Jack’s Fintech Giant Just Quadrupled Profits

The stock market has a way of turning heroes into villains overnight, and Block is a perfect case study. Just a few years ago, it was one of the hottest names on Wall Street, riding high on the wave of digital adoption.

Fast forward to today, and the stock is trading nearly 80% below its all-time highs.

» Read more about: Jack’s Fintech Giant Just Quadrupled Profits »

Read More

Why Buffett’s Latest Move Is So Scary

Buffett says he doesn’t time the market but when you look at his past moves, it’s clear that the old sage uses metrics that happen to coincide well with smart market timing.

Take his purchases at the bottom of the market in 2008-09 when he deployed almost 50% of his cash pile within the space of just a few weeks in October 2008.

» Read more about: Why Buffett’s Latest Move Is So Scary »

Read More

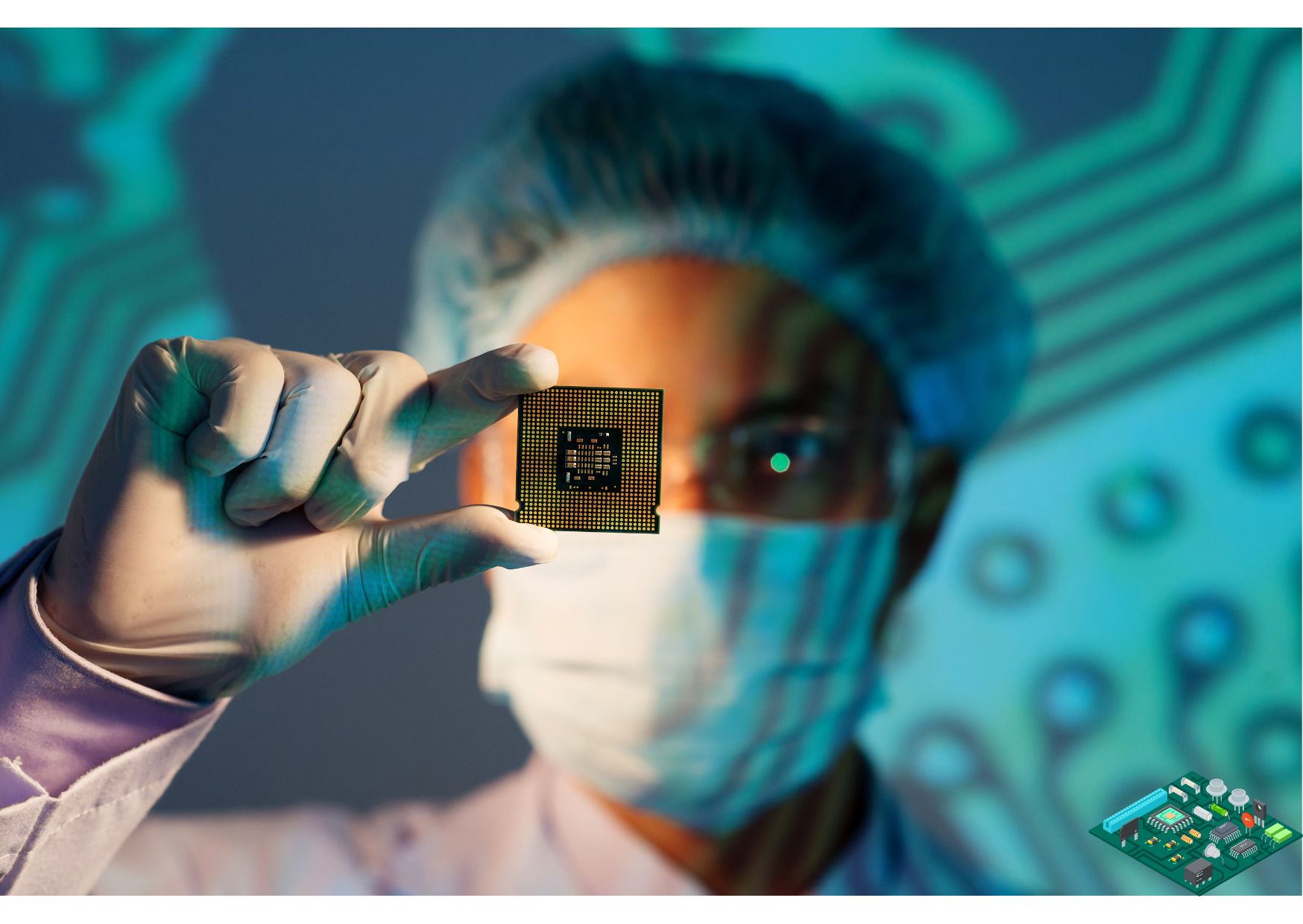

Avoid This Semi Stock Like The Plague?

On August 1st, Intel released its Q2 earnings report, much to the chagrin of longtime shareholders.

In the release, the company reported a 1% year-over-year revenue drop alongside a quarterly net loss of $1.6 billion. Much more concerning was the company’s plan for a cost reduction campaign that involved layoffs, reduced capital expenditures and a suspension of the company’s quarterly dividend.

» Read more about: Avoid This Semi Stock Like The Plague? »

Read More

The Max Pain Trade Is…

If one market analyst is to be believed, the path of the market that will lead to most pain will involve a move higher from the early August lows followed by a sharp correction in September and October, repeating a pattern not seen since 1998.

Back then July marked the high and October the low,

» Read more about: The Max Pain Trade Is… »

Read More

Why Lyft Might Be The Highest Potential Stock Now

In the world of rideshare investing, Uber tends to get all the attention. And with autonomous driving hype swirling around Tesla, it’s easy to overlook the other major U.S. player in the space. But if you’re willing to dig deeper, Lyft (NASDAQ: LYFT) might just be one of the market’s most overlooked opportunities.

Key Points

-

Lyft targets the $59.2B U.S.

» Read more about: Why Lyft Might Be The Highest Potential Stock Now »

Read MoreThe Burst

Micron Is Down 42%, Why It Might Be a Screaming Buy?

Micron Technology (NASDAQ: MU) is no stranger to volatility, but its recent price action has been brutal even by semiconductor standards. Since peaking in June of last year, the stock has tumbled 42%. And nearly 30% of that decline happened in just the past month.

So, is this a falling knife or an undervalued gem in the chip sector?

» Read more about: Micron Is Down 42%, Why It Might Be a Screaming Buy? »

Read MoreThe Spotlight

1 Social Media Stock Savvy Investors Are Watching

Reddit, often referred to as “the front page of the internet,” has a claim to fame that over 400 million monthly active users engage with it across 130,000 active communities.

There is no two ways about it, Reddit has carved out a niche in the social media landscape that is distinct from giants like Facebook and Twitter.

» Read more about: 1 Social Media Stock Savvy Investors Are Watching »

Read More