Is The Santa Claus Rally Real?

Every seasoned trader has heard the phrase “Santa Claus Rally,” but very few understand precisely why it happens. Is it random or is there something structural under the surface that repeats like clockwork each year?

Beyond the whimsical idea of holiday cheer spilling over into the markets, there are structural and behavioral dynamics at play that make the final weeks of the year particularly conducive to market gains. » Read more about: Is The Santa Claus Rally Real? »

Read More

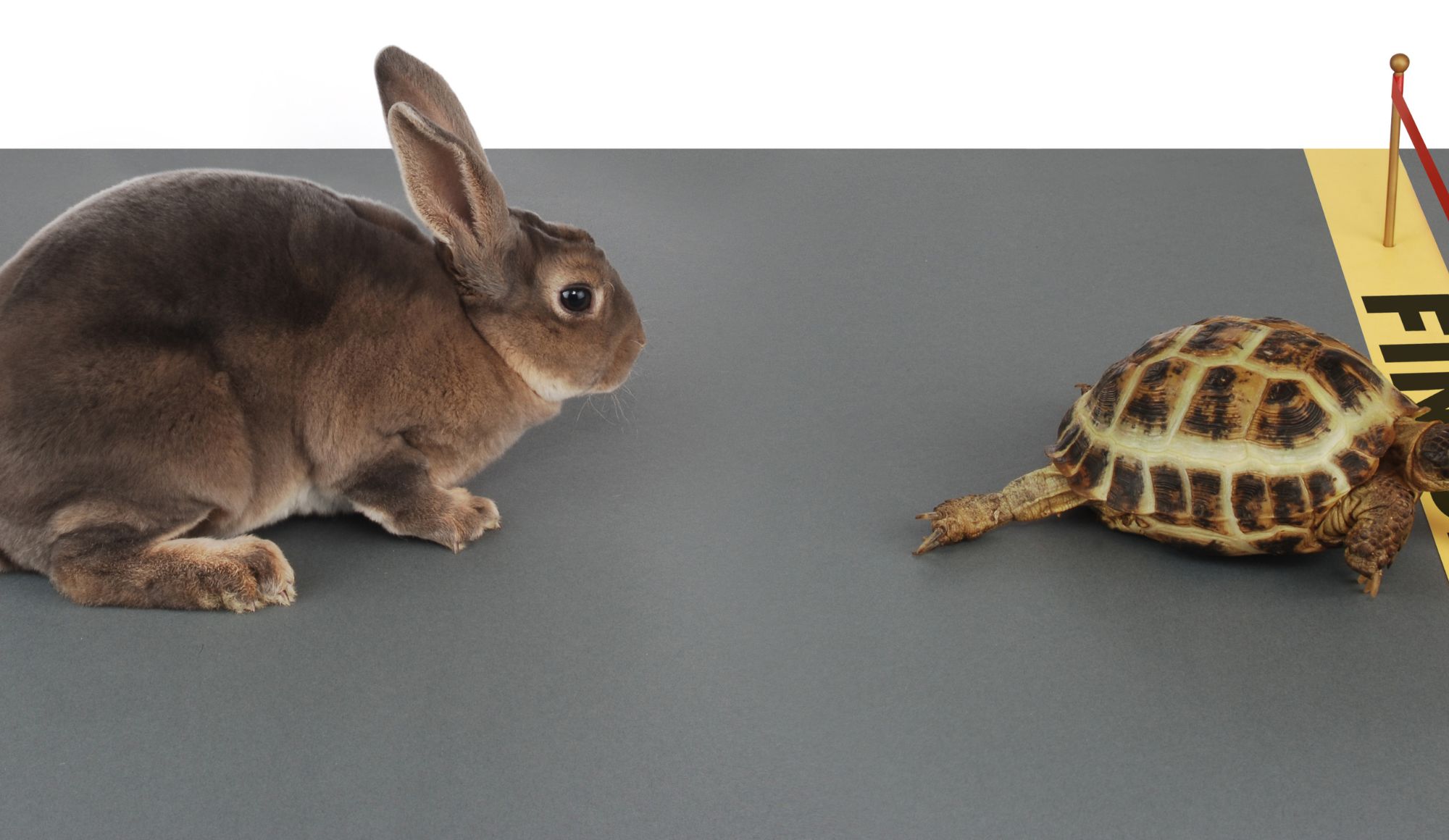

Buffett Wins the Hare vs Tortoise Race, Again

ARK Invest (ARKK) was a darling of Wall Street for several years. It focused on disruptive technologies and its promise to outperform the market attracted enormous interest. Then interest rates rose and growth stocks fell out of favor. Since then, Berkshire Hathaway (BRK.A)(BRK.B) has been slowly but surely overtaking ARK Invest,

» Read more about: Buffett Wins the Hare vs Tortoise Race, Again »

Read More

Billionaire With Perfect Track Record Bets Big On…

Each investor has their reasons for investing in select stocks. While some invest based on technicals, fundamental research, or macroeconomic factors, others focus on “shadow investing”. With this strategy, you follow in the footsteps of expert, high-net-worth investors — like Stanley Druckenmiller.

After three decades as a successful hedge fund manager,

» Read more about: Billionaire With Perfect Track Record Bets Big On… »

Read MoreShocking Turnabout, Buffett Bets $4 Billion on NEW Tech Stock

When Bill Gates met Warren Buffett for the first time, Gates tried to convince the Sage of Omaha of the merits of investing in technology. As the story goes, Buffett would re-direct the conversation towards everyday consumer habits, like chewing gum and eating ice-cream. Those behaviors would continue, in Buffett’s view, and so those businesses would be good ones for the long-term.

» Read more about: Shocking Turnabout, Buffett Bets $4 Billion on NEW Tech Stock »

Read More

Beware: 1 Major Hit To Your Portfolio If You Sell Now?

Have you ever wondered how much short-term versus long-term taxes actually affect your net worth and portfolio over time?

Let’s imagine a $100,000 portfolio goes up 20% annually and is taxed at the end of the year at 33% due to short-term capital gains. What would the portfolio grow to after 10 years?

» Read more about: Beware: 1 Major Hit To Your Portfolio If You Sell Now? »

Read MoreThe Burst

Oh, That Can’t Be Good

Usually, we talk about interesting stocks that may be on the cusp of growing revenues, profits or share price rapidly on a Tuesday but today we’re breaking from our regular programming to flag a major concern that could affect consumers. And because consumer spending is widely regarded to constitute about 70% of GDP, anything that affects it has a material impact on the broader stock market.

» Read more about: Oh, That Can’t Be Good »

Read MoreThe Spotlight

150 Year Old Indicator Picks Bear Market Bottom

It’s hard to figure out one golden indicator that could accurately point to when the bear market will bottom. Should you look at Buffett’s favorite indicator tracking Total Market Cap/GDP? Or maybe it’s best to look at the S&P vs the Fed Balance Sheet? What about book values or price-to-earnings ratios for the indices? As you can see,

» Read more about: 150 Year Old Indicator Picks Bear Market Bottom »

Read MoreThe Daily

Cathie Wood's Ark Scoops Up $12.4 Million In Beaten-Down Robinhood — Dumps More Airbnb Shares

The Robinhood Trade

The Vlad Tenev-led company’s shares fell 8.20% to $71.51 on Thursday after posting mixed fourth-quarter results, beating profit expectations but missing on revenue a day earlier.