Sell This Stock Now? Ask Questions Later

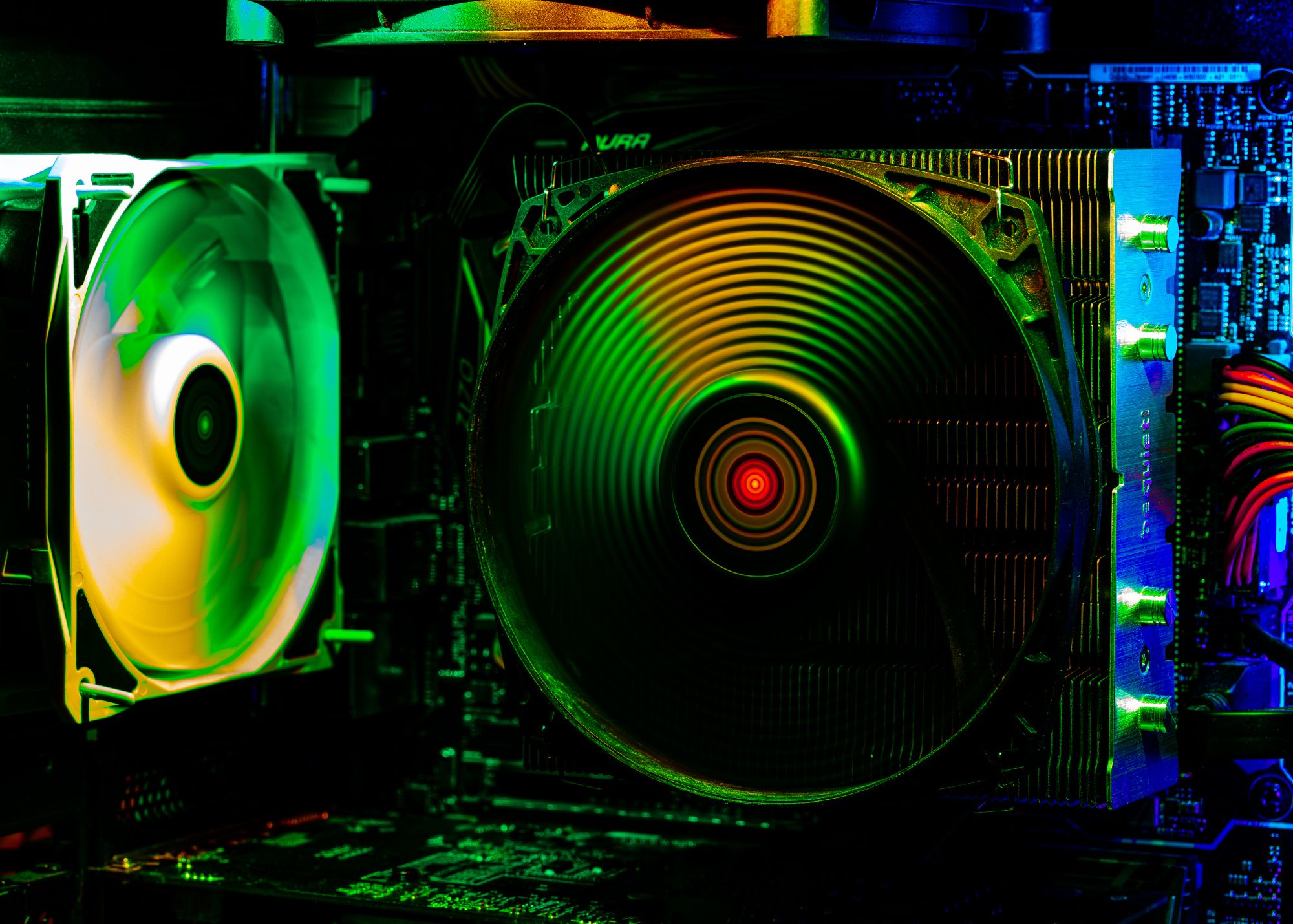

NVIDIA Corporation (NVDA) is a well-known name in the tech industry, and for a good reason. The company has been a significant player in the development of graphics processing units (GPUs) that power gaming and is a leader in chips that were foundational to crypto and AI applications.

However, recent news suggests that investors may want to sell their shares sooner rather than later. Nvidia’s inventory levels have been growing faster than its revenue.

This could signify that demand for its products is waning, leading to lower margins and profits. If this issue persists or worsens, it could be wise to sell your shares and take your losses now. Here’s why:

NVIDIA Chips Power The World

Nvidia (NVDA) is one of the most valuable technology companies today by market capitalization. It specializes in computer graphics, artificial intelligence, and data center technologies. Nvidia’s GPUs improve the gaming experience and are also used for other purposes, such as professional visualization, data centers, and self-driving cars.

Nvidia offers a range of technologies and platforms that enable AI. Its deep learning software development tools provide solutions for enterprise AI applications. It also provides GPU-accelerated computing platforms to boost the performance and scalability of AI systems—from edge devices to cloud-based services.

What’s causing the decline in demand for NVIDIA’s products?

The primary factor driving the decline in demand for Nvidia’s products is weak PC sales.

While the company benefited from strong console gaming and cryptocurrency mining in 2020, the pandemic and economic recession have caused people to hold off on buying new laptops, desktops and graphics cards. The weakening demand for PCs and GPUs is expected to persist into 2023, putting pressure on Nvidia’s margins and bottom line.

Competition is also increasing, with rival AMD expanding its product lineup.

AMD’s new Radeon RX 7900 family of GPUs is expected to provide more formidable competition, further impacting Nvidia’s profitability. AMD’s GPUs are predicted to cost less than NVIDIA’s equivalent products, NVIDIA RTX 4090, which could cause consumers to switch over to AMD and further reduce Nvidia’s market share.

To make matters worse, geopolitical tensions between China and the US have caused significant problems for the company. New regulations have stopped Nvidia from selling specific GPU models to customers in China, its second-largest market.

So even if demand increases in China, NVIDIA cannot capitalize on the opportunity entirely. In the third quarter of 2022, NVIDIA lost $400 million in revenue due to the restrictions. However, it should be noted that NVIDIA has been able to redesign its chips to comply with the regulations and can sell a lower-spec variation of its GPUs in China.

How might this issue impact the company’s bottom line in the future?

NVIDIA’s inventory has soared by 70% over the past year. Since October 2022, the company has been sitting on $4.5 billion in inventory, almost equal to its $5.9 billion in revenue in the third quarter.

This problem presents multiple concerns for the company, including:

- Inventory costs: NVIDIA will have to bear the additional costs of storing and managing its increasing inventory, resulting in lower profits.

- Reduced margins: If demand remains low and inventory levels remain high, NVIDIA may resort to dropping prices to shift inventory, leading to lower profits.

- Reduced cash flow: If NVIDIA cannot reduce its inventory levels, it may be unable to generate the cash flow needed to fund additional research and development, leading to a decrease in innovation.

The future of NVIDIA

Though the foreseeable future of NVIDIA looks grim, investors should consider some factors before deciding whether to sell their shares.

NVIDIA may be able to turn things around if the demand for PCs and GPUs picks up in 2023 or later. The company will also likely benefit from its strong AI offerings and partnerships with tech giants like Microsoft and Oracle, which are expected to power future growth.

NVIDIA’s data center segment, which makes up about two-thirds of its total revenue, has performed strongly and is likely to remain a source of strength for the company. With the world becoming increasingly digital, the data center market is poised for solid growth in the coming years, and NVIDIA is well-positioned to capitalize on that. In the third quarter of 2022, the data segment grew by 31% year-over-year to $3.8 billion.

Sell now or wait?

Given NVIDIA’s current challenges, investors may want to consider selling their shares before the situation worsens. The company’s inventory levels remain very high, and there is no immediate resolution.

Even if demand picks up later this year or next, it may be too late for NVIDIA to turn things around effectively. For risk-averse investors, now may be the best time to sell their shares and preserve capital.

On the other hand, long-term risk-tolerant investors may want to wait and see if the company can come out of this challenging situation unscathed. If the global economy recovers and demand for PCs and GPUs increases, NVIDIA could benefit from its strong portfolio of products and partnerships with major tech companies.

Ultimately, it’s up to each investor to decide whether they should sell their shares of NVIDIA now or hold onto them in the hopes of a recovery. Investors should carefully consider all their options before making any decisions.