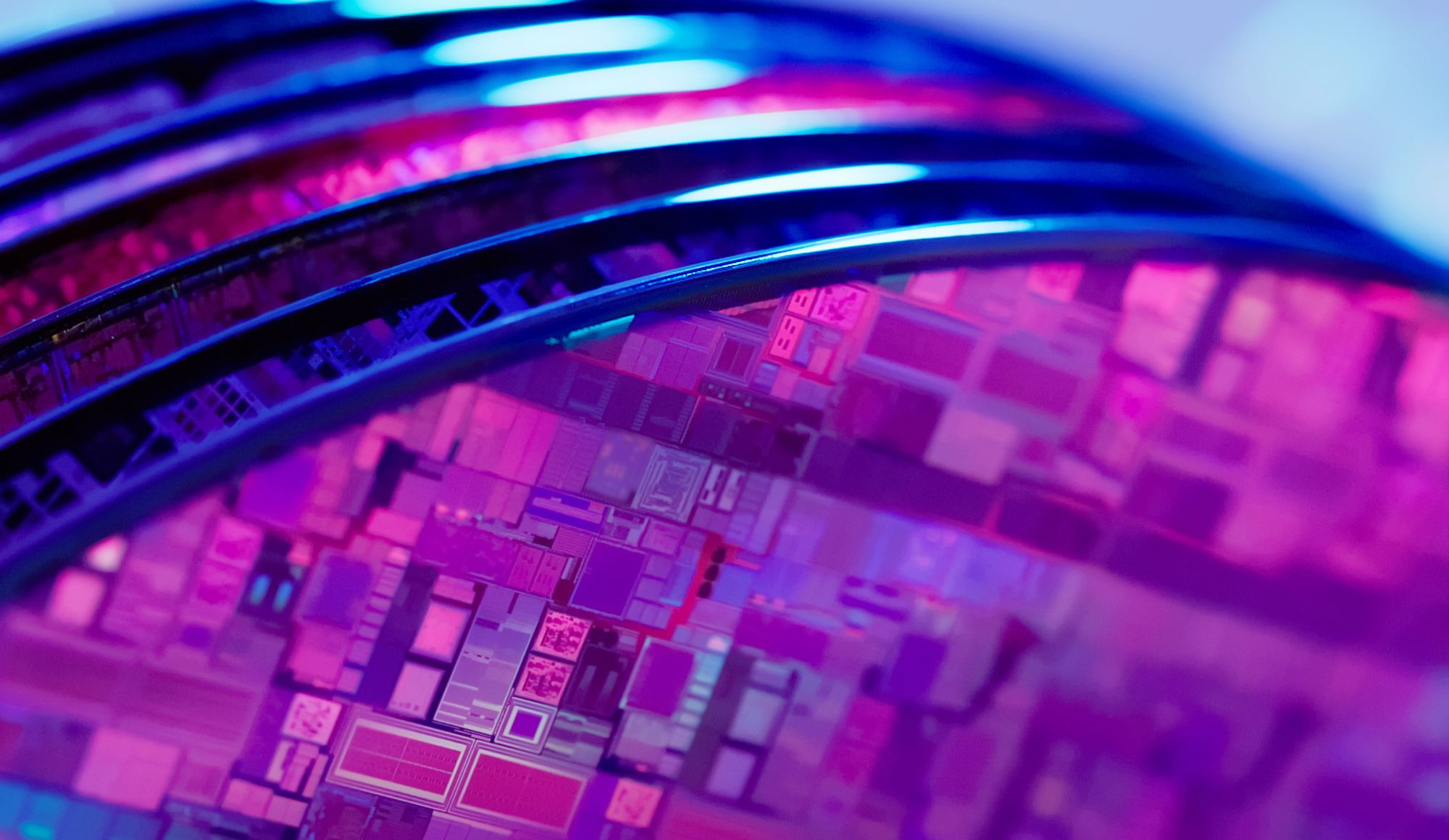

The investment team at Berkshire sold most of its stake in Taiwan Semiconductor, and that’s rattled investors who thought this was a long term play on a company that supplies chips to Apple, Berkshire’s largest holding.

To figure out why Berkshire sold, let’s start with why Berkshire snapped up TSM in the first place.

Key Points

- Berkshire Hathaway, the investment firm led by Warren Buffett, sold most of its stake in Taiwan Semiconductor, which rattled investors who thought it was a long-term play on the company that supplies chips to Apple, Berkshire’s largest holding.

- The reasons why Berkshire bought TSM in the first place include TSM being the world’s largest manufacturer of advanced semiconductors, financially strong, and having a virtually unshakeable dominance in the semiconductor business with high barriers to entry.

- Berkshire sold TSM likely because its business model requires all profits to be reinvested to maintain its competitive advantage, leading to a more fragile moat than might appear at first glance.

Why Buffett Bought Taiwan Semiconductor

The reasons why Buffett or his lieutenants took a swing at TSM in the first place can be summarized as follows:

- TSM is the world’s largest manufacturer of advanced semiconductors, with a market cap approaching half a trillion dollars and enjoys a 56% share of the global foundry market.

- It is financially strong with a net revenue increase of 35.9% in Q3, a gross margin expansion of +9.1%, and a lead over many of its rivals in feature size.

- The semiconductor business has high barriers to entry, and TSM’s dominance is virtually unshakeable.

- At an average buy price of $75.16 per share, Berkshire was sitting pretty with a nice unrealized gain.

A company with a fortress moat that is virtually impenetrable is just the kind of competitive advantage Buffett likes to align himself with, so why did he dump 86% of his TSM holdings according to the most recent 13F filings?

Why Buffett Sold Taiwan Semiconductor

A clue was revealed when Charlie Munger held a meeting to discuss his own Daily Journal positions. He described TSM as the “strongest semiconductor company on earth” but shared his disdain for its business model that, to survive and stay ahead of its competition, must effectively bet the farm each time.

To really understand what Munger means, imagine a gambler who keeps winning but is forced to put all chips in each time he/she plays the next hand. For TSM, all the profits must be re-invested each generation to stay ahead of the curve. In Munger’s view, that’s a horrible business model, and the so-called impenetrable moat that TSM possesses is much more porous than it seems.

So, if you hold shares of Taiwan Semiconductor, should you also sell?

TSM: Buy or Sell?

The answer of whether to buy or sell boils down to how you think about making money in the markets. If, like Buffett and Munger, the business model is most important – and it’s clear Munger detests the semiconductor industry model – then it would appear, like Berkshire, it’s time to sell.

On the other hand, traders and shorter-term investors pay more attention to price and valuation respectively. If TSM is undervalued, perhaps it’s worth holding until it realizes its potential.

By our calculations, TSM is undervalued. In fact, when we crunched the numbers we arrived at fair value of $102 per share, suggesting TSM share price could climb by about 15% before it hits a valuation ceiling.